Question: Help with red! Problem 19-4A The following data were taken from the records of Clarkson Company for the fiscal year ended June 30, 2017. $5,700

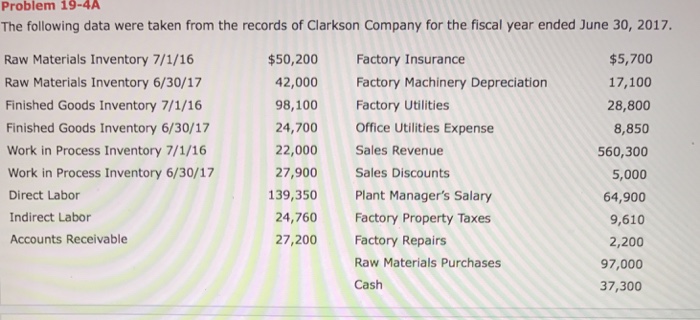

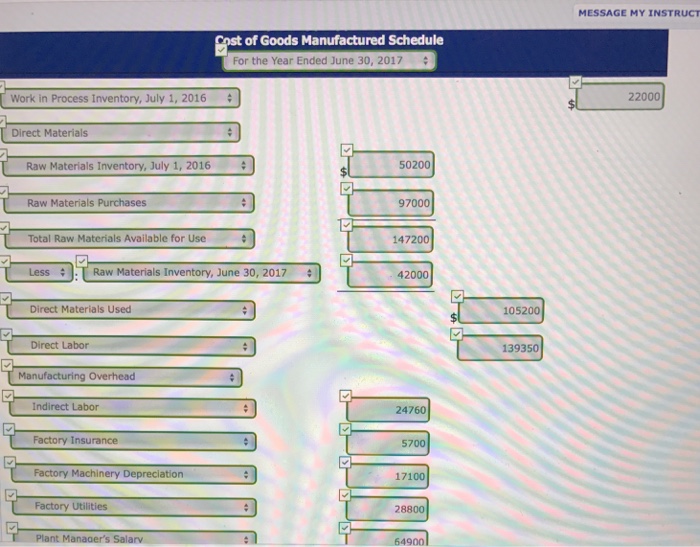

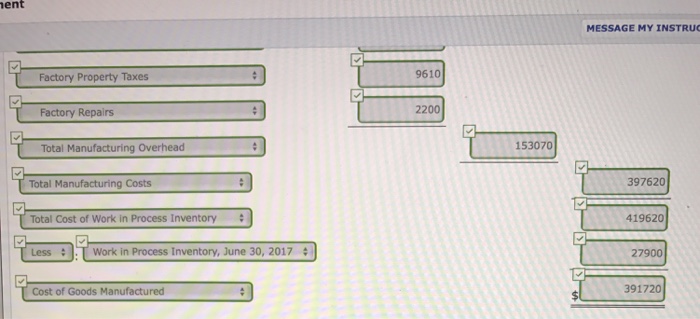

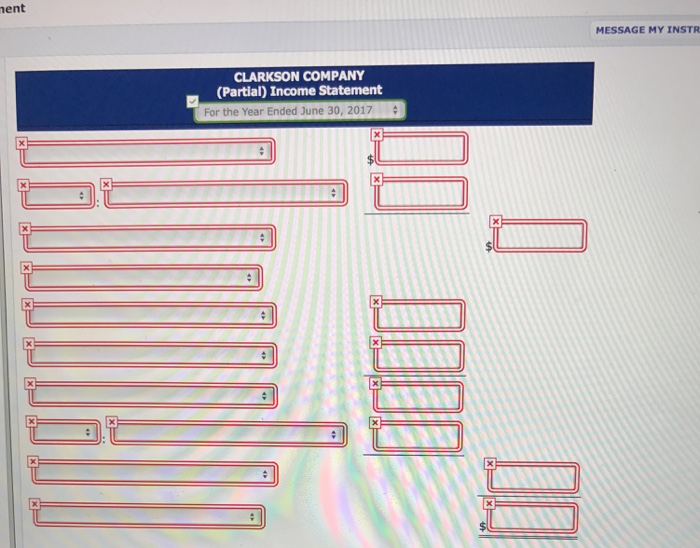

Problem 19-4A The following data were taken from the records of Clarkson Company for the fiscal year ended June 30, 2017. $5,700 17,100 28,800 8,850 560,300 5,000 64,900 9,610 2,200 97,000 37,300 $50,200 Factory Insurance Raw Materials Inventory 7/1/16 Raw Materials Inventory 6/30/17 Finished Goods Inventory 7/1/16 Finished Goods Inventory 6/30/17 Work in Process Inventory 7/1/16 Work in Process Inventory 6/30/17 Direct Labor Indirect Labor Accounts Receivable 42,000 Factory Machinery Depreciation 98,100 Factory Utilities 24,700 Office Utilities Expense 22,000 Sales Revenue 27,900Sales Discounts 139,350 Plant Manager's Salary Factory Property Taxes Factory Repairs Raw Materials Purchases Cash 24,760 27,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts