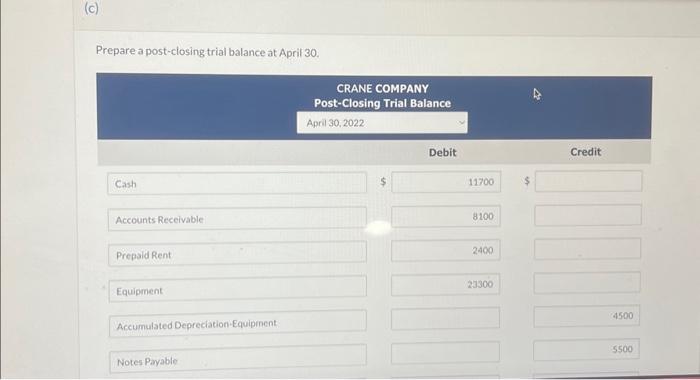

Question: help with part c please! Prepare a post-closing trial balance at April 30. Post the closing entries. (Post entries in the order of journal entries

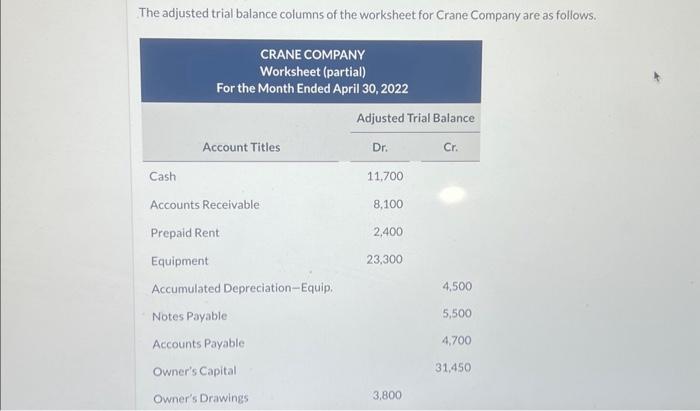

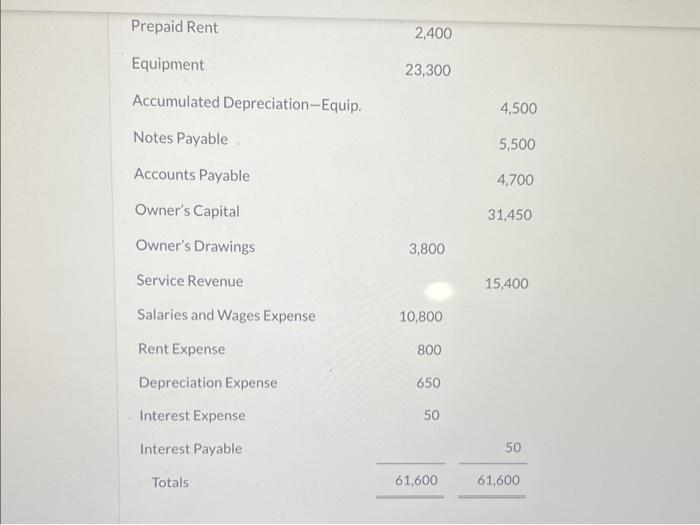

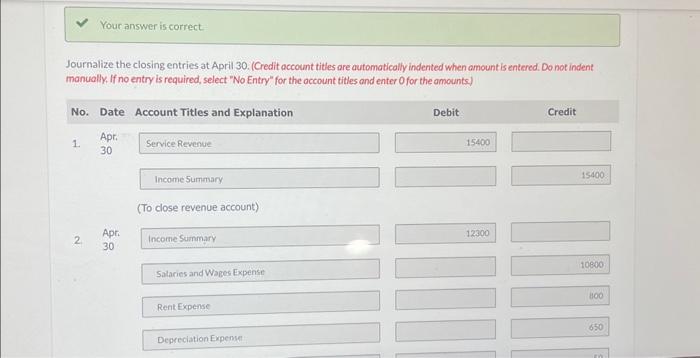

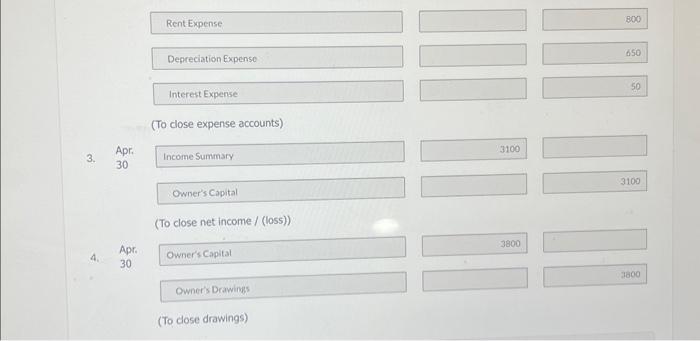

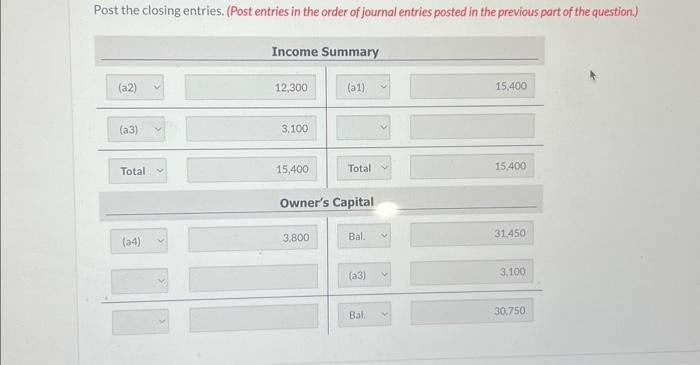

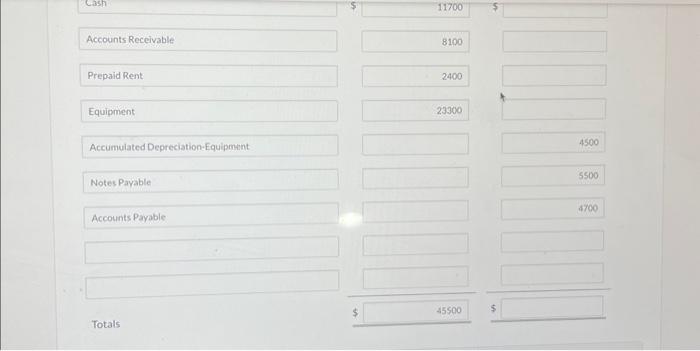

Prepare a post-closing trial balance at April 30. Post the closing entries. (Post entries in the order of journal entries posted in the previous part of the question.) Rent Expense Depreciation Expense 650 Interest Expense 50 (To close expense accounts) 3. Apr. Income Summary 3100 Owner's Capital (To close net income / (loss)) 4. Apr. Owner's Capital Owner's Drawings (To close drawings) Accounts Receivable 8100 Prepaid Rent 2400 Equipment 23900 Accumulated Depreciation-Equipment Notes Payable Accounts Payable \begin{tabular}{|l|} \hline 4500 \\ \hline 5500 \\ \hline 4700 \\ \hline \end{tabular} Totals $ Journalize the closing entries at April 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts) The adjusted trial balance columns of the worksheet for Crane Company are as follows. \begin{tabular}{|c|c|c|} \hline Prepaid Rent & 2,400 & \\ \hline Equipment & 23,300 & \\ \hline Accumulated Depreciation-Equip. & & 4,500 \\ \hline Notes Payable & & 5,500 \\ \hline Accounts Payable & & 4,700 \\ \hline Owner's Capital & & 31,450 \\ \hline Owner's Drawings & 3,800 & \\ \hline Service Revenue & & 15,400 \\ \hline Salaries and Wages Expense & 10,800 & \\ \hline Rent Expense & 800 & \\ \hline Depreciation Expense & 650 & \\ \hline Interest Expense & 50 & \\ \hline Interest Payable & & 50 \\ \hline Totals & 61,600 & 61,600 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts