Question: help with problem 3 please Problem 3-Activity-Based Costing (ABC): (50 points) ABC is a review of activities that use overhead resources. Based on this review,

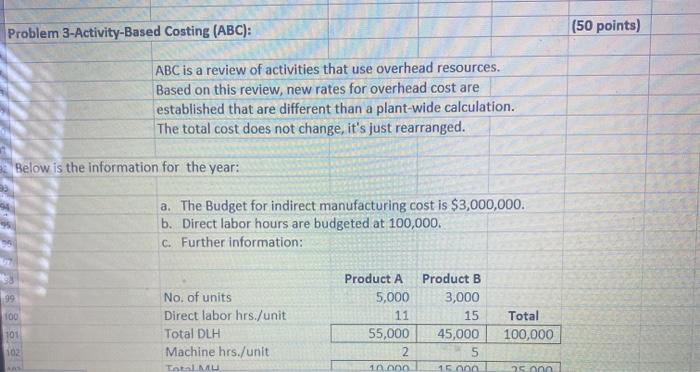

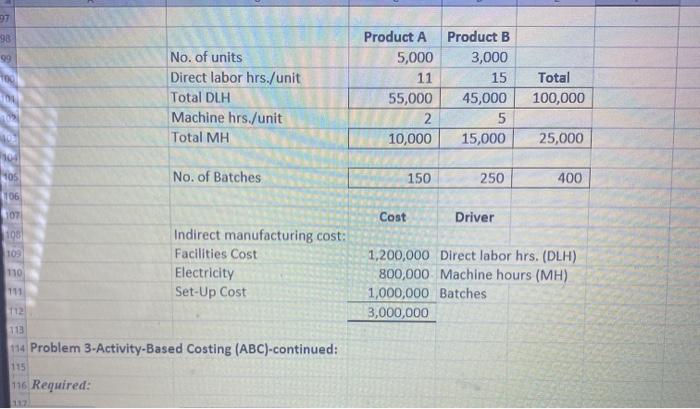

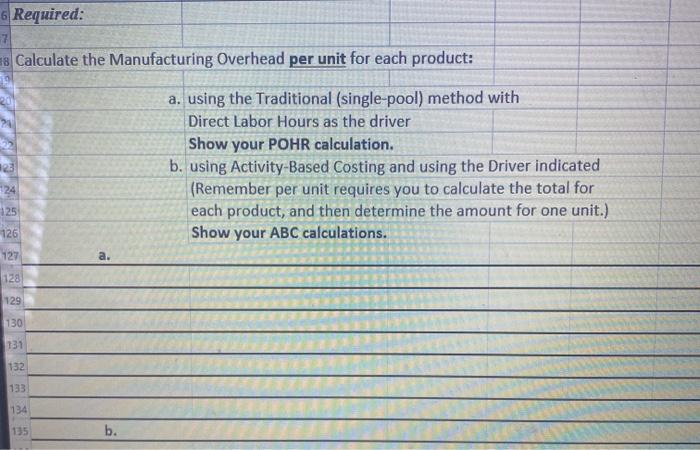

Problem 3-Activity-Based Costing (ABC): (50 points) ABC is a review of activities that use overhead resources. Based on this review, new rates for overhead cost are established that are different than a plant-wide calculation. The total cost does not change, it's just rearranged. Below is the information for the year: a. The Budget for indirect manufacturing cost is $3,000,000. b. Direct labor hours are budgeted at 100,000. C. Further information: 99 100 No. of units Direct labor hrs./unit Total DLH Machine hrs./unit Product A 5,000 11 55,000 2 Product B 3,000 15 45,000 5 Total 100,000 101 102 Total 10 15 25ann 97 99 No. of units Direct labor hrs./unit Total DLH Machine hrs./unit Total MH Product A 5,000 11 55,000 2 10,000 Product B 3,000 15 45,000 5 15,000 Total 100,000 25,000 10- 105 No. of Batches 150 250 400 106 107 Cost Driver 108 10 Indirect manufacturing cost: Facilities Cost Electricity Set-Up Cost 110 1,200,000 Direct labor hrs. (DLH) 800,000 Machine hours (MH) 1,000,000 Batches 3,000,000 111 112 113 114 Problem 3-Activity-Based Costing (ABC)-continued: 115 116 Required: 112 6 Required: 7 Calculate the Manufacturing Overhead per unit for each product: 28 a. using the Traditional (single-pool) method with Direct Labor Hours as the driver Show your POHR calculation. b. using Activity-Based Costing and using the Driver indicated (Remember per unit requires you to calculate the total for each product, and then determine the amount for one unit.) Show your ABC calculations. 124 125 126 127 a. 128 129 130 131 133 134 b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts