Question: Help with part d Problem 15-07A a-d (Part Level Submission) The following is taken from the Wildhorse Company balance sheet. Wildhorse Company Balance Sheet (partial)

Help with part d

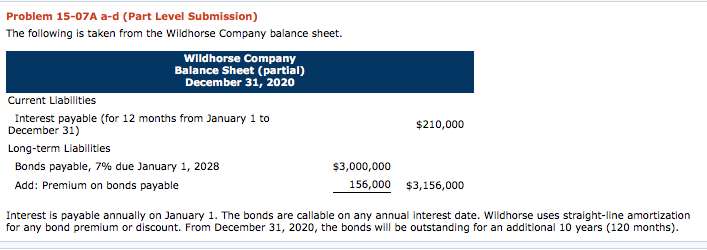

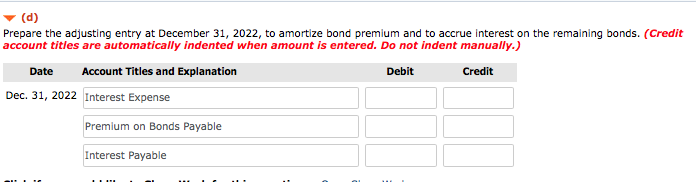

Problem 15-07A a-d (Part Level Submission) The following is taken from the Wildhorse Company balance sheet. Wildhorse Company Balance Sheet (partial) December 31, 2020 Current Liabilities Interest payable (for 12 months from January 1 to $210,000 December 31) Long-term Liabilities Bonds payable, 7% due January 1, 2028 $3,000,000 Add: Premium on bonds payable 156,000 $3,156,000 Interest is payable annually on January 1. The bonds are callable on any annual interest date. Wildhorse uses straight-line amortization for any bond premium or discount. From December 31, 2020, the bonds will be outstanding for an additional 10 years (120 months). (d) Prepare the adjusting entry at December 31, 2022, to amortize bond premium and to accrue interest on the remaining bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2022 Interest Expense Premium on Bonds Payable Interest Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts