Question: Help with the incorrect Cash Flow Statement A Statement of Cash Flows explains how changes in balance sheet accounts and income statement accounts cause the

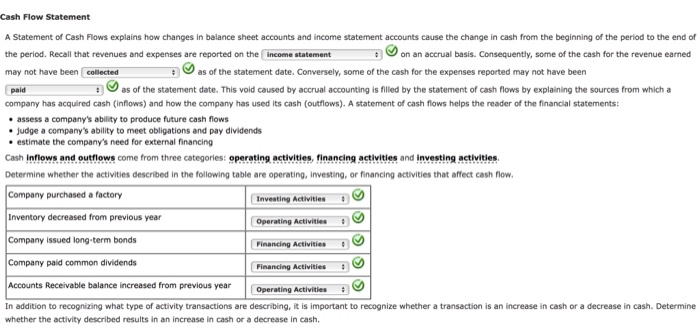

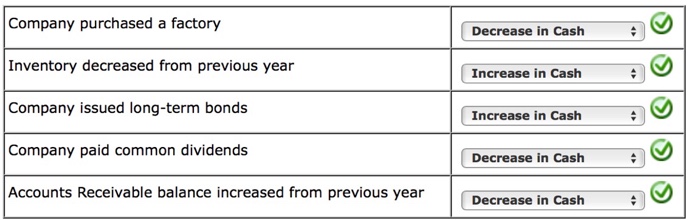

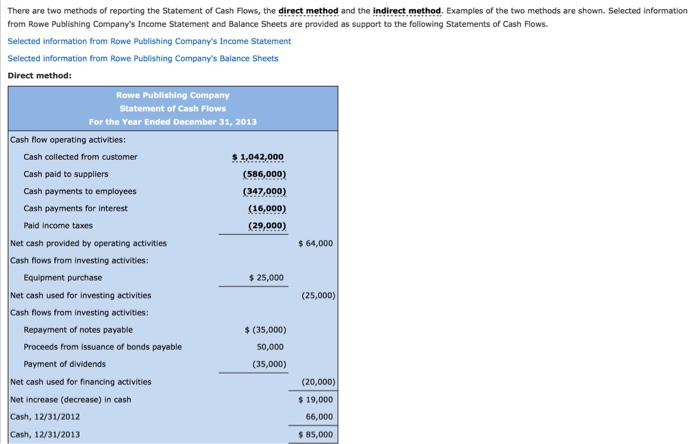

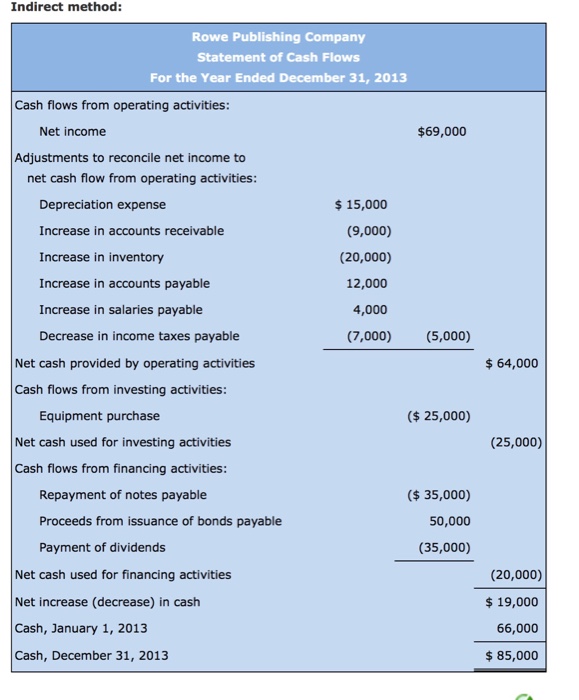

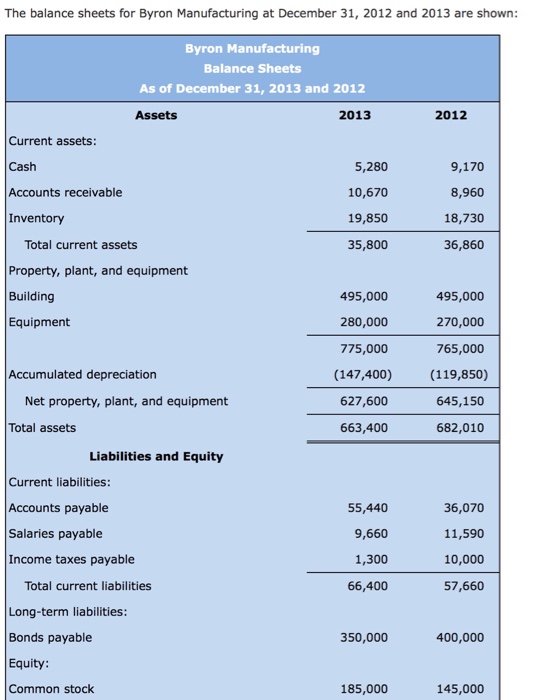

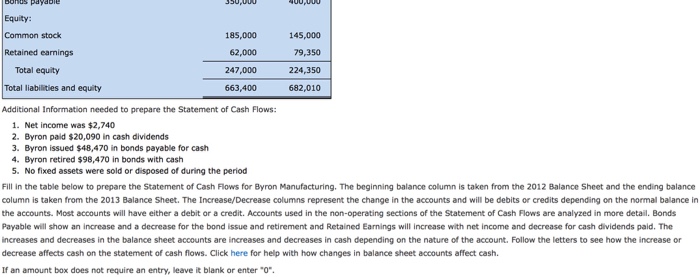

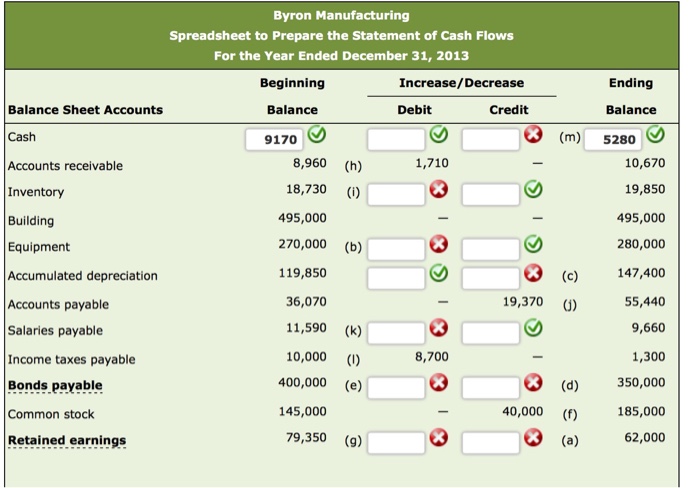

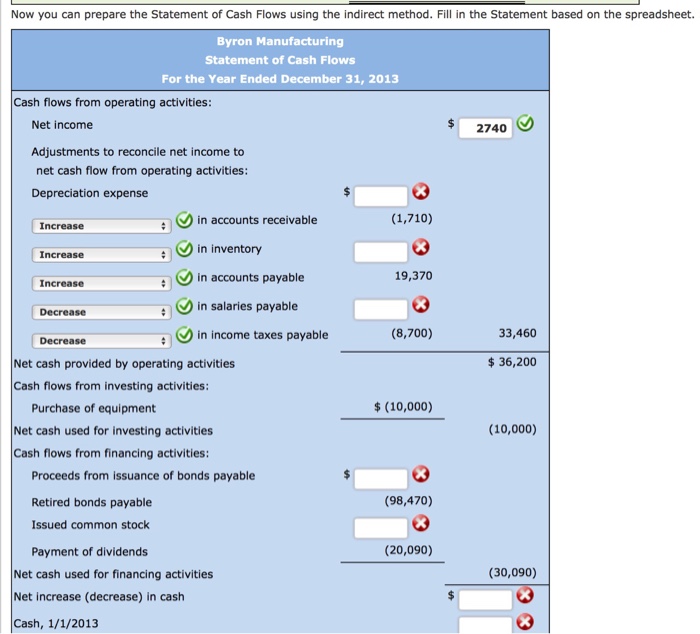

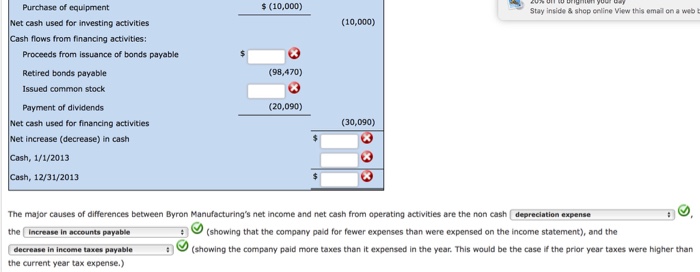

Cash Flow Statement A Statement of Cash Flows explains how changes in balance sheet accounts and income statement accounts cause the change in cash from the beginning of the period to the end of the period. Recall that revenues and expenses are reported on the income statement on an accrual basis. Consequently, some of the cash for the revenue earned may not have been collected as of the statement date. Conversely, some of the cash for the expenses reported may not have been as of the statement date. This void caused by accrual accounting is filled by the statement of cash flows by explaining the sources from which a paid company has acquired cash (inflows) and how the company has used its cash (outflows). A statement of cash flows helps the reader of the financial statements: assess a company's ability to produce future cash flows judge a company's ability to meet obligations and pay dividends estimate the company's need for external financing Cash inflows and outflows come from three categories: operating activities, financing activities and investing activities. Determine whether the activities described in the following table are operating, investing, or financing activities that affect cash flow. Company purchased a factory Investing Activities Inventory decreased from previous year Operating Activities Company issued long term bonds Financing Activities Company paid common dividends Financing Activities Accounts Receivable balance increased from previous year Operating Activities In addition to recognizing what type of activity transactions are describing, it is important to recognize whether a transaction is an increase in cash or a decrease in cash. Determine whether the activity described results in an increase in cash or a decrease in cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts