Question: Help with this problem. If you could explain how you did the calculations or how you got the answers Id so appreciate it. Thanks. Hamilton

Help with this problem. If you could explain how you did the calculations or how you got the answers Id so appreciate it. Thanks.

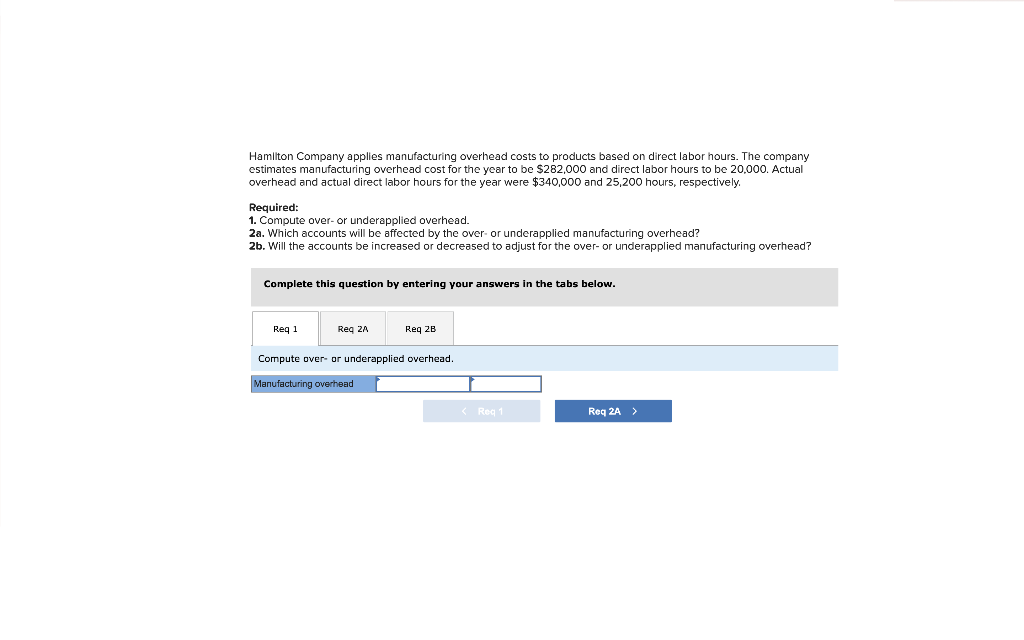

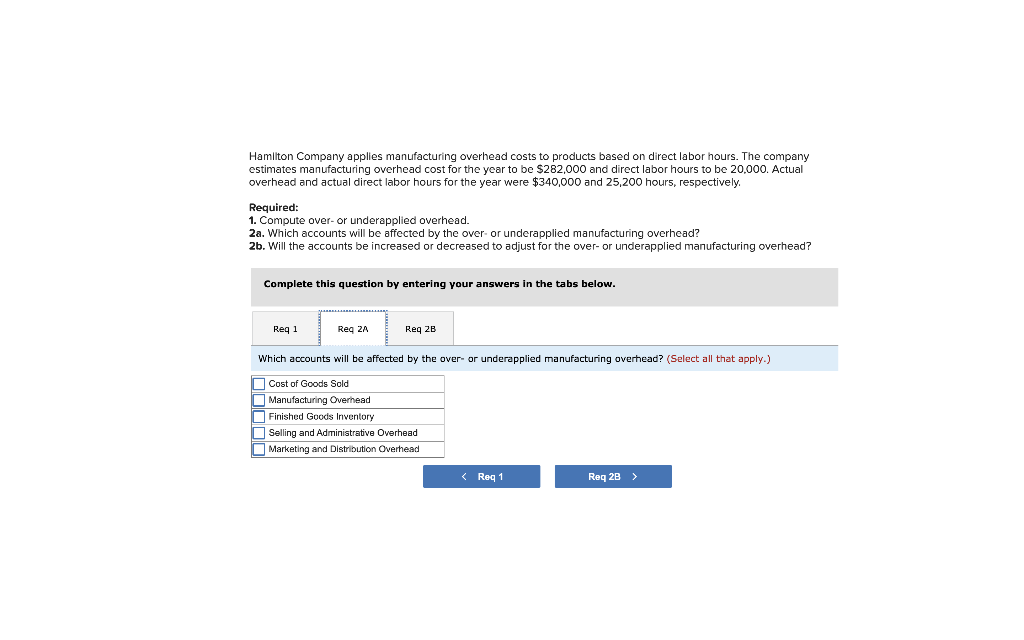

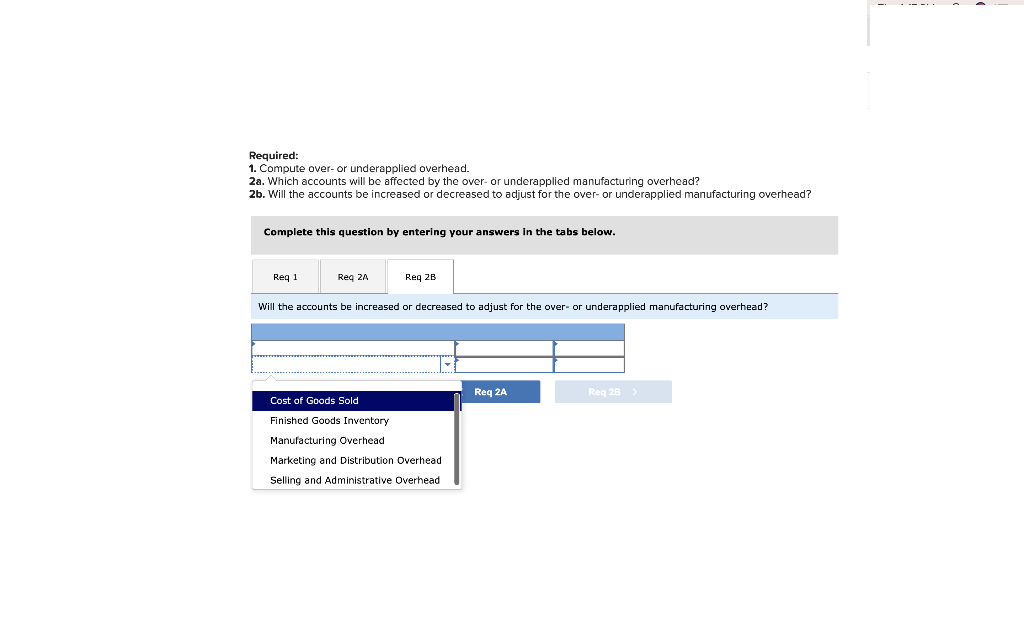

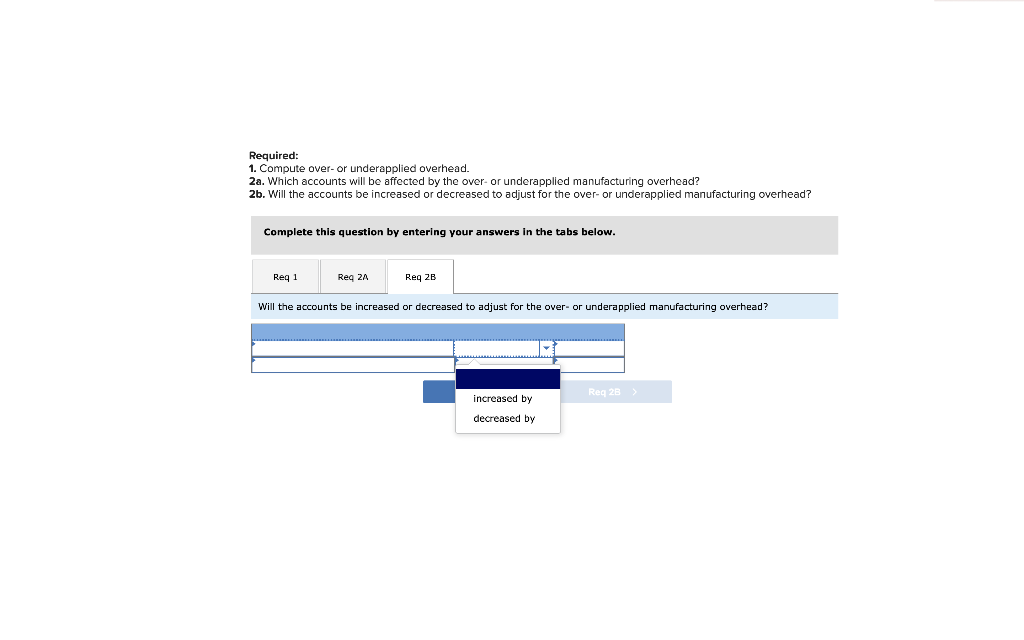

Hamilton Company applies manufacturing overhead costs to products based on direct labor hours. The company estimates manufacturing overhead cost for the year to be $282,000 and direct labor hours to be 20.000. Actual overhead and actual direct labor hours for the year were $340,000 and 25,200 hours, respectively. Required: 1. Compute over- or underapplied overhead. 2a. Which accounts will be affected by the over- or underapplied manufacturing overhead? 2b. Will the accounts be increased or decreased to adjust for the over- or underapplied manufacturing overhead? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Req 2B Compute over- or underapplied overhead. Manufacturing overhead s Reg Req 2A > Hamilton Company applies manufacturing overhead costs to products based on direct labor hours. The company estimates manufacturing overhead cost for the year to be $282,000 and direct labor hours to be 20,000. Actual overhead and actual direct labor hours for the year were $340,000 and 25,200 hours, respectively. Required: 1. Compute over- or underapplied overhead. 2a. Which accounts will be affected by the over- or underapplied manufacturing overhead? 2b. Will the accounts be increased or decreased to adjust for the over- or underapplied manufacturing overhead? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 2B Which accounts will be affected by the over- or underapplied manufacturing overhead? (Select all that apply.) Cost of Goods Sold Manufacturing Overhead Finished Goods Inventory Selling and Administrative Overhead Marketing and Distribution Overhead Required: 1. Compute over- or underapplied overhead. 2a. Which accounts will be affected by the over- or underapplied manufacturing overhead? 2b. Will the accounts be increased or decreased to adjust for the over- or underapplied manufacturing overhead? Complete this question by entering your answers in the tabs below. Reg 1 Rea 2 Reg 28 Will the accounts be increased or decreased to adjust for the over- or underapplied manufacturing overhead? Req 2A Req 28 Cost of Goods Sold Finished Goods Inventory Manufacturing Overhead Marketing and Distribution Overhead Selling and Administrative Overhead Required: 1. Compute over- or underapplied overhead. 2a. Which accounts will be affected by the over- or underapplied manufacturing overhead? 2b. Will the accounts be increased or decreased to adjust for the over- or underapplied manufacturing overhead? Complete this question by entering your answers in the tabs below. Reg 1 Rea 2 Reg 2B Will the accounts be increased or decreased to adjust for the over- or underapplied manufacturing overhead? increased by Req 28 decreased by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts