Question: HELP WITH JOURNAL ENTRIES!!! begin{tabular}{|c|c|c|c|} hline Event & Date & Description of Event & hline 1 & 3-Jan & Employees are paid monthly on

HELP WITH JOURNAL ENTRIES!!!

HELP WITH JOURNAL ENTRIES!!!

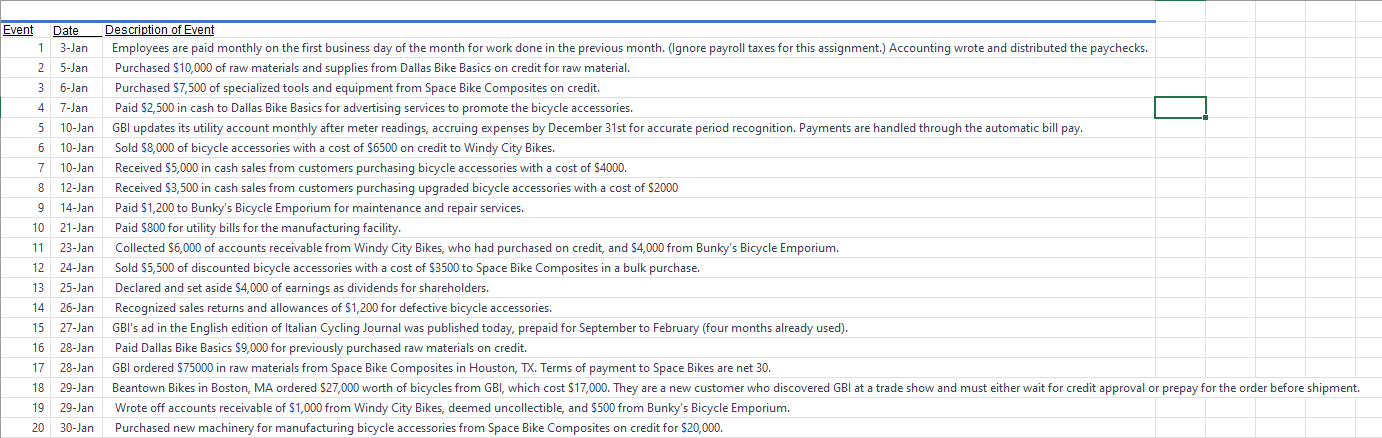

\begin{tabular}{|c|c|c|c|} \hline Event & Date & Description of Event & \\ \hline 1 & 3-Jan & Employees are paid monthly on the first business day of the month for work done in the previous month. (Ignore payroll taxes for this assignment.) Accounting wrote and distributed the paychecks. & \\ \hline 2 & 5-Jan & Purchased $10,000 of raw materials and supplies from Dallas Bike Basics on credit for raw material. & \\ \hline 3 & 6-Jan & Purchased $7,500 of specialized tools and equipment from Space Bike Composites on credit. & \\ \hline 4 & 7-Jan & Paid \$2,500 in cash to Dallas Bike Basics for advertising services to promote the bicycle accessories. & \\ \hline 5 & 10-Jan & GBI updates its utility account monthly after meter readings, accruing expenses by December 31 st for accurate period recognition. Payments are handled through the automatic bill pay. & \\ \hline 6 & 10-Jan & Sold $8,000 of bicycle accessories with a cost of $6500 on credit to Windy City Bikes. & \\ \hline 7 & 10-Jan & Received $5,000 in cash sales from customers purchasing bicycle accessories with a cost of $4000. & \\ \hline 8 & 12-Jan & Received $3,500 in cash sales from customers purchasing upgraded bicycle accessories with a cost of $2000 & \\ \hline 9 & 14-Jan & Paid \$1,200 to Bunky's Bicycle Emporium for maintenance and repair services. & \\ \hline 10 & 21-Jan & Paid $800 for utility bills for the manufacturing facility. & \\ \hline 11 & 23-Jan & Collected $6,000 of accounts receivable from Windy City Bikes, who had purchased on credit, and $4,000 from Bunky's Bicycle Emporium. & \\ \hline 12 & 24-Jan & Sold $5,500 of discounted bicycle accessories with a cost of $3500 to Space Bike Composites in a bulk purchase. & \\ \hline 13 & 25-Jan & Declared and set aside $4,000 of earnings as dividends for shareholders. & \\ \hline 14 & 26-Jan & Recognized sales returns and allowances of $1,200 for defective bicycle accessories. & \\ \hline 15 & 27-Jan & GBI's ad in the English edition of Italian Cycling Journal was published today, prepaid for September to February (four months already used). & \\ \hline 16 & 28-Jan & Paid Dallas Bike Basics $9,000 for previously purchased raw materials on credit. & \\ \hline 17 & 28-Jan & GBI ordered $75000 in raw materials from Space Bike Composites in Houston, TX. Terms of payment to Space Bikes are net 30. & \\ \hline 18 & 29-Jan & Beantown Bikes in Boston, MA ordered $27,000 worth of bicycles from GBI, which cost $17,000. They are a new customer who discovered GBI at a trade show and must either wait for credit approval or & prepay for the order before shipment. \\ \hline 19 & 29-Jan & Wrote off accounts receivable of $1,000 from Windy City Bikes, deemed uncollectible, and $500 from Bunky's Bicycle Emporium. & \\ \hline 20 & 30-Jan & Purchased new machinery for manufacturing bicycle accessories from Space Bike Composites on credit for $20,000. & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts