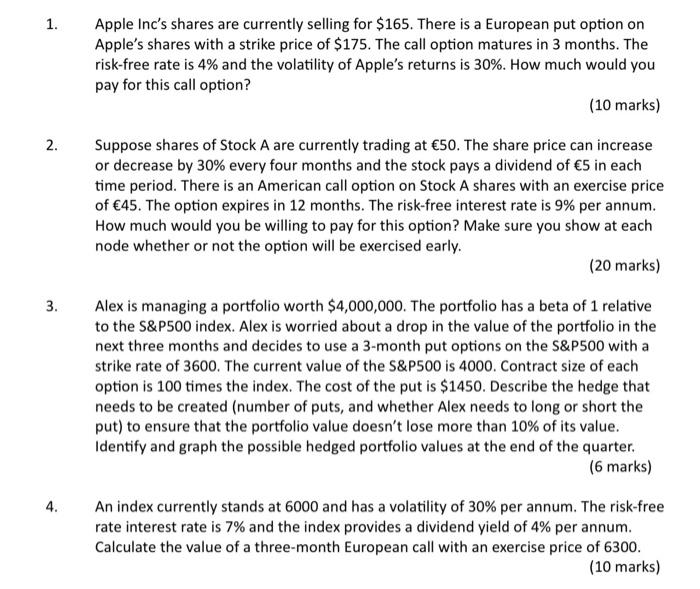

Question: help with question 1 2 3 and 4 Apple Inc's shares are currently selling for $165. There is a European put option on Apple's shares

Apple Inc's shares are currently selling for $165. There is a European put option on Apple's shares with a strike price of $175. The call option matures in 3 months. The risk-free rate is 4% and the volatility of Apple's returns is 30%. How much would you pay for this call option? (10 marks) Suppose shares of Stock A are currently trading at 50. The share price can increase or decrease by 30% every four months and the stock pays a dividend of 5 in each time period. There is an American call option on Stock A shares with an exercise price of 45. The option expires in 12 months. The risk-free interest rate is 9% per annum. How much would you be willing to pay for this option? Make sure you show at each node whether or not the option will be exercised early. (20 marks) Alex is managing a portfolio worth $4,000,000. The portfolio has a beta of 1 relative to the S\&P500 index. Alex is worried about a drop in the value of the portfolio in the next three months and decides to use a 3-month put options on the S\&P500 with a strike rate of 3600 . The current value of the S\&P500 is 4000 . Contract size of each option is 100 times the index. The cost of the put is $1450. Describe the hedge that needs to be created (number of puts, and whether Alex needs to long or short the put) to ensure that the portfolio value doesn't lose more than 10% of its value. Identify and graph the possible hedged portfolio values at the end of the quarter. (6 marks) An index currently stands at 6000 and has a volatility of 30% per annum. The risk-free rate interest rate is 7% and the index provides a dividend yield of 4% per annum. Calculate the value of a three-month European call with an exercise price of 6300 . (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts