Question: help with this question Revie Please complete the cash flow waterfall section using the assumption provided. What is the IRR for LPs? 40.5 34.3 28.7

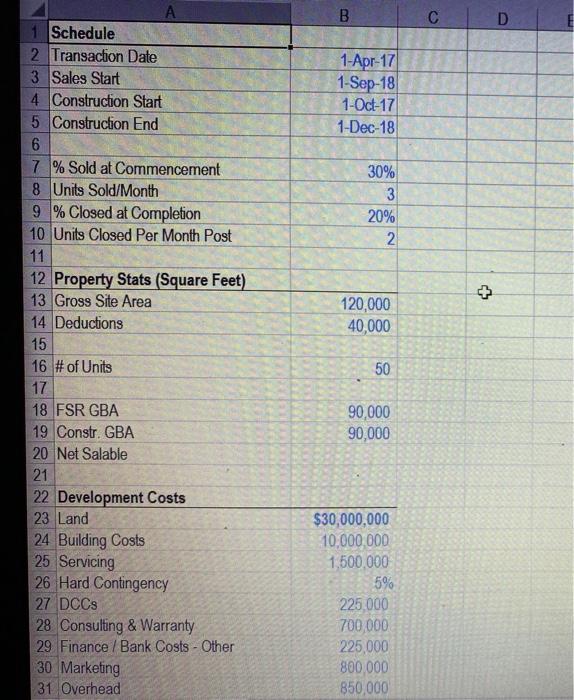

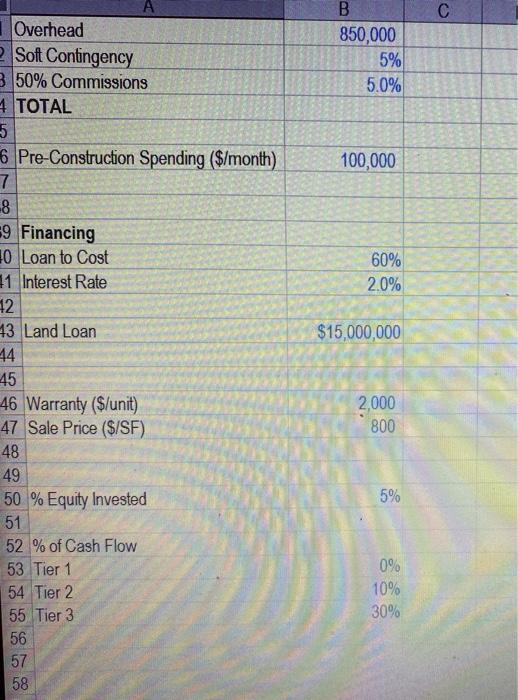

Revie Please complete the cash flow waterfall section using the assumption provided. What is the IRR for LPs? 40.5 34.3 28.7 37.4 B D 1-Apr-17 1-Sep-18 1-Oct-17 1-Dec-18 30% 3 20% 2. + 120,000 40,000 1 Schedule 2 Transaction Date 3 Sales Start 4 Construction Start 5 Construction End 6 7 % Sold at Commencement 8 Units Sold/Month 9 % Closed at Completion 10 Units Closed Per Month Post 11 12 Property Stats (Square Feet) 13 Gross Site Area 14 Deductions 15 16 # of Units 17 18 FSR GBA 19 Constr. GBA 20 Net Salable 21 22 Development Costs 23 Land 24 Building Costs 25 Servicing 26 Hard Contingency 27 DCCS 28 Consulting & Warranty 29 Finance / Bank Costs - Other 30 Marketing 31 Overhead 50 90,000 90,000 $30,000,000 10,000,000 1,500,000 5% 225.000 700,000 225,000 800,000 850,000 B 850,000 5% 5.0% 100,000 60% 2.0% $15,000,000 A Overhead Soft Contingency 3 50% Commissions 4 TOTAL 5 6 Pre-Construction Spending ($/month) 7 8 =9 Financing 10 Loan to Cost 11 Interest Rate 12 43 Land Loan 14 45 46 Warranty ($/unit) 47 Sale Price ($/SF) 48 49 50 % Equity Invested 51 52 % of Cash Flow 53 Tier 1 54 Tier 2 55 Tier 3 56 57 58 2,000 800 5% 0% 10% 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts