Question: Help with part B. RCES Exercise 10-7 (Part Level Submission) Windsor Furniture Company started construction of a combination office and warehouse building for its own

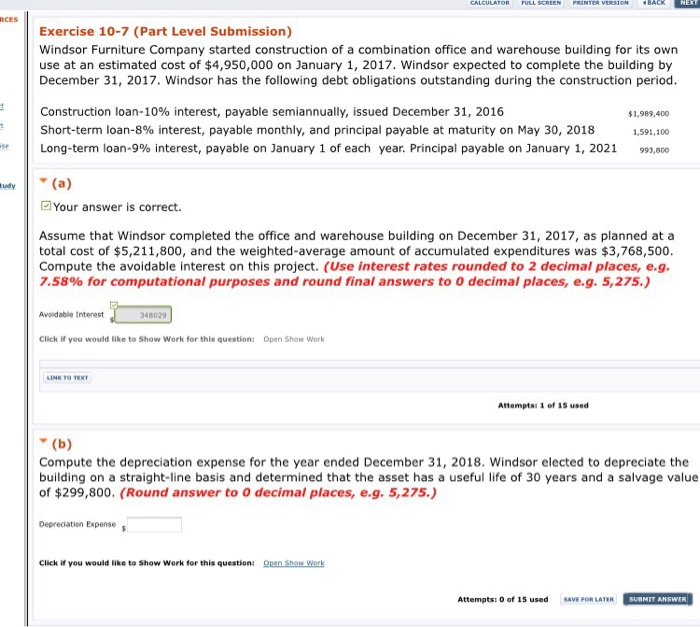

RCES Exercise 10-7 (Part Level Submission) Windsor Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $4,950,000 on January 1, 2017. Windsor expected to complete the building by December 31, 2017. Windsor has the following debt obligations outstanding during the construction period. Construction loan-10% interest, payable semiannually, issued December 31, 2016 Short-term loan-8% interest, payable monthly, and principal payable at maturity on May 30, 2018 Long-term loan-9% interest, payable on January 1 of each year. Principal payable on January 1, 2021 1,989,400 1,591,100 993,000 | se Your answer is correct. Assume that Windsor completed the office and warehouse building on December 31, 2017, as planned ata total cost of $5,211,800, and the weighted-average amount of accumulated expenditures was $3,768,500 Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g 7.58% for computational purposes and round final answers to 0 decimal places, eg. 5,275.) m4802 Avoidable Interest Click if you would like to Show Work for this question: Open Show Work INK TO TEN Attempts1 of 15 used Compute the depreciation expense for the year ended December 31, 2018. Windsor elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $299,800. (Round answer to O decimal places, e.g. 5,275.) Depreciatien Expense Click ir you would like to Show Work for this question: een Show Werk Attempts: 0 of 15 used SAVE FOR LATER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts