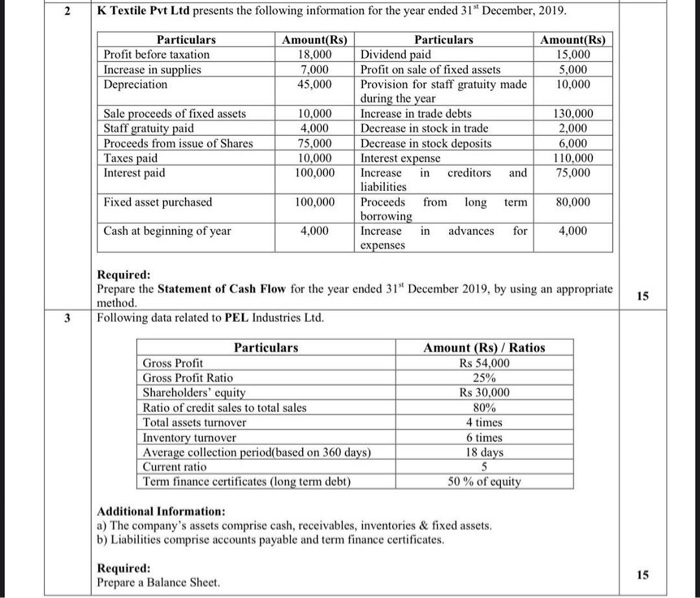

Question: help with question 2 and 3 2 K Textile Pvt Ltd presents the following information for the year ended 31 December, 2019. Particulars Amount(Rs) Particulars

2 K Textile Pvt Ltd presents the following information for the year ended 31" December, 2019. Particulars Amount(Rs) Particulars Amount(Rs) Profit before taxation 18,000 Dividend paid 15,000 Increase in supplies 7,000 Profit on sale of fixed assets 5,000 Depreciation 45,000 Provision for staff gratuity made 10,000 during the year Sale proceeds of fixed assets 10,000 Increase in trade debts 130,000 Staff gratuity paid 4,000 Decrease in stock in trade 2,000 Proceeds from issue of Shares 75,000 Decrease in stock deposits 6,000 Taxes paid 10,000 Interest expense 110,000 Interest paid 100,000 Increase in creditors and 75,000 liabilities Fixed asset purchased 100,000 Proceeds from long term 80,000 borrowing Cash at beginning of year 4,000 Increase in advances for 4,000 expenses Required: Prepare the Statement of Cash Flow for the year ended 31" December 2019, by using an appropriate method. Following data related to PEL Industries Ltd. Particulars Amount (Rs) / Ratios Gross Profit Rs 54,000 Gross Profit Ratio 25% Shareholders' equity Rs 30,000 Ratio of credit sales to total sales 80% Total assets turnover 4 times Inventory turnover 6 times Average collection period(based on 360 days) 18 days Current ratio 5 Term finance certificates (long term debt) 50% of equity Additional Information: a) The company's assets comprise cash, receivables, inventories & fixed assets. b) Liabilities comprise accounts payable and term finance certificates. Required: Prepare a Balance Sheet 15 3 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts