Question: Help with part B please SmartWatch Ltd. manufacture electronic security products. One such product is a tracking component used in building management systems. They manufacture

Help with part B please

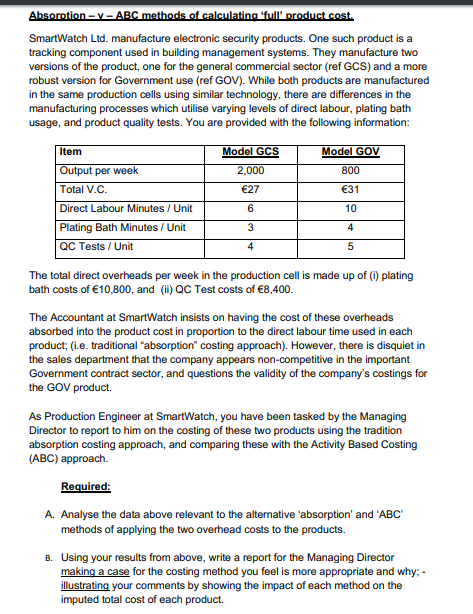

SmartWatch Ltd. manufacture electronic security products. One such product is a tracking component used in building management systems. They manufacture two versions of the product, one for the general commercial sector (ref GCS) and a more robust version for Government use (ref GOV). While both products are manufactured in the same production cells using similar technology, there are differences in the manufacturing processes which utilise usage, and product quality tests. You are provided with the following information: varying levels of direct labour, plating bath Item Model GCS Model GOV 800 31 10 per week Total V.C. Direct Labour Minutes Unit Plating Bath Minutes/Unit QC Tests/ Unit 27 The total direct overheads per week in the production cell is made up of () plating bath costs of 10,800, and (i) QC Test costs of 8,400 The Accountant at SmartWatch insists on having the cost of these overheads absorbed into the product cost in proportion to the direct labour time used in each product; (i.e. traditional "absorption" costing approach). However, there is disquiet in the sales department that the company appears non-competitive in the important Government contract sector, and questions the validity of the company's costings for the GOV product. As Production Engineer at SmartWatch, you have been tasked by the Managing Director to report to him on the costing of these two products using the tradition absorption costing approach, (ABC) approach. and comparing ng these with the Activity Based C Required: A. Analyse the data above relevant to the alternative 'absorption' and ABC methods of applying the two overhead costs to the products. B. Using your results from above, write a report for the Managing Director making a case for the costing method you feel is more appropriate and why;- illustrating your comments by showing the impact of each method on the imputed total cost of each product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts