Question: help with letters a-h with using excel formulas please the company is preparing its budget for the coming year, 2022. The first step is to

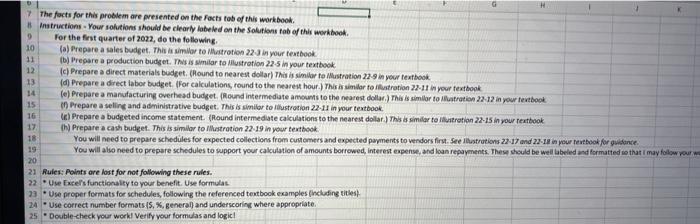

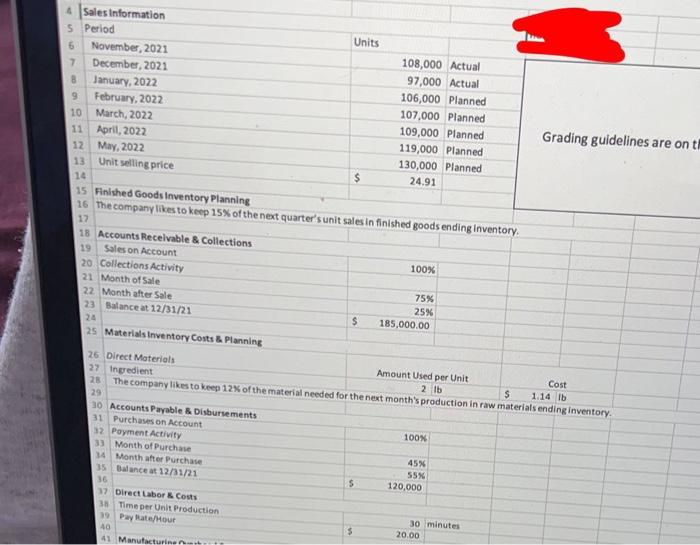

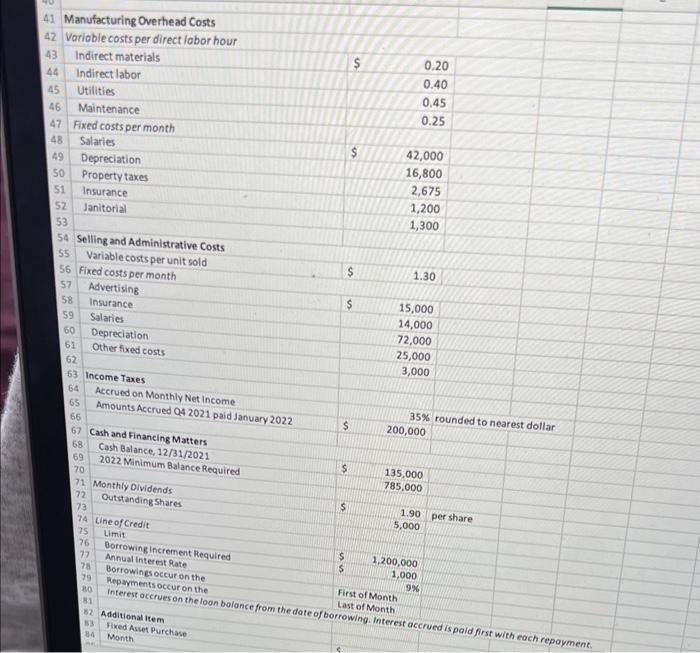

The facts for this aroblem are presented on the focts tob of this workbook. inatructions - Your solutions should be ciearly labeled on the solutions tab of thir workbook. For the frat quarter of 2022, do the following. (a) Prepare a sales budget, This a simior to Matidrotion 22.3 in your tevitook: (b) Prepare a production budget. Ths is similar to llilistration 22.5 in your textbook (c) Prepare a direct materials budget. (Hound to nearest dollar) This is similar to Mustration 22-9 in your lextbook. (d) Prepare a direct labor budget. (For calculations, tound to the nearent hour.) Thir ar simllar fo ilstration 22-11 in your fextbook (e) Prepare a manufacturing overhead budget. (Rlound intermedate amoums to the nearest dollar.) Fhan is simlor to illatration 22 - 12 in your tevebook (f) Prepare a seling and administrative budget. This is similor to llistrotion 22-11 in your textbook. (s) Prepare a budgeted income statement. (Round intermediate calculations to the neares dollar.) This as similar te lavitration 22 -15 in your rextbook (h) Prepare a cash budget. This is similor to Ilmstrotion 22-19 in your textbook. You will need to prepare schedules for expected collections from cugtomers and expected paymerts to vendors firs. See ithatrutions 2217 and 2218 in your hevethokf for gublance. You will also need to prepare schedules to support your calculation of amounts borrowed, interest expense, and loan repayments. These dhould be wel labeled and formatted wo that i may folow rair w Rules: Polints are lost for not following these rules. - Use Excers functionality to your benefit. Use formulat - Use proper formats for schedules, following the referenced tentbook examples (including titest - Use correct number formats 15,%, general and underscoring where appropriate. - Double-check your workI Verify your formulas and logic! 4 Sales information. 5 Period 5. Navember, 2021 7 December, 2021 8 January, 2022 9 February, 2022 10 March, 2022 11 April, 2022 12 May, 2022 Grading guidelines are on 13 Unit selling price 14 15 Finlshed Goods lnventory Planning 16 The company likes to keep 15% of the next quarter's unit sales in finished goods ending Inventory. 17 Accounts Recelvable 8 Collections. 19 Sales on Account. 20 Collections Activity 21 Manth of Sale 22. Month after Sale 23 Balance at 12/31/21 26 Direct Materials 27. In gredient 28 The company likes to keep 12K of the Amount Used per Unit 12. Poyment Activity 33. Month of Purchase 14 Month after Purchase. Direct Labor 8 Costs Time per Unit Production Pay leatefliour 41. Manufacturing Overhead Costs 42 Varioble costs per direct lobor hour Selling and Administrative Costs 55 Variable costs per unit sold 56 Fixed costs per month 57 Advertising $1.30 58. Insurance 59 Salaries \begin{tabular}{l|l} 60 & Depreciation \\ 61 & Other fixed costs \\ \hline 62 & \\ \hline \end{tabular} 65 Amounts Accrued Q4 2021 paid January 202235% rounded to nearest dollar 67 Cash and Financing Matters 68. Cash Balance, 12/31/2021 Limit Borrowing increment Required Annual interest Rate Borrowines occur on the Reparmentsoccur on the interest occrues on the toon bolonce from hirst of Month Additional item Last of Month Hixed Aset Purchase 82 Additional Item 83 Fixed Asset Purchase 84 Month $400,000 85 February The facts for this aroblem are presented on the focts tob of this workbook. inatructions - Your solutions should be ciearly labeled on the solutions tab of thir workbook. For the frat quarter of 2022, do the following. (a) Prepare a sales budget, This a simior to Matidrotion 22.3 in your tevitook: (b) Prepare a production budget. Ths is similar to llilistration 22.5 in your textbook (c) Prepare a direct materials budget. (Hound to nearest dollar) This is similar to Mustration 22-9 in your lextbook. (d) Prepare a direct labor budget. (For calculations, tound to the nearent hour.) Thir ar simllar fo ilstration 22-11 in your fextbook (e) Prepare a manufacturing overhead budget. (Rlound intermedate amoums to the nearest dollar.) Fhan is simlor to illatration 22 - 12 in your tevebook (f) Prepare a seling and administrative budget. This is similor to llistrotion 22-11 in your textbook. (s) Prepare a budgeted income statement. (Round intermediate calculations to the neares dollar.) This as similar te lavitration 22 -15 in your rextbook (h) Prepare a cash budget. This is similor to Ilmstrotion 22-19 in your textbook. You will need to prepare schedules for expected collections from cugtomers and expected paymerts to vendors firs. See ithatrutions 2217 and 2218 in your hevethokf for gublance. You will also need to prepare schedules to support your calculation of amounts borrowed, interest expense, and loan repayments. These dhould be wel labeled and formatted wo that i may folow rair w Rules: Polints are lost for not following these rules. - Use Excers functionality to your benefit. Use formulat - Use proper formats for schedules, following the referenced tentbook examples (including titest - Use correct number formats 15,%, general and underscoring where appropriate. - Double-check your workI Verify your formulas and logic! 4 Sales information. 5 Period 5. Navember, 2021 7 December, 2021 8 January, 2022 9 February, 2022 10 March, 2022 11 April, 2022 12 May, 2022 Grading guidelines are on 13 Unit selling price 14 15 Finlshed Goods lnventory Planning 16 The company likes to keep 15% of the next quarter's unit sales in finished goods ending Inventory. 17 Accounts Recelvable 8 Collections. 19 Sales on Account. 20 Collections Activity 21 Manth of Sale 22. Month after Sale 23 Balance at 12/31/21 26 Direct Materials 27. In gredient 28 The company likes to keep 12K of the Amount Used per Unit 12. Poyment Activity 33. Month of Purchase 14 Month after Purchase. Direct Labor 8 Costs Time per Unit Production Pay leatefliour 41. Manufacturing Overhead Costs 42 Varioble costs per direct lobor hour Selling and Administrative Costs 55 Variable costs per unit sold 56 Fixed costs per month 57 Advertising $1.30 58. Insurance 59 Salaries \begin{tabular}{l|l} 60 & Depreciation \\ 61 & Other fixed costs \\ \hline 62 & \\ \hline \end{tabular} 65 Amounts Accrued Q4 2021 paid January 202235% rounded to nearest dollar 67 Cash and Financing Matters 68. Cash Balance, 12/31/2021 Limit Borrowing increment Required Annual interest Rate Borrowines occur on the Reparmentsoccur on the interest occrues on the toon bolonce from hirst of Month Additional item Last of Month Hixed Aset Purchase 82 Additional Item 83 Fixed Asset Purchase 84 Month $400,000 85 February

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts