Question: help with letter C Suppose that you are a U.S.-based importer of goods from the United Kingdom, You expect the value of the pound to

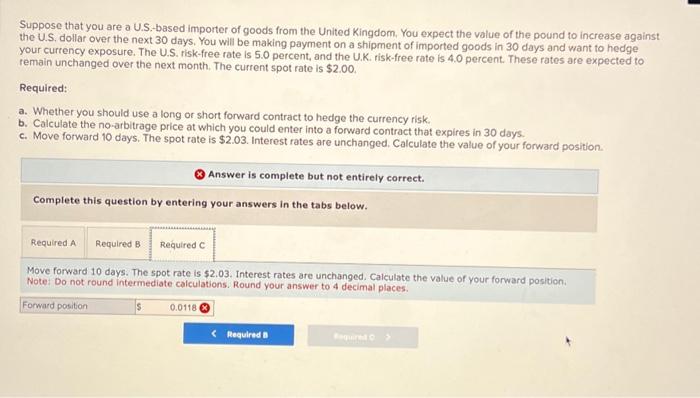

Suppose that you are a U.S.-based importer of goods from the United Kingdom, You expect the value of the pound to increase against the U.S, dollar over the next 30 days, You will be making payment on a shipment of imported goods in 30 days and want to hedge your currency exposure. The U.S. risk-free rate is 5.0 percent, and the U.K. risk-free rate is 4.0 percent. These rates are expected to remain unchanged over the next month. The current spot rate is $2.00. Required: a. Whether you should use a long or short forward contract to hedge the currency risk. b. Calculate the no-arbitrage price at which you could enter into a forward contract that expires in 30 days. c. Move forward 10 days. The spot rate is $2.03. Interest rates are unchanged. Calculate the value of your forward position. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Move forward 10 days. The spot rate is $2.03. Interest rates are unchanged. Calculate the value of your forward position. Note: Do not round intermediate calculations. Round your answer to 4 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts