Question: help with part b please!:) 1 A put option in finance allows you to sell a share of stock at a given price in the

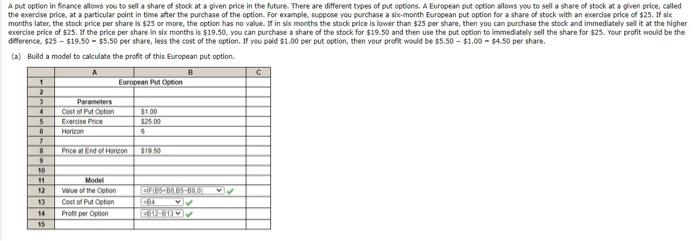

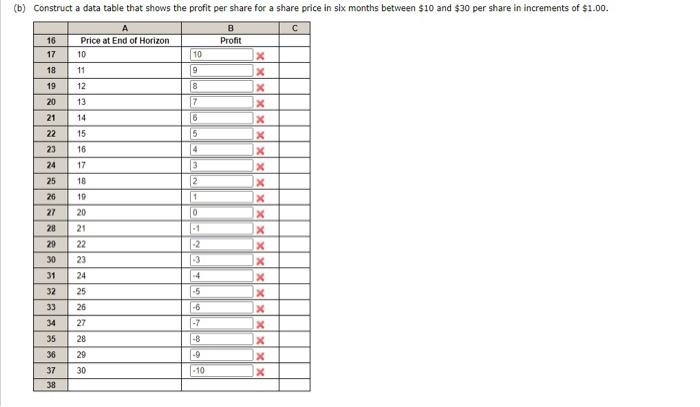

1 A put option in finance allows you to sell a share of stock at a given price in the future. There are different types of put options. A European put option allows you to sell a share of stock at a given price, called the exercise price at a particular point in time after the purchase of the option. For example, suppose you purchase a six-month European put option for a share of stock with an exercise price of $25. If six months later, the stock price per share is $25 or more, the option has no value of in six months the stock price is lower than $25 per share, then you can purchase the stock and immediately sell it at the higher excercise price of $25. If the price per share in six months is $19.50, you can purchase a share of the stock for $19.50 and then use the put option to immediately sell the share for $25. Your profit would be the difference, $25 - $19.50 - $5.50 per share, less the cost of the option. If you paid $1.00 per put option, then your profit would be $5.50 - $1.00 - $4.50 per share. (a) Build a model to calculate the profit of this European put option A European PutOption 2 3 Parameters 4 cost of puttion 5100 5 Exercise Price 5.25.00 Horizon 7 PRICE End of Horton 9 10 11 Model 12 Value of the option CIFIES BB5-00 13 Cost of PutOption CBA 14 Prott per Option 15 6 B (b) Construct a data table that shows the profit per share for a share price in six months between $10 and $30 per share in increments of $1.00. A B 16 Price at End of Horizon Profit 17 10 10 X 18 11 19 X 19 12 8 X 20 13 17 x 21 14 6 x 22 15 5 X 23 16 4 X 24 17 3 X 25 18 2 X 26 19 1 X 27 20 0 X 28 21 -1 29 22 -2 30 23 -3 X 31 24 -4 X 32 25 -5 X 33 26 -6 X 34 27 -7 X 35 28 -8 36 29 37 30 38 XXX - 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts