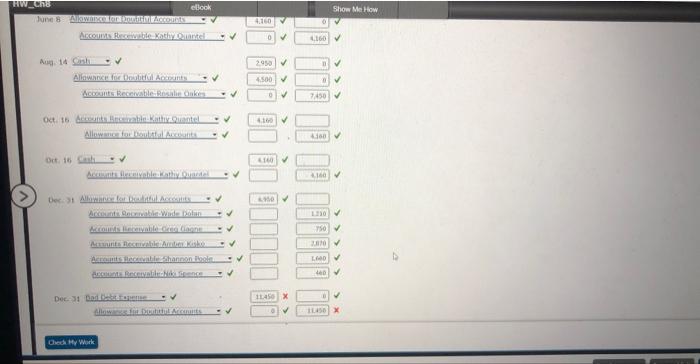

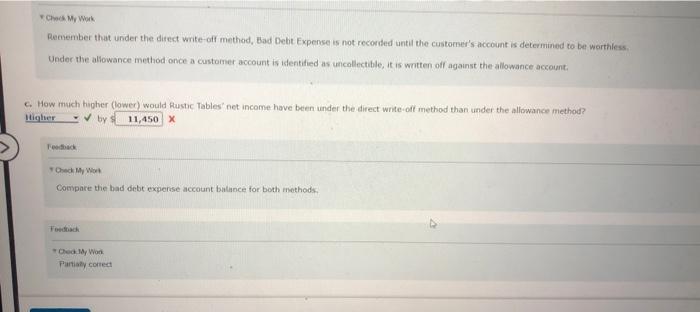

Question: help with missing value bad debt expense and allowance for doubtful the answer is not 11450 and part c Entries for bad debt expense under

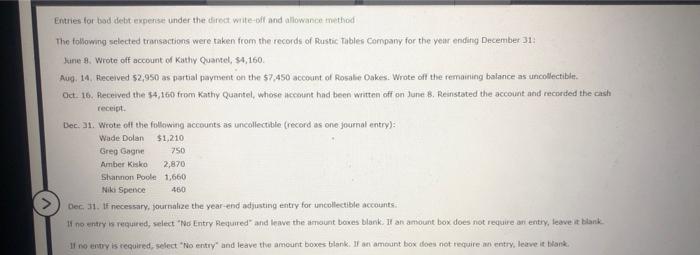

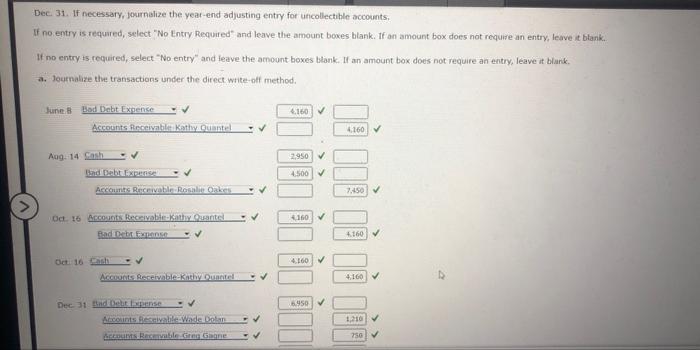

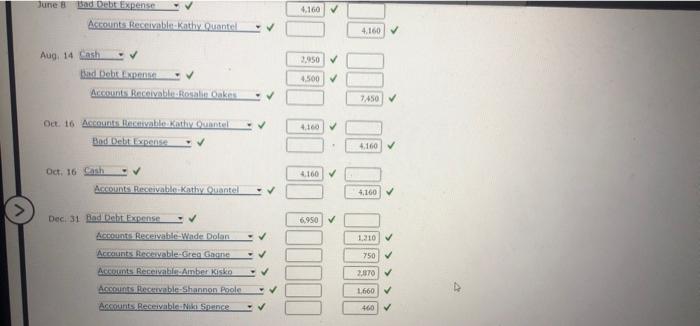

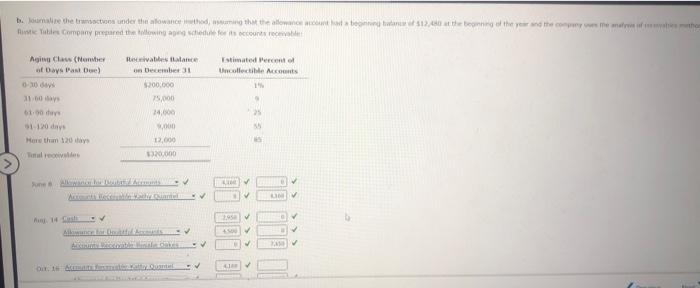

Entries for bad debt expense under the direct wite-oif and allowance thethod The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31 : Line -9. Wrote off account of Kathy Quantel, $4,160. Aug. 14. Received 52,950 as partial payment on the 57,450 account of Rosalie Dakes. Wrote ofl the remaining balance as uncollectible. Gct. 16. Received the $4,1 tho from Kathy Quantel, Whose wceohnt had been written off on June:-8, Reinstated the account ahd recorded the cash receist. Dec. 31. Wrote oft the follawing accounts as uncollectible (record as one journal entry): Der. I1. If necessary, journalize the year-end adjusting entry for uncollectible accounts: II no entry is required, select "No Entry Requared" and leave the ammaunt bowes blank. If an amount box does not require an entry, leave it blank. 11 no enoy is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave ie biank Dec- 31. If necessary, journblize the yeat-end adjusting entry for uncollectible accounts. If no: entry is requared, select "No Entry Required" and leave the amount boxes blaAk. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry" and feave the amount boxes blank. If an amount box does not require an entry, leave it blank. a. Journalize the transactions under the direct wtite-otf method. Ain. if Guatis = C Chou. Mr Work Recnember that under the direct write-off method, Bad Debt Expense is not recorded untif the custorner's account is deternined to bet warthiess. Under the aliowance method once a customer account is identified as uncollectible, it is wntten off against the allowance account. How mach higher (lower) would Austic Tables' net income have been under the direct write-off method than under the allowance method? by 3 X Feoshack + Greck My Writ Compare the bad debt experse account batinoce for both methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts