Question: help with option A would be helpful it is incorrect Sheridan Clinic is considering imvesting in new heart-monitoring equipment. It has two options, Option A

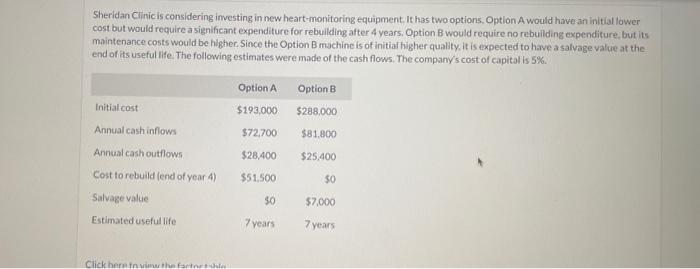

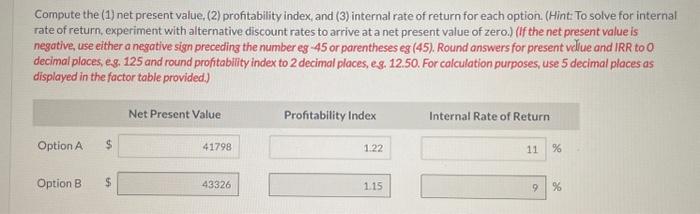

Sheridan Clinic is considering imvesting in new heart-monitoring equipment. It has two options, Option A would have an initial lower cost but would require a significant expenditure for rebuilding after 4 years. Option B would require no rebuilding expenditure, but its maintenance costs would be higher. Since the Option B machine is of initial higher quality, it is expected to have a salvage value at the end of its useful life. The following estimates were made of the cash flows. The company s cost of capital is 5%. Compute the (1) net present value, (2) profitability index, and (3) internal rate of return for each option. (Hint: To solve for internal rate of return, experiment with alternative discount rates to arrive at a net present value of zero.) (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answers for present vellue and IRR to 0 decimal places, eg. 125 and round profitability index to 2 decimal places, es. 12.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts