Question: help with P8-1. need tabular summary like the one below and current liabilities balance sheet Determine the effect on net income and earnings per share

help with P8-1.

need tabular summary like the one below and current liabilities balance sheet

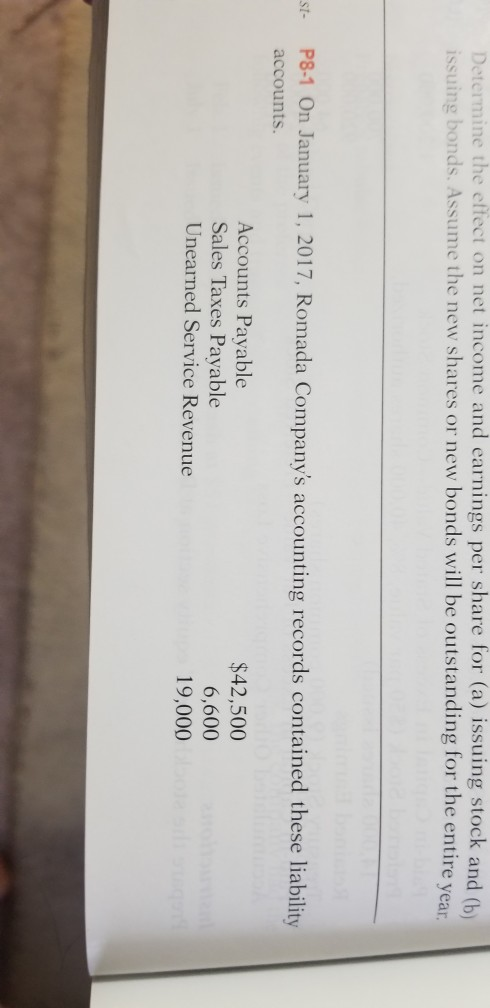

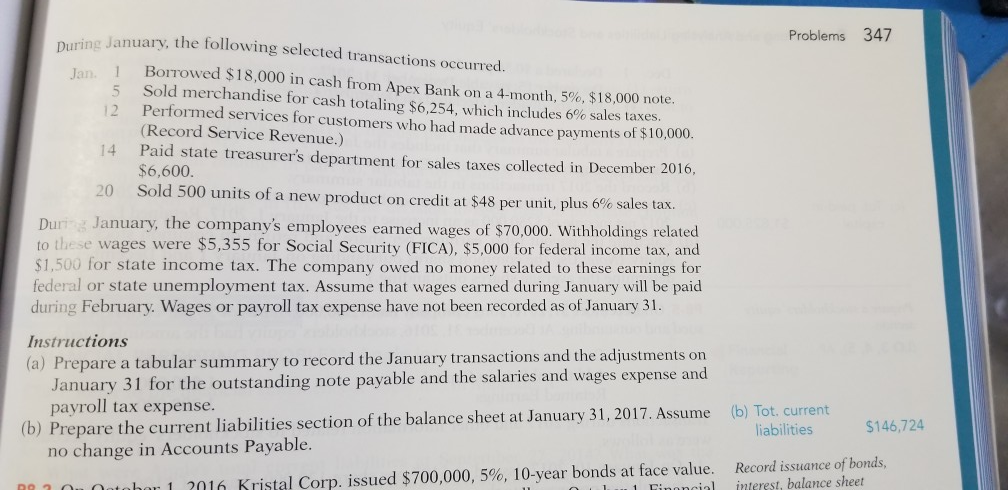

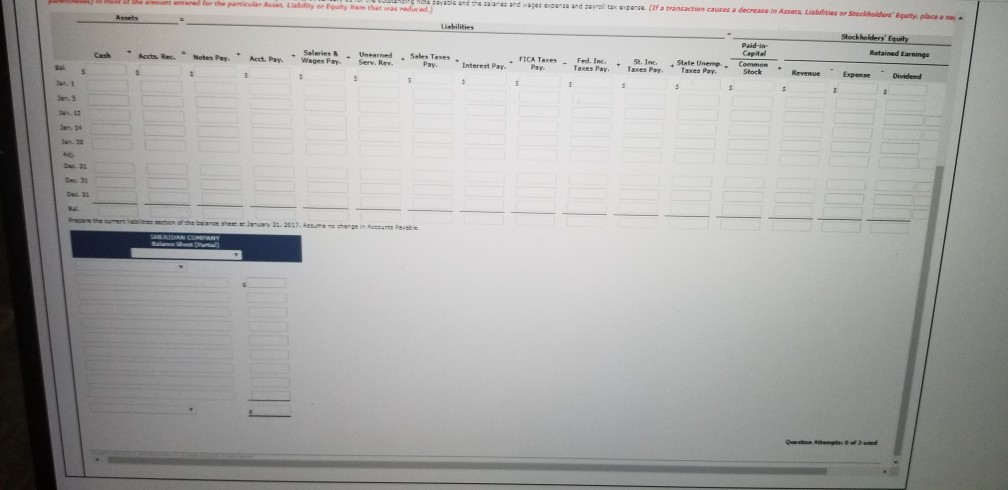

Determine the effect on net income and earnings per share for (a) issuing stock and (b issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year s P8-1 On January 1, 2017, Romada Company's accounting records contained these liability accounts. Accounts Pavable Sales Taxes Payable Unearned Service Revenue $42,500 6,600 19,000 ary, the following selected transactions occurred. Problems 347 Borowed $18,000 in cash from Apex Bank on a 4-month, 5% $18,000 note. Sold merchandise for cash totaling $6,254, which includes 6% sales taxes Performed services for customers who had made advance payments of $10,000 (Record Service Revenue.) Paid state treasurer's department for sales taxes collected in December 2016, $6,600. Sold 500 units of a new product on credit at $48 per unit, plus 6% sales tax I 5 12 an. 14 20 Durig January, the company's employees earned wages of $70,000. Withholdings related to these wages were $5,355 for Social Security (FICA), $5,000 for federal income tax, and $1,500 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during February. Wages or payroll tax expense have not been recorded as of January 31. Instructions (a) Prepare a tabular summary to record the January transactions and the adjustments on January 31 for the outstanding note payable and the salaries and wages expense and payroll tax expense. (b) Tot t curent (b )Prepare the current liabilities section of the balance sheet at January 31, 2017. Assume $146,724 iabilities no change in Accounts Payable. Kristal Corp. issued $700,000.5%, 10-yearbonds at face value. ial Record issuance ofbds. interest, balance sheet 1 2016 and waer epunae and sayrall taxeper (a transaction causes a decrease in Assecs Liabuliess or Seockholdars Equity place a ne er for the pareclae Asst tiabality or Equity em that was aduc adivasda Retainad Earnings Capital St. Inc State Unemp. Common Sales Taxes Interest FICA Taxes - Pay. Fed. Inc + Taxes Pay. Taxes Pay. Taxes Pay Revenue Expenpe Dividend Accts. Rec. Notes Pay Acct. Pay Wages Pay. Serv. Rev Pay. Interest Pay. Cash lan. s Dec. 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts