Question: help with steps plz Several companies, including Green Forest Technology and Violet Sky Food, are considering project A, which is believed by all to have

help with steps plz

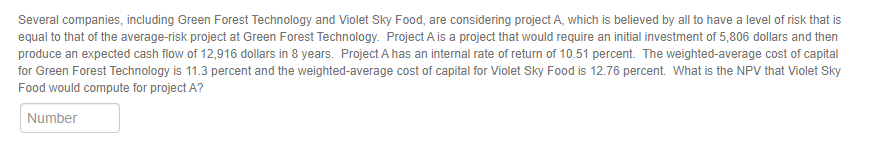

Several companies, including Green Forest Technology and Violet Sky Food, are considering project A, which is believed by all to have a level of risk that is equal to that of the average-risk project at Green Forest Technology. Project A is a project that would require an initial investment of 5,806 dollars and then produce an expected cash flow of 12,916 dollars in 8 years. Project A has an internal rate of return of 10.51 percent. The weighted average cost of capital for Green Forest Technology is 11.3 percent and the weighted average cost of capital for Violet Sky Food is 12.76 percent. What is the NPV that Violet Sky Food would compute for project A? Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts