Question: Help with this Java question Income tax system in a country called Java works as follows: a. An employee has $4000 of salary tax free.

Help with this Java question

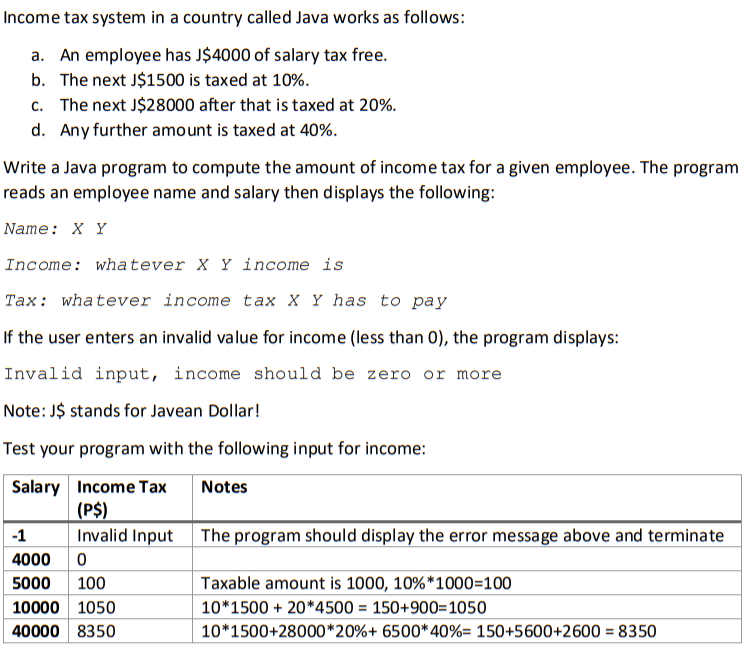

Income tax system in a country called Java works as follows: a. An employee has $4000 of salary tax free. b. The next $1500 is taxed at 10%. C. The next J$28000 after that is taxed at 20%. d. Any further amount is taxed at 40%. Write a Java program to compute the amount of income tax for a given employee. The program reads an employee name and salary then displays the following: Name: X Y Income: whatever X Y income is Tax: whatever income tax X Y has to pay If the user enters an invalid value for income (less than 0), the program displays: Invalid input, income should be zero or more Note: J$ stands for Javean Dollar! Test your program with the following input for income: Salary Income Tax Notes (P$) -1 Invalid Input The program should display the error message above and terminate 40000 5000 100 Taxable amount is 1000, 10%*1000=100 10000 1050 10*1500 + 20*4500 = 150+900=1050 40000 8350 10*1500+28000*20%+ 6500*40%= 150+5600+2600 = 8350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts