Question: Help with the following problem, explain please. Exercise 175 a1-a3 (Part Level Submission) Ando, Dadd, and Porter formed a partnership on January 1, 2020. Ando

Help with the following problem, explain please.

Help with the following problem, explain please.

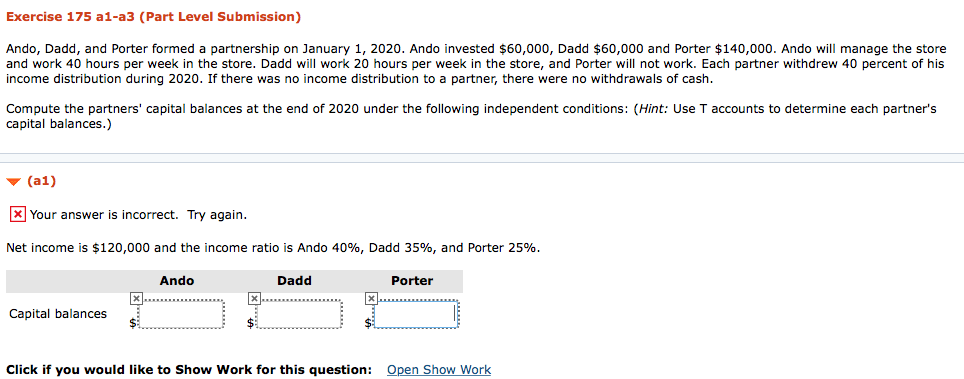

Exercise 175 a1-a3 (Part Level Submission) Ando, Dadd, and Porter formed a partnership on January 1, 2020. Ando invested $60,000, Dadd $60,000 and Porter $140,000. Ando will manage the store and work 40 hours per week in the store. Dadd will work 20 hours per week in the store, and Porter will not work. Each partner withdrew 40 percent of his income distribution during 2020. If there was no income distribution to a partner, there were no withdrawals of cash. Compute the partners' capital balances at the end of 2020 under the following independent conditions: (Hint: Use T accounts to determine each partner's capital balances.) (1) X Your answer is incorrect. Try again. Net income is $120,000 and the income ratio is Ando 40%, Dadd 35%, and Porter 25%. Ando Dadd Porter Capital balances Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts