Question: HELP WITH PART C ONLY! !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! Please help me with part C. I know how to do Part A and B, but I cannot figure

HELP WITH PART C ONLY!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

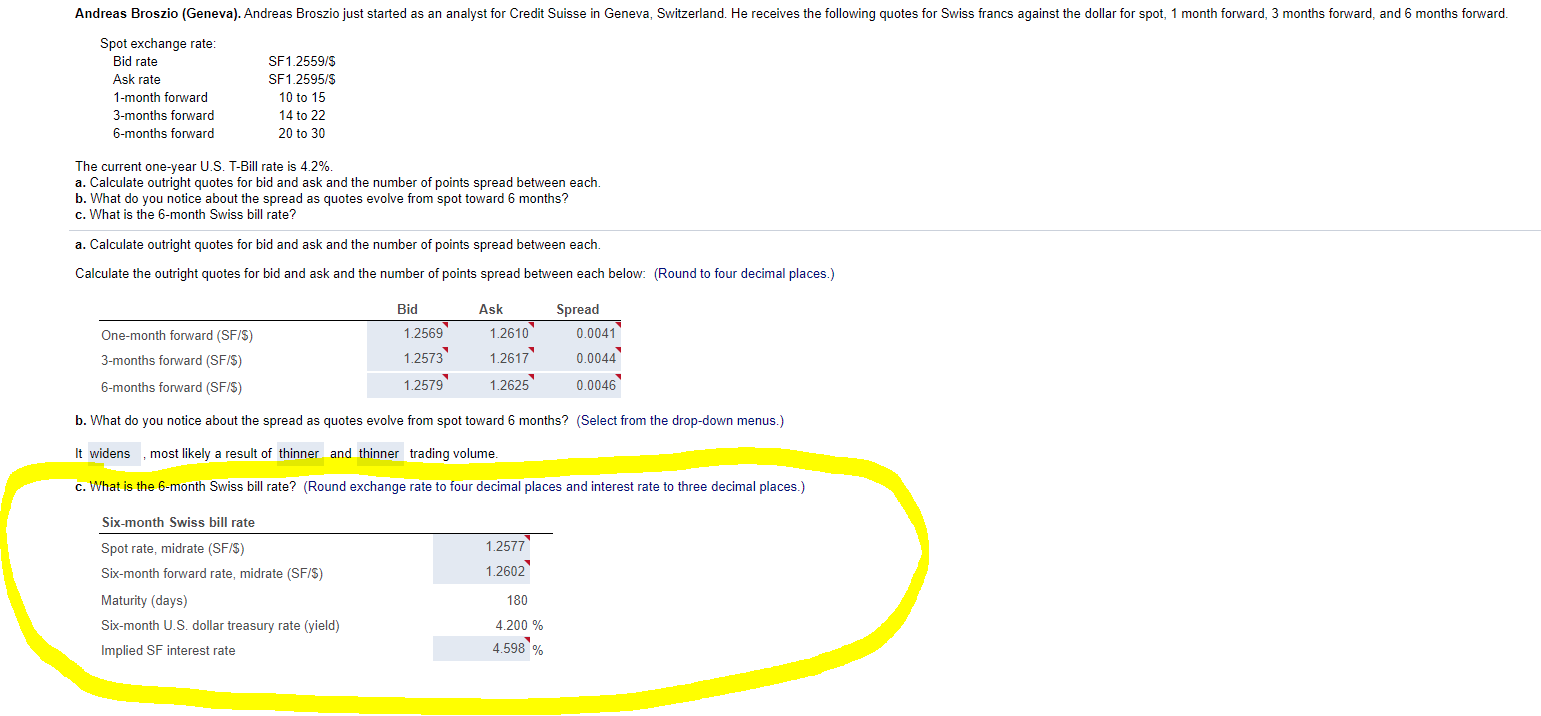

Please help me with part C. I know how to do Part A and B, but I cannot figure out how to get any of the answers in part C. Please provide an explanation for how to do the spot rate, midrate, the six-month forward rate, midrate and the implied SF interest rate.

Thank you so much

Andreas Broszio (Geneva). Andreas Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives the following quotes for Swiss francs against the dollar for spot, 1 month forward, 3 months forward, and 6 months forward. Spot exchange rate: Bid rate Ask rate 1-month forward 3-months forward 6-months forward SF1.2559/5 SF1.2595/$ 10 to 15 14 to 22 20 to 30 The current one-year U.S. T-Bill rate is 4.2%. a. Calculate outright quotes for bid and ask and the number of points spread between each. b. What do you notice about the spread as quotes evolve from spot toward 6 months? c. What is the 6-month Swiss bill rate? a. Calculate outright quotes for bid and ask and the number of points spread between each. Calculate the outright quotes for bid and ask and the number of points spread between each below: (Round to four decimal places.) Bid 1.2569 One-month forward (SF/S) 3-months forward (SF/S) 6-months forward (SF/S) Ask 1.2610 1.2617 1.2625 Spread 0.0041 0.0044 1.2573 1.2579 0.0046 b. What do you notice about the spread as quotes evolve from spot toward 6 months? (Select from the drop-down menus.) It widens most likely a result of thinner and thinner trading volume. c. What is the 6-month Swiss bill rate? (Round exchange rate to four decimal places and interest rate to three decimal places.) Six-month Swiss bill rate 1.2577 1.2602 Spot rate, midrate (SF/S) Six-month forward rate, midrate (SF/S) Maturity (days) Six-month U.S. dollar treasury rate (yield) Implied SF interest rate 180 4.200 % 4.598 % Andreas Broszio (Geneva). Andreas Broszio just started as an analyst for Credit Suisse in Geneva, Switzerland. He receives the following quotes for Swiss francs against the dollar for spot, 1 month forward, 3 months forward, and 6 months forward. Spot exchange rate: Bid rate Ask rate 1-month forward 3-months forward 6-months forward SF1.2559/5 SF1.2595/$ 10 to 15 14 to 22 20 to 30 The current one-year U.S. T-Bill rate is 4.2%. a. Calculate outright quotes for bid and ask and the number of points spread between each. b. What do you notice about the spread as quotes evolve from spot toward 6 months? c. What is the 6-month Swiss bill rate? a. Calculate outright quotes for bid and ask and the number of points spread between each. Calculate the outright quotes for bid and ask and the number of points spread between each below: (Round to four decimal places.) Bid 1.2569 One-month forward (SF/S) 3-months forward (SF/S) 6-months forward (SF/S) Ask 1.2610 1.2617 1.2625 Spread 0.0041 0.0044 1.2573 1.2579 0.0046 b. What do you notice about the spread as quotes evolve from spot toward 6 months? (Select from the drop-down menus.) It widens most likely a result of thinner and thinner trading volume. c. What is the 6-month Swiss bill rate? (Round exchange rate to four decimal places and interest rate to three decimal places.) Six-month Swiss bill rate 1.2577 1.2602 Spot rate, midrate (SF/S) Six-month forward rate, midrate (SF/S) Maturity (days) Six-month U.S. dollar treasury rate (yield) Implied SF interest rate 180 4.200 % 4.598 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts