Question: help with this 2 part question, if you are not able to answer it all please let someone else do it. Required information [The following

![following information applies to the questions displayed below.] Brooks Company purchases debt](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f950a9f1c0a_14566f950a993a6b.jpg)

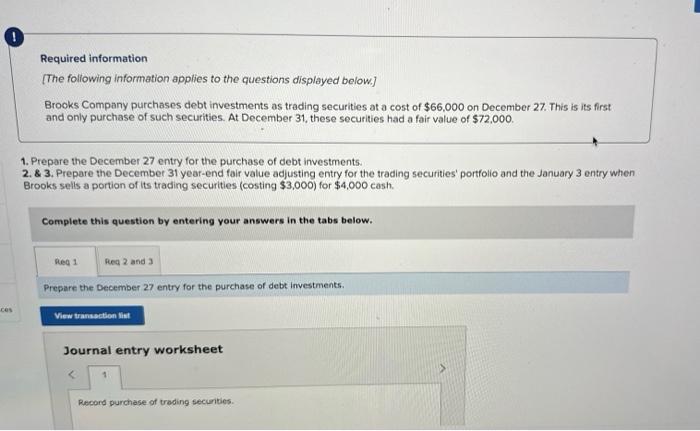

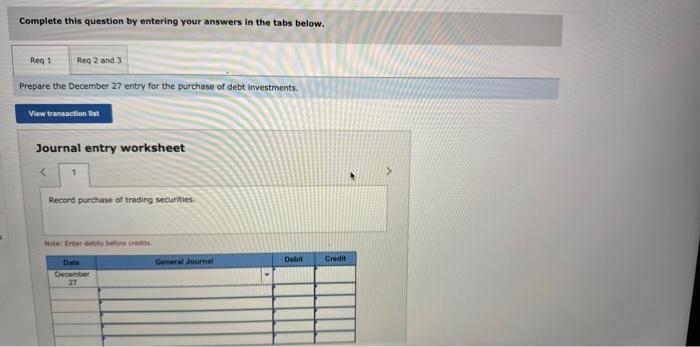

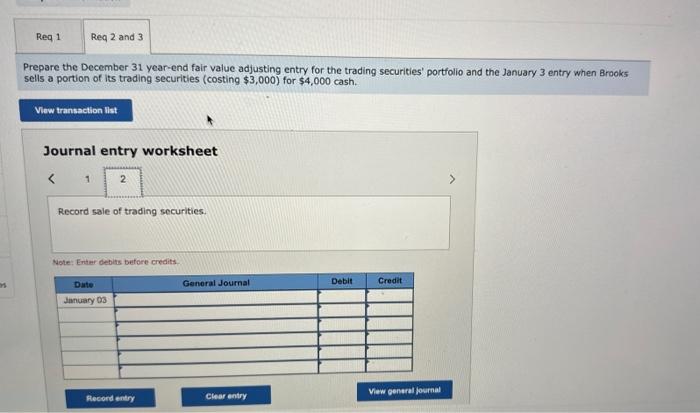

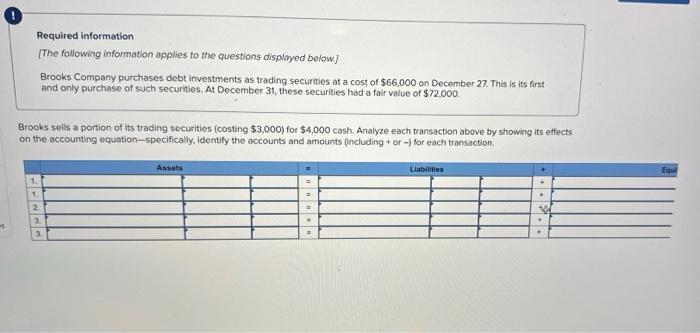

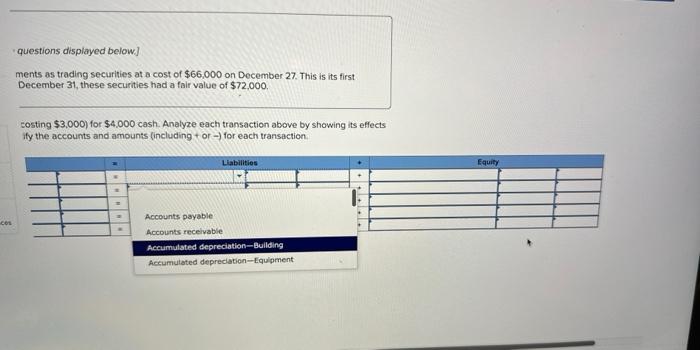

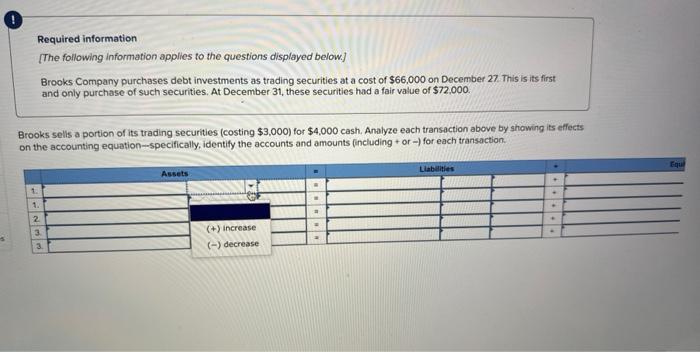

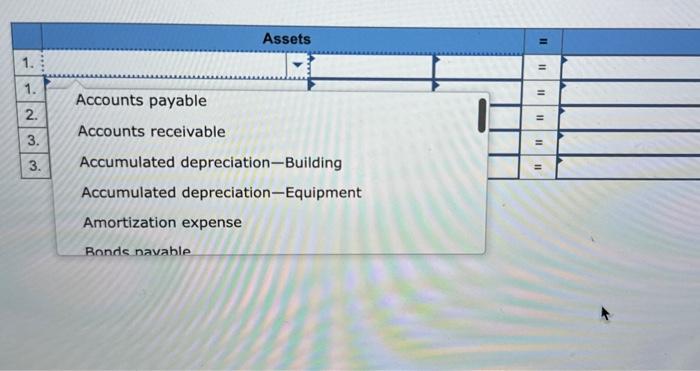

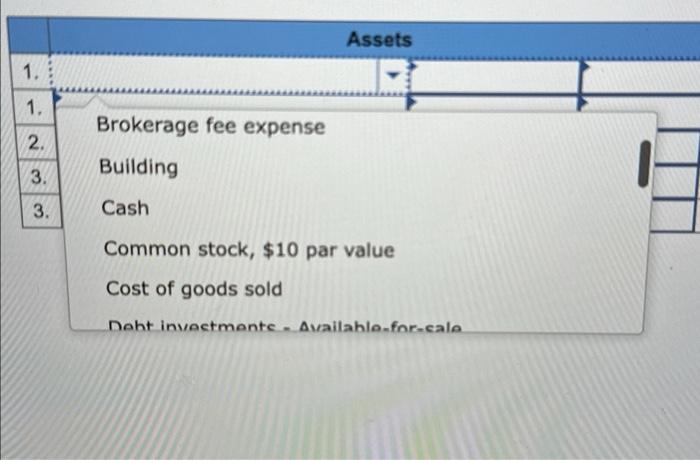

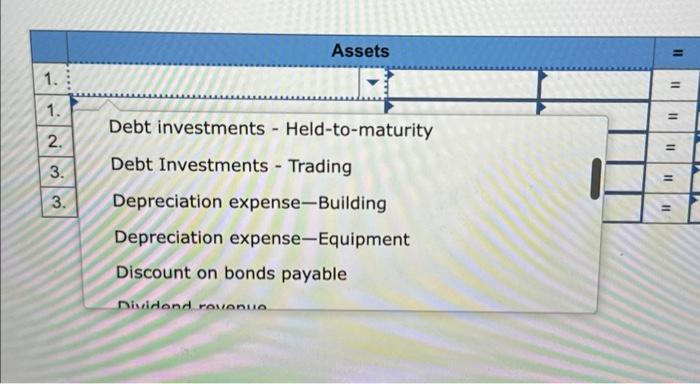

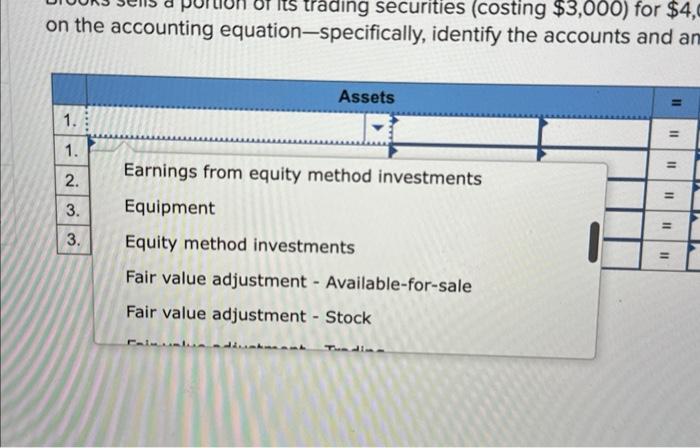

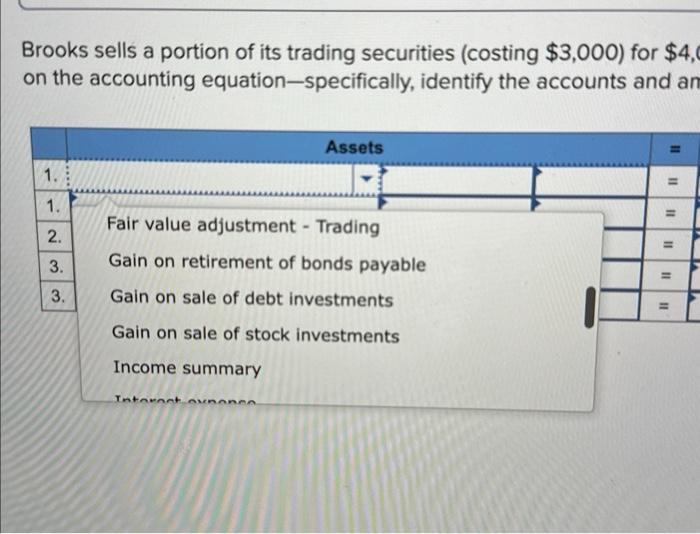

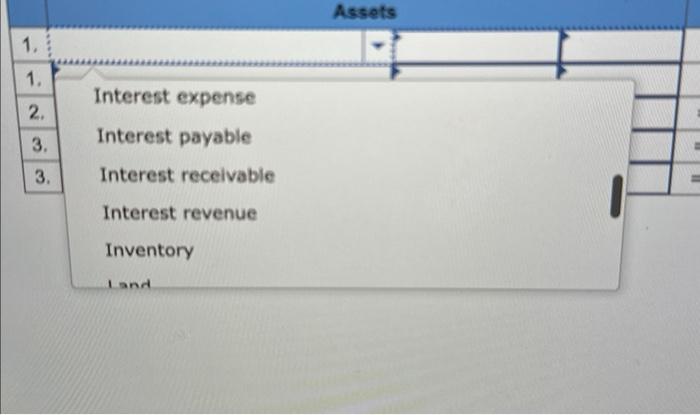

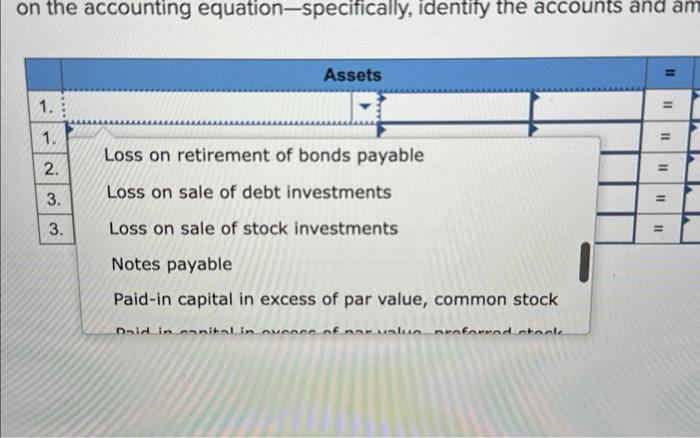

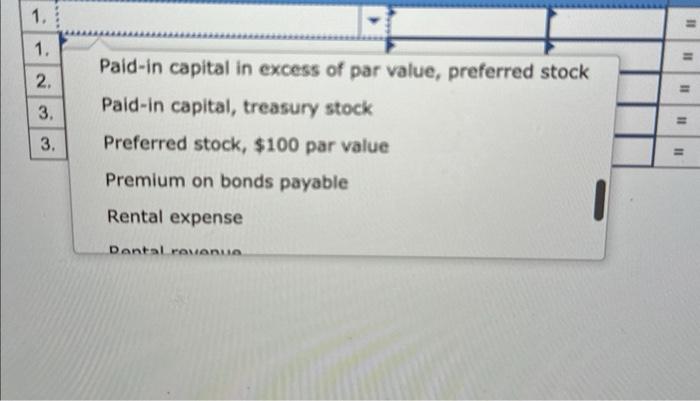

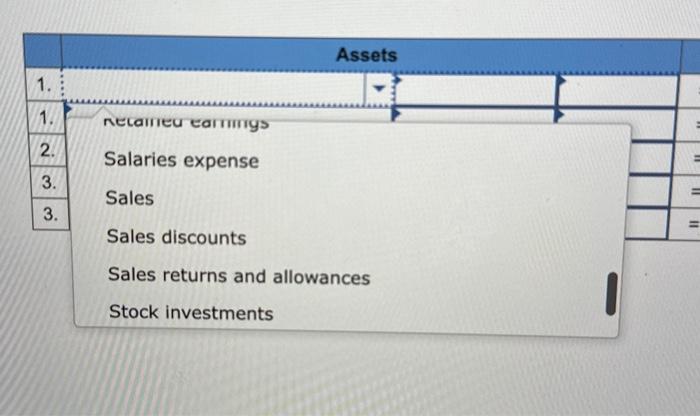

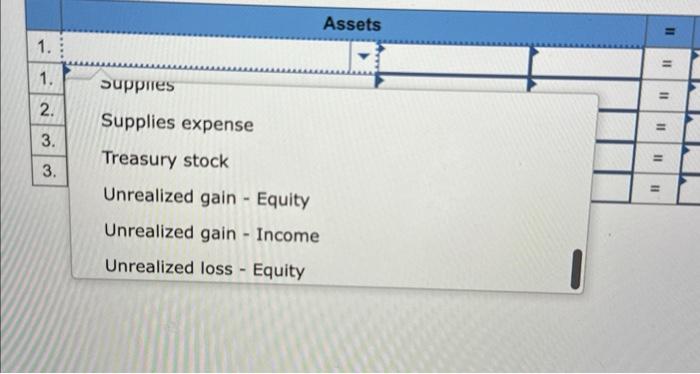

Required information [The following information applies to the questions displayed below.] Brooks Company purchases debt investments as trading securities at a cost of $66,000 on December 27 . This is its first and only purchase of such securities. At December 31 , these securities had a fair value of $72,000. 1. Prepare the December 27 entry for the purchase of debt investments. 2. \& 3. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $3,000 ) for $4,000 cash. Complete this question by entering your answers in the tabs below. Prepare the December 27 entry for the purchase of debt investments. Journal entry worksheet Record purchase of troding securties. Complete this question by entering your answers in the tabs below. Prepare the December 27 entry for the purchase of debt investments. Journal entry worksheet Hecord purchise of trading securities. Note Ever detios betion trects. 'repare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks selis a portion of its trading securities (costing $3,000 ) for $4,000 cash. Journal entry worksheet 2. Record the year-end adjustment to fair value, if any. Noter Tnter Gebits tefore credits. Prepare the December 31 year-end fair value adjusting entry for the trading securities' portfolio and the January 3 entry when Brooks sells a portion of its trading securities (costing $3,000 ) for $4,000 cash. Journal entry worksheet Note: Enter deblts before credits. Required information [The following information applies to the questions displayed bolow] Brooks Company purchases debt investments as trading securities at a cost of $66,000 on December 27 . This is its first and only purchase of such securities. At December 31 , these securities had a fair value of $72,000. Brooks sells a portion of its trading securities (costing $3,000 ) for $4,000 cash. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + of for each transaction. - questions displayed below] ments as trading securities at a cost of $66,000 on December 27 . This is its first December 31 , these securities had a fair value of $72,000. costing $3,000 ) for $4.000 cash. Analyze each transaction above by showing its effects ify the accounts and amounts (including + or ) for each transaction. Required information [The following information applies to the questions displayed below.] Brooks Company purchases debt investments as trading securities at a cost of $66,000 on December 27 . This is its first and only purchase of such securities. At December 31 , these securities had a fair value of $72,000. Brooks selis a portion of its trading securities (costing $3,000 ) for $4,000 cash. Analyze each transaction above by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or ) for each transaction. \begin{tabular}{|l|l|} \hline 1. & Assets \\ \hline 1. & Brokerage fee expense \\ \hline 3. & Building \\ \hline 3. & Cash \\ & Common stock, $10 par value \\ Cost of goods sold \\ noht invectmonte- Availahle-for-calo \end{tabular} on the accounting equation-specifically, identify the accounts and ar Brooks sells a portion of its trading securities (costing $3,000 ) for $4, on the accounting equation-specifically, identify the accounts and an \begin{tabular}{|l|l|l|} \hline 1. Assets \\ \hline 1. & Interest expense \\ 3. & Interest payable \\ Interest receivable \\ Interest revenue \\ Inventory \\ Ind \end{tabular} on the accounting equation-specifically, identify the accounts and an \begin{tabular}{l} 1. \\ 1. Sassets \\ \hline 1. S. Salaries expense \\ 3. Sales \\ Sales returns and allowances \\ Stock investments \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts