Question: help with this question 6 Listed below are a few events and transactions of Kodax Company Year 1 January 2. Purchased 30, 0ee shares of

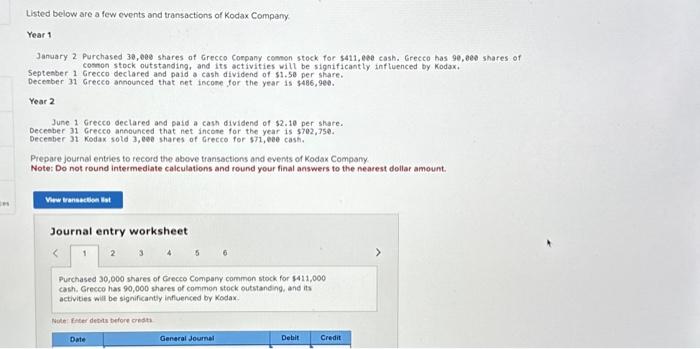

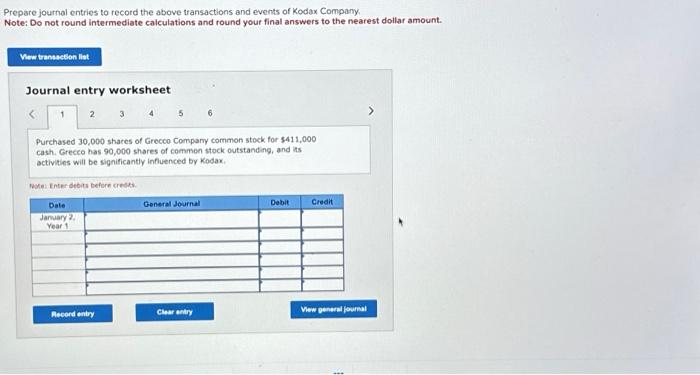

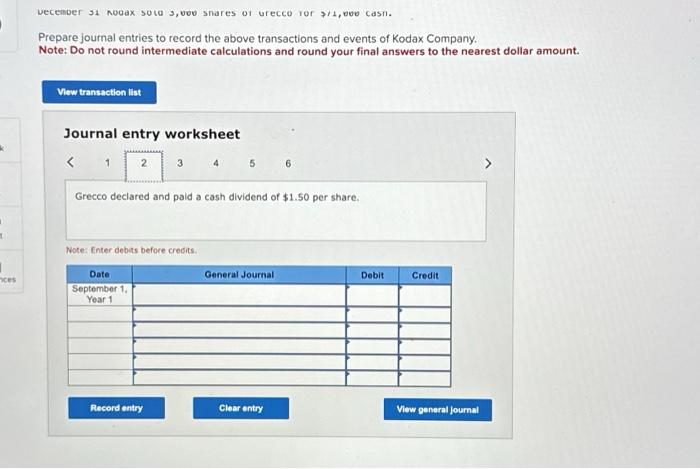

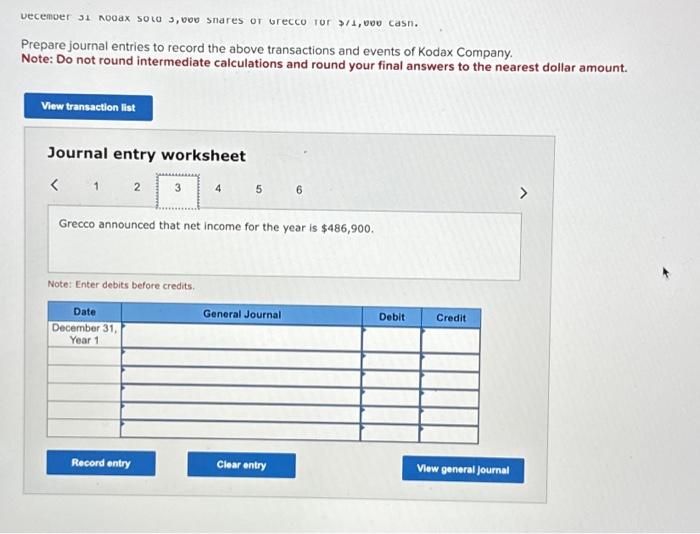

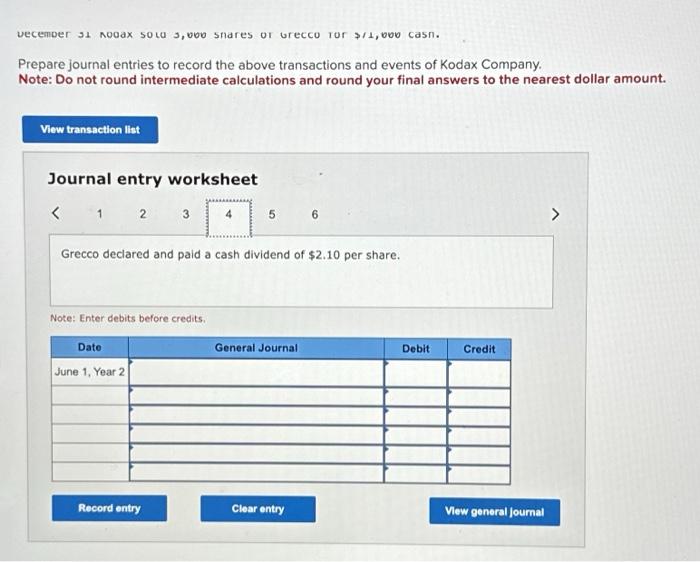

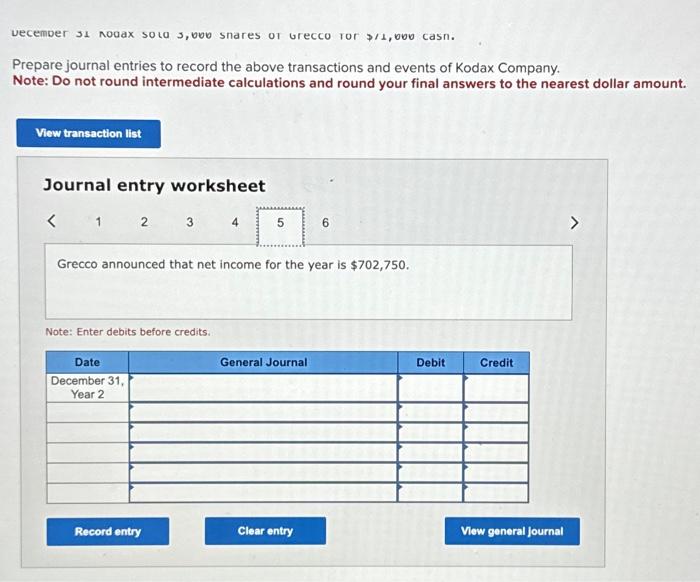

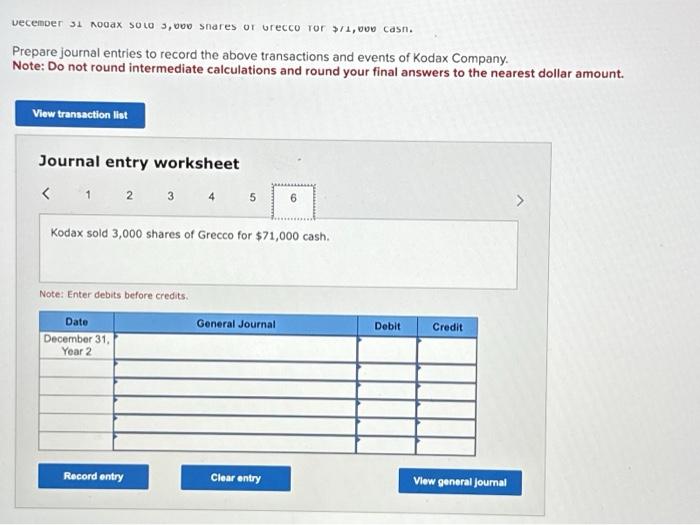

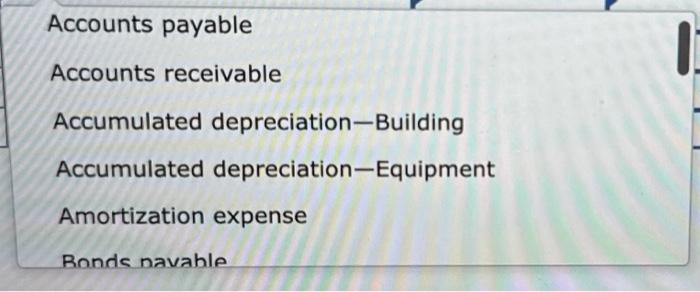

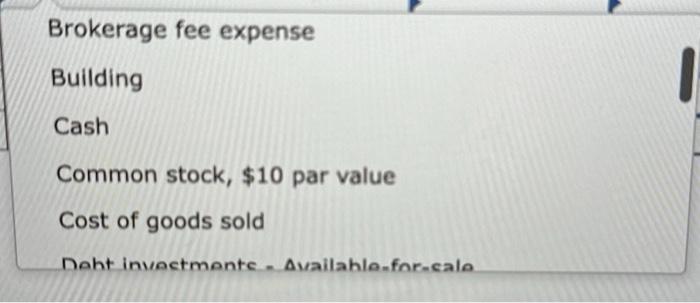

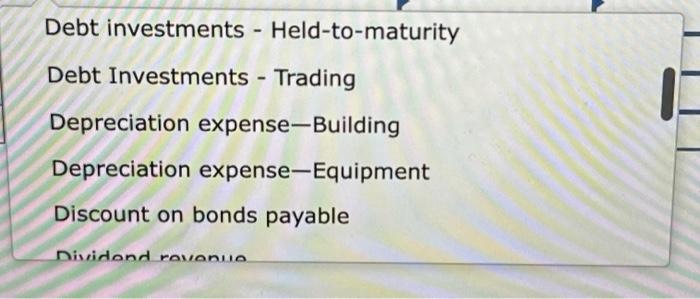

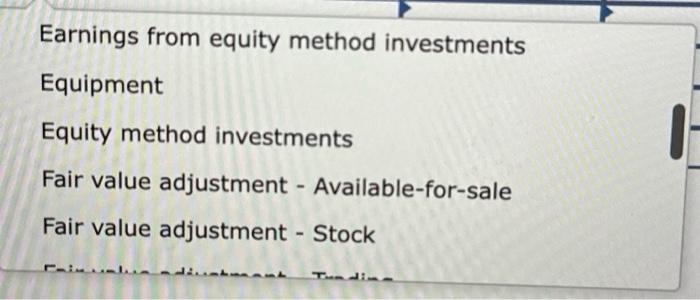

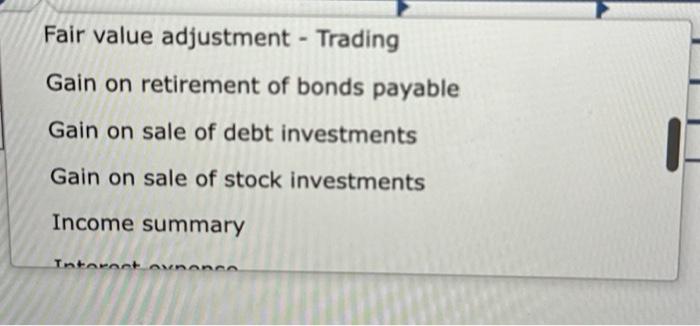

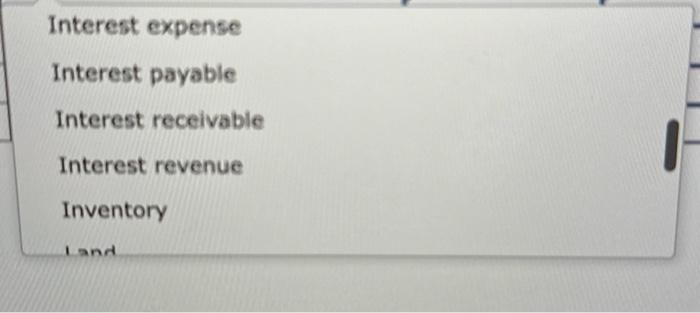

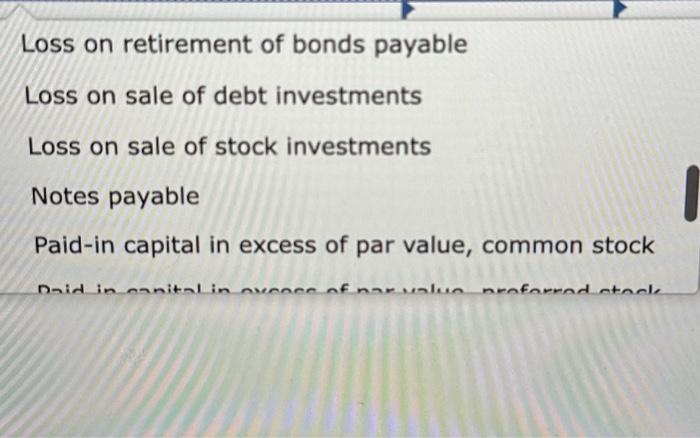

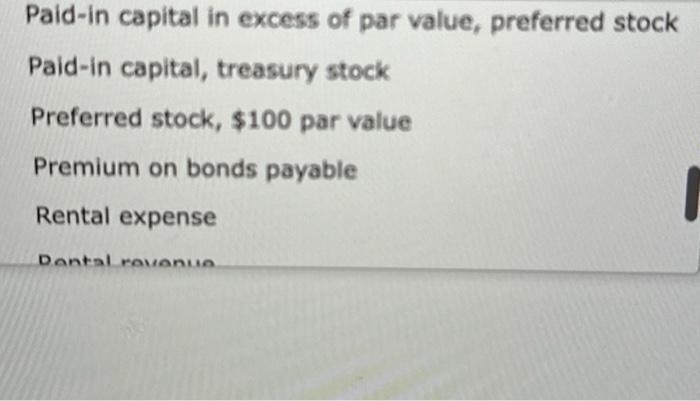

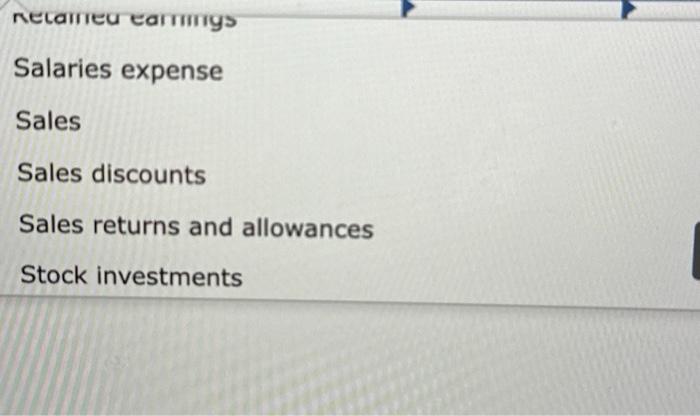

Listed below are a few events and transactions of Kodax Company Year 1 January 2. Purchased 30, 0ee shares of Grecco Corpany comon stock for $411, ebe cash. Grecco has 90 , eee shares of cosnon stock outstanding, and its activities will be significantly influenced by Kodax. Septenber 1 Grecco declared and paid a cash dividend of s1,se per share. Decenber 31 Grecco announced that net incone for the year is $486,900. Year 2 June 1 Grecco declared and paid a cash dividend of $2.10 per share. Decenber 31 Grecco announced that net incone for the year is 5702,750 . Decenber 31 Kodax sold 3, eee shares of Grecto for $71, eee cash. Prepare journal entries to fecord the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet Purchased 30,000 shares of Crecco Compary common stock for \$411,000 cash, Grecco has 90,000 shares of common stock outstanding, and its activities will be significantly influenced by Kodax. Nuke fiter deterts pefore crests Prepare journal entries to record the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet \begin{tabular}{ll|ll} 2 & 3 & 5 & 6 \end{tabular} Purchased 30,000 shares of Grecco Compary common stock for $411,000 cash. Grecco has 90,000 shares of commen stock outstanding, and las actlvities witt be significantly infuenced by Kodax. Nove Enter debits befere crests. vecenoer $1 nooax sola 3 , vov snares or urecco ror $11, vov casn. Prepare journal entries to record the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet 56 Grecco declared and paid a cash dividend of $1.50 per share. Note: Enter debits before credits. vecemoer s1 noodx soto 3, vov snares or vrecco ror $11, vov casn. Prepare journal entries to record the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet 1 6 Grecco announced that net income for the year is $486,900. Note: Enter debits before credits. vecember $1 nooax sota 3, voo shares or brecco ror $/1, vov casn. Prepare journal entries to record the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet Grecco declared and paid a cash dividend of $2.10 per share. Note: Enter debits before credits. vecember s1 nodax sola 3 , vov snares or urecco ror $11, bve casn. Prepare journal entries to record the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet 1 Grecco announced that net income for the year is $702,750. Note: Enter debits before credits. vecember 31 nooax solo 3 , vov snares or urecco ror $11, vov casn. Prepare journal entries to record the above transactions and events of Kodax Company. Note: Do not round intermediate calculations and round your final answers to the nearest dollar amount. Journal entry worksheet Kodax sold 3,000 shares of Grecco for $71,000 cash. Note: Enter debits before credits. Accounts payable Accounts receivable Accumulated depreciation-Building Accumulated depreciation-Equipment Amortization expense Ronde navahle Brokerage fee expense Building Cash Common stock, $10 par value Cost of goods sold noht invoctmonte - Availahle-for-cale Earnings from equity method investments Equipment Equity method investments Fair value adjustment - Available-for-sale Fair value adjustment - Stock Fair value adjustment - Trading Gain on retirement of bonds payable Gain on sale of debt investments Gain on sale of stock investments Income summary Interest expense Interest payable Interest receivable Interest revenue Inventory Loss on retirement of bonds payable Loss on sale of debt investments Loss on sale of stock investments Notes payable Paid-in capital in excess of par value, common stock Paid-in capital in excess of par value, preferred stock Paid-in capital, treasury stock Preferred stock, $100 par value Premium on bonds payable Rental expense Dantal ravanue Salaries expense Sales Sales discounts Sales returns and allowances Stock investments Supplies expense Treasury stock Unrealized gain - Equity Unrealized gain - Income Unrealized loss - Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts