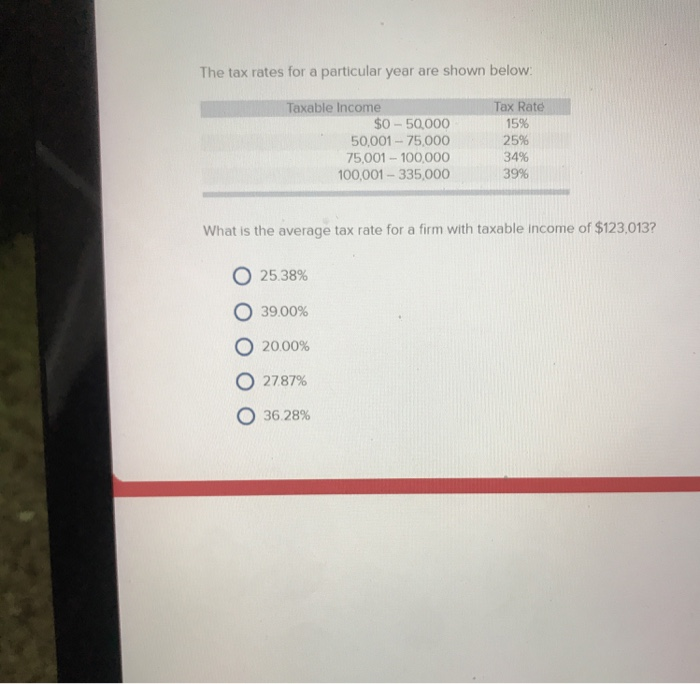

Question: Help with these multiple choice The tax rates for a particular year are shown below: Taxable Income Tax Rate $0-50,000 50,001-75,000 15% 25% 34% 75,001-100,000

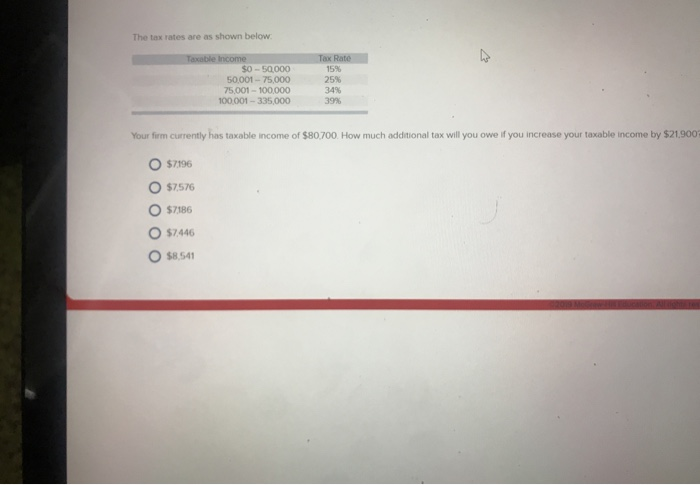

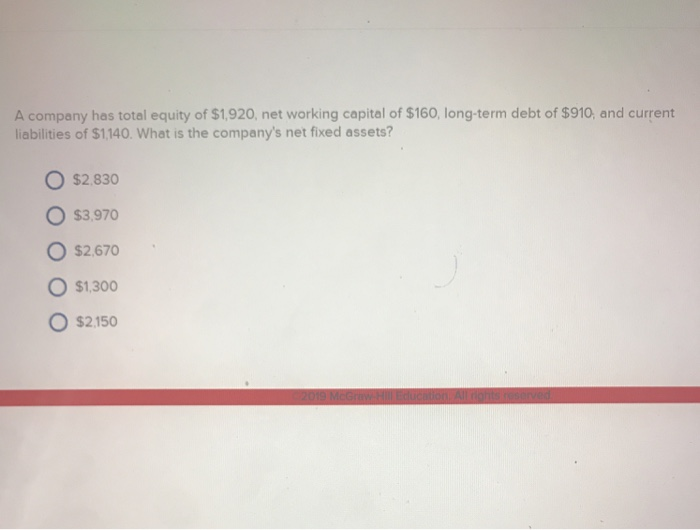

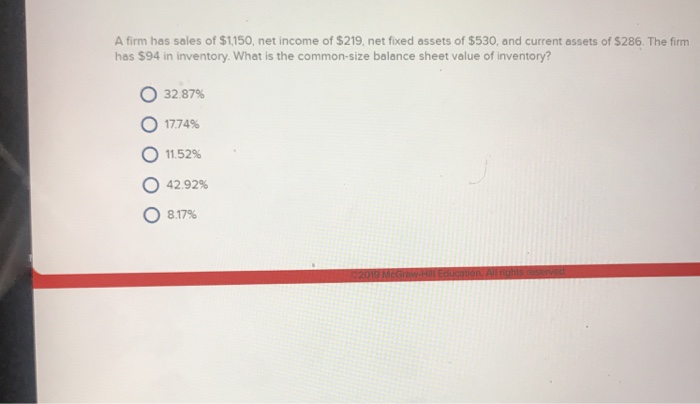

The tax rates for a particular year are shown below: Taxable Income Tax Rate $0-50,000 50,001-75,000 15% 25% 34% 75,001-100,000 39% 100,001-335,000 What is the average tax rate for a firm with taxable income of $123,013? O 25.38% 39.00% O20.00% 2787% 36.28% The tax rates are as shown below Tax Rate Taxoble Income 15 % 25 % 34 % $0-50000 50001-75.000 75,001-100,000 100001-335,000 39% Your firm currently has taxable income of $80,700 How much additional tax will you owe if you increase your taxable income by $21,9007 $7196 O $7576 O $7186 $7446 $8.541 A company has total equity of $1,920, net working capital of $160, long-term debt of $910, and current liabilities of $1,140. What is the company's net fixed assets? $2.830 $3,970 $2,670 $1,300 O$2,150 A firm has sales of $1,150, net income of $219, net fixed assets of $530, and current assets of $286. The firm has $94 in inventory. What is the common-size balance sheet value of inventory? 32.87% 17.74% 11.52% 42.92% 8.17%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts