Question: help with the after stock split 8. On October 31, the stockholders' equity section of Heins Company consists of common stock $280,000 and retained earnings

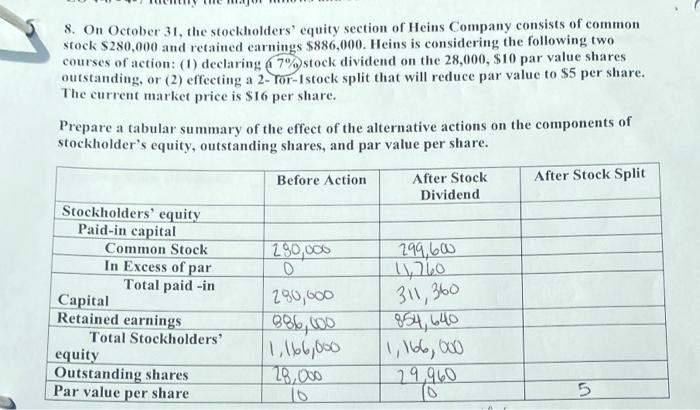

8. On October 31, the stockholders' equity section of Heins Company consists of common stock $280,000 and retained earnings $886,000. Heins is considering the following two courses of action: (1) declaring 7%) stock dividend on the 28,000, $10 par value shares outstanding, or (2) effecting a 2-fr-Istock split that will reduce par value to $5 per share. The current market price is $16 per share. Prepare a tabular summary of the effect of the alternative actions on the components of stockholder's equity, outstanding shares, and par value per share. Before Action After Stock Split After Stock Dividend 299,60 1210 Stockholders' equity Paid-in capital Common Stock In Excess of par Total paid -in Capital Retained earnings Total Stockholders' equity Outstanding shares Par value per share 311,360 290,000 D 290,600 886,000 1, 166,000 28,000 854, 640 11, 166,000 29960 To 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts