Question: Help with question 2 and 3 please! PROJECT 2 INFORMATION: TravelCorp is evaluating a new asset as an investment. The annual rate of return and

Help with question 2 and 3 please!

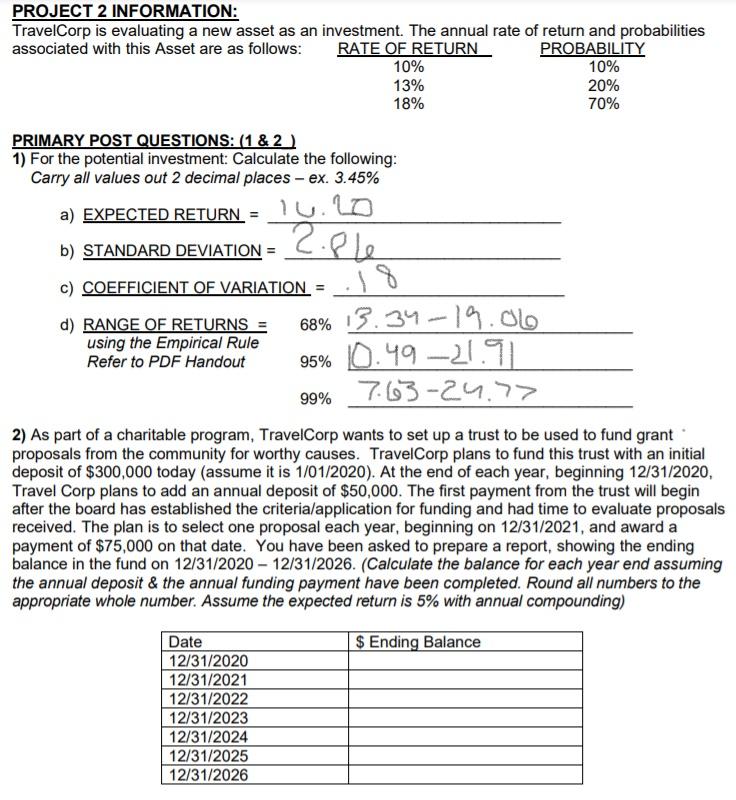

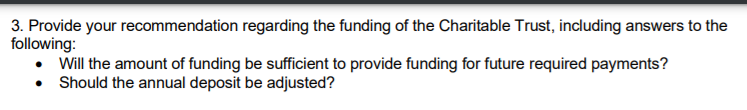

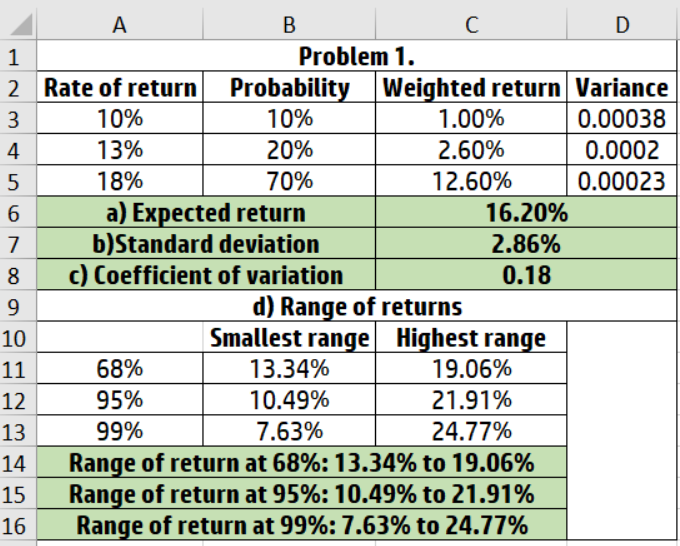

PROJECT 2 INFORMATION: TravelCorp is evaluating a new asset as an investment. The annual rate of return and probabilities associated with this Asset are as follows: RATE OF RETURN PROBABILITY 10% 10% 13% 20% 18% 70% 2.ple PRIMARY POST QUESTIONS: (1 & 2 ) 1) For the potential investment: Calculate the following: Carry all values out 2 decimal places - ex. 3.45% a) EXPECTED RETURN = 14.20 b) STANDARD DEVIATION = c) COEFFICIENT OF VARIATION = d) RANGE OF RETURNS = 68% 3.34-19.06 using the Empirical Rule Refer to PDF Handout 95% 0.49 -21.91 99% 7.63-24.>> 2) As part of a charitable program, TravelCorp wants to set up a trust to be used to fund grant proposals from the community for worthy causes. TravelCorp plans to fund this trust with an initial deposit of $300,000 today (assume it is 1/01/2020). At the end of each year, beginning 12/31/2020, Travel Corp plans to add an annual deposit of $50,000. The first payment from the trust will begin after the board has established the criteria/application for funding and had time to evaluate proposals received. The plan is to select one proposal each year, beginning on 12/31/2021, and award a payment of $75,000 on that date. You have been asked to prepare a report, showing the ending balance in the fund on 12/31/2020 - 12/31/2026. (Calculate the balance for each year end assuming the annual deposit & the annual funding payment have been completed. Round all numbers to the appropriate whole number. Assume the expected return is 5% with annual compounding) $ Ending Balance Date 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 3. Provide your recommendation regarding the funding of the Charitable Trust, including answers to the following: Will the amount of funding be sufficient to provide funding for future required payments? Should the annual deposit be adjusted? A B D 1 Problem 1. 2 Rate of return Probability Weighted return Variance 3 10% 10% 1.00% 0.00038 4 13% 20% 2.60% 0.0002 5 18% 70% 12.60% 0.00023 6 a) Expected return 16.20% 7 b)Standard deviation 2.86% 8 c) Coefficient of variation 0.18 9 d) Range of returns 10 Smallest range Highest range 11 68% 13.34% 19.06% 12 95% 10.49% 21.91% 13 99% 7.63% 24.77% 14 Range of return at 68%: 13.34% to 19.06% 15 Range of return at 95%: 10.49% to 21.91% 16 Range of return at 99%: 7.63% to 24.77% PROJECT 2 INFORMATION: TravelCorp is evaluating a new asset as an investment. The annual rate of return and probabilities associated with this Asset are as follows: RATE OF RETURN PROBABILITY 10% 10% 13% 20% 18% 70% 2.ple PRIMARY POST QUESTIONS: (1 & 2 ) 1) For the potential investment: Calculate the following: Carry all values out 2 decimal places - ex. 3.45% a) EXPECTED RETURN = 14.20 b) STANDARD DEVIATION = c) COEFFICIENT OF VARIATION = d) RANGE OF RETURNS = 68% 3.34-19.06 using the Empirical Rule Refer to PDF Handout 95% 0.49 -21.91 99% 7.63-24.>> 2) As part of a charitable program, TravelCorp wants to set up a trust to be used to fund grant proposals from the community for worthy causes. TravelCorp plans to fund this trust with an initial deposit of $300,000 today (assume it is 1/01/2020). At the end of each year, beginning 12/31/2020, Travel Corp plans to add an annual deposit of $50,000. The first payment from the trust will begin after the board has established the criteria/application for funding and had time to evaluate proposals received. The plan is to select one proposal each year, beginning on 12/31/2021, and award a payment of $75,000 on that date. You have been asked to prepare a report, showing the ending balance in the fund on 12/31/2020 - 12/31/2026. (Calculate the balance for each year end assuming the annual deposit & the annual funding payment have been completed. Round all numbers to the appropriate whole number. Assume the expected return is 5% with annual compounding) $ Ending Balance Date 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 3. Provide your recommendation regarding the funding of the Charitable Trust, including answers to the following: Will the amount of funding be sufficient to provide funding for future required payments? Should the annual deposit be adjusted? A B D 1 Problem 1. 2 Rate of return Probability Weighted return Variance 3 10% 10% 1.00% 0.00038 4 13% 20% 2.60% 0.0002 5 18% 70% 12.60% 0.00023 6 a) Expected return 16.20% 7 b)Standard deviation 2.86% 8 c) Coefficient of variation 0.18 9 d) Range of returns 10 Smallest range Highest range 11 68% 13.34% 19.06% 12 95% 10.49% 21.91% 13 99% 7.63% 24.77% 14 Range of return at 68%: 13.34% to 19.06% 15 Range of return at 95%: 10.49% to 21.91% 16 Range of return at 99%: 7.63% to 24.77%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts