Question: help with one or any would be amazing!!! 1. The valuation of property included in a decedent's gross estate is either the fair market value

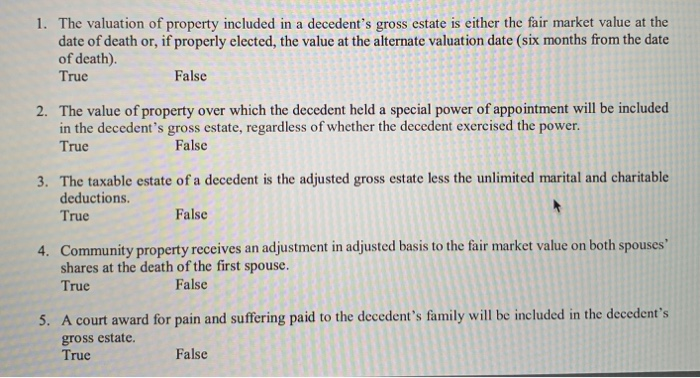

1. The valuation of property included in a decedent's gross estate is either the fair market value at the date of death or, if properly elected, the value at the alternate valuation date (six months from the date of death). False True 2. The value of property over which the decedent held a special power of appointment will be included in the decedent's gross estate, regardless of whether the decedent exercised the power True False 3. The taxable estate of a decedent is the adjusted gross estate less the unlimited marital and charitable deductions. True False Community property receives an adjustment in adjusted basis to the fair market value on both spouses shares at the death of the first spouse. True False 5. A court award for pain and suffering paid to the decedent's family will be included in the decedent's gross estate. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts