Question: help with project I and II NPV please! Net Present Value Versus Internal Rate of Return For discount factors use Exhibit 12B-1 and Exhibit 12B-2.

help with project I and II NPV please!

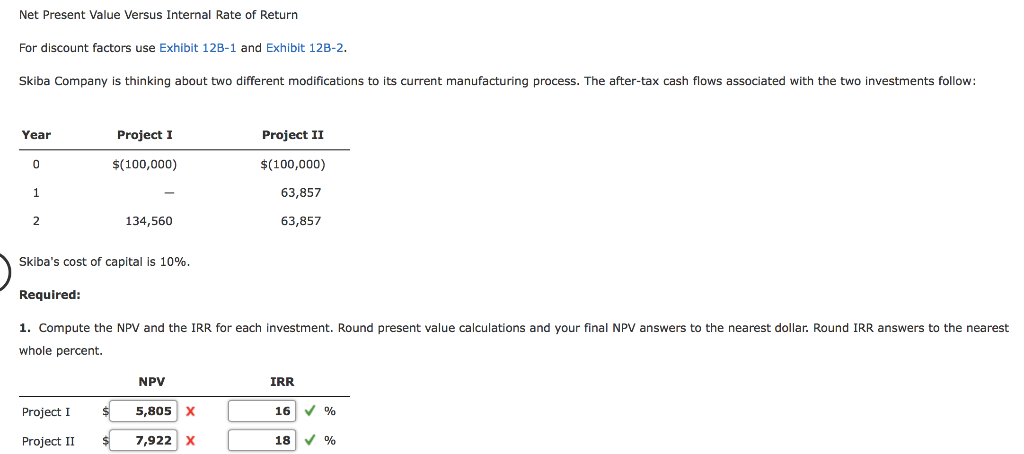

Net Present Value Versus Internal Rate of Return For discount factors use Exhibit 12B-1 and Exhibit 12B-2. Skiba Company is thinking about two different modifications to its current manufacturing process. The after-tax cash flows associated with the two investments follow Year Project I Project II $(100,000) 63,857 63,857 $(100,000) 134,560 Skiba's cost of capital is 10%. Required: 1. Compute the NPV and the IRR for each investment. Round present value calculations and your final NPV answers to the nearest dollar. Round IRR answers to the nearest whole percent NPV 5,805X 7,922 X IRR 161 % 18 % Project I Project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts