Question: help with part 2, 3 and 4 please Intro Suppose the stock of GameStop trades currently for $5. You believe that the stock is significantly

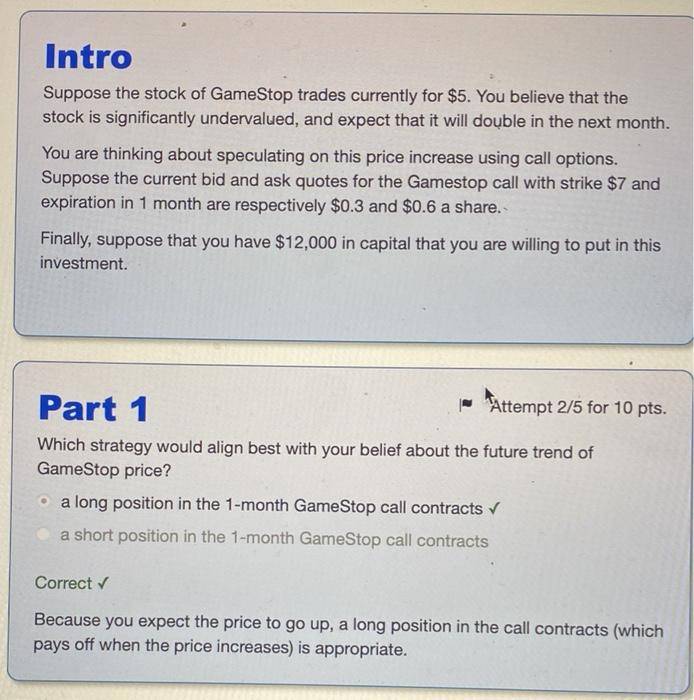

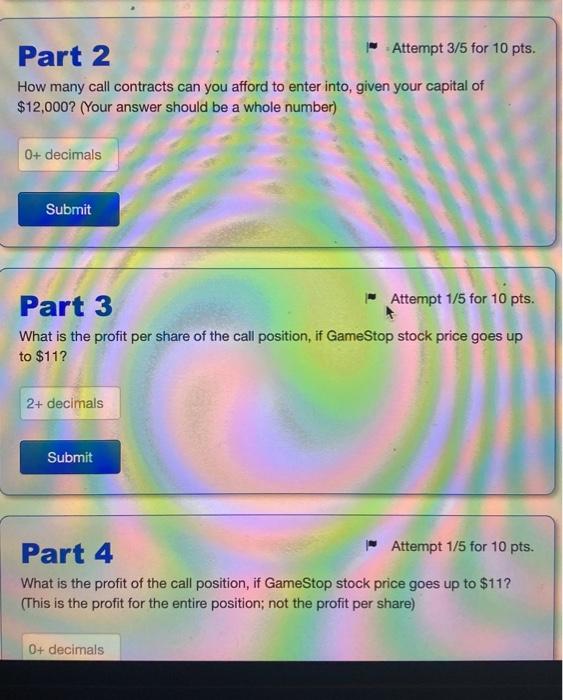

Intro Suppose the stock of GameStop trades currently for $5. You believe that the stock is significantly undervalued, and expect that it will double in the next month. You are thinking about speculating on this price increase using call options. Suppose the current bid and ask quotes for the Gamestop call with strike $7 and expiration in 1 month are respectively $0.3 and $0.6 a share. Finally, suppose that you have $12,000 in capital that you are willing to put in this investment. Part 1 "Attempt 2/5 for 10 pts. Which strategy would align best with your belief about the future trend of GameStop price? a long position in the 1-month GameStop call contracts a short position in the 1-month GameStop call contracts Correct Because you expect the price to go up, a long position in the call contracts (which pays off when the price increases) is appropriate. Part 2 Attempt 3/5 for 10 pts. How many call contracts can you afford to enter into, given your capital of $12,000? (Your answer should be a whole number) 0+ decimals Submit Part 3 Attempt 1/5 for 10 pts. What is the profit per share of the call position, if GameStop stock price goes up to $11? 2+ decimals Submit Part 4 Attempt 1/5 for 10 pts. What is the profit of the call position, if GameStop stock price goes up to $11? (This is the profit for the entire position; not the profit per share) 0+ decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts