Question: Help with PR 5-8A. the 5-3A has been solved. also how to adjust and close these accounts? Chapter 5 Accounting for Retail Businesses 287 Appendix

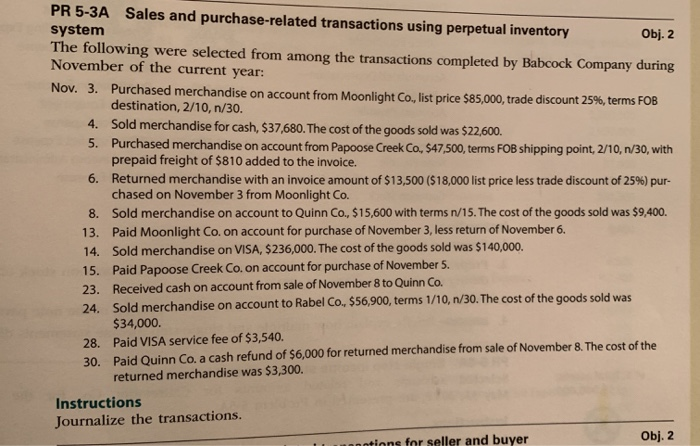

Chapter 5 Accounting for Retail Businesses 287 Appendix 2 PR 5-8A Sales and purchase-related transactions using periodic inventory system Selected transactions for Babcock Company during November of the current year are listed in Problem 5-3A. Instructions Journalize the entries to record the transactions of Babcock Company for November using the periodic inventory system. Annandiy PR 5-3A Sales and purchase-related transactions using perpetual inventory system Obj. 2 The following were selected from among the transactions completed by Babcock Company during November of the current year: Nov. 3. Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/30. 4. Sold merchandise for cash, $37,680. The cost of the goods sold was $22,600. 5. Purchased merchandise on account from Papoose Creek Co., 547,500, terms FOB shipping point, 2/10, 1/30, with prepaid freight of $810 added to the invoice. 6. Returned merchandise with an invoice amount of $13,500 ($18,000 list price less trade discount of 25%) pur. chased on November 3 from Moonlight Co. 8. Sold merchandise on account to Quinn Co., $15,600 with terms n/15. The cost of the goods sold was $9,400. 13. Paid Moonlight Co. on account for purchase of November 3, less return of November 6. 14. Sold merchandise on VISA, $236,000. The cost of the goods sold was $140,000 15. Paid Papoose Creek Co. on account for purchase of November 5. 23. Received cash on account from sale of November 8 to Quinn Co. 24. Sold merchandise on account to Rabel Co., $56,900, terms 1/10, n/30. The cost of the goods sold was $34,000. 28. Paid VISA service fee of $3,540. 30. Paid Quinn Co. a cash refund of $6,000 for returned merchandise from sale of November 8. The cost of the returned merchandise was $3,300. Instructions Journalize the transactions. nntinns for seller and buyer Obj. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts