Question: help with this question.... Ticker Services began operations in Year 1 and holds long-term investments in available-for-sale debt securities. The year-end costs and fair values

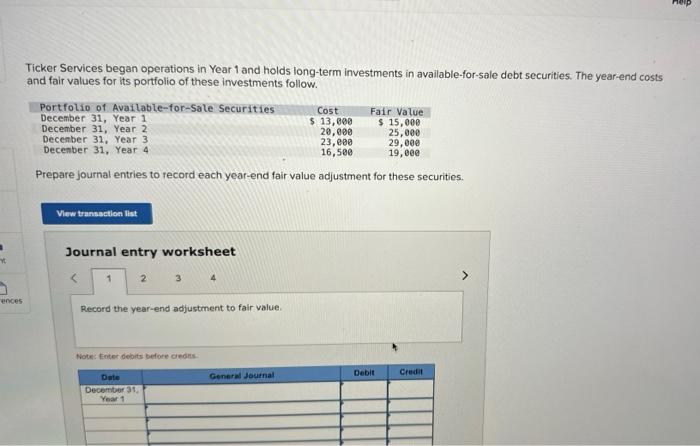

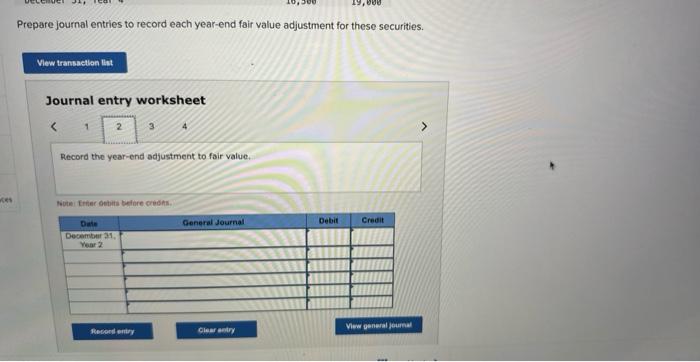

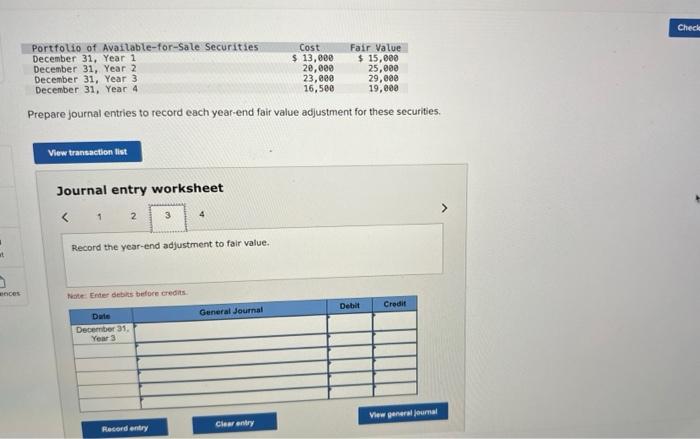

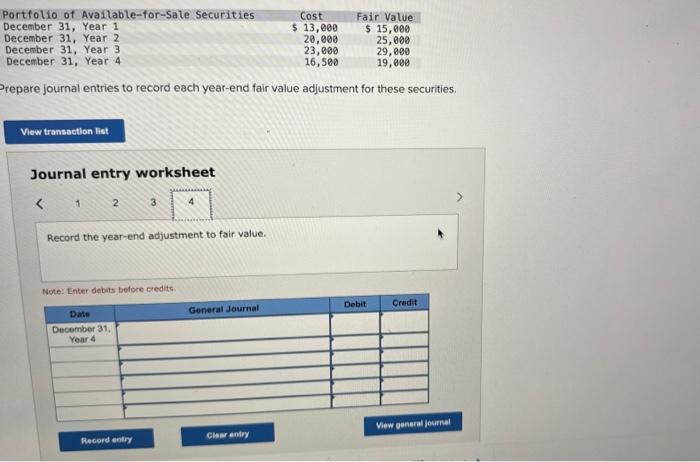

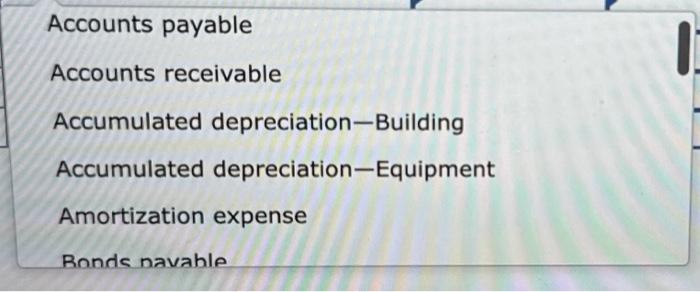

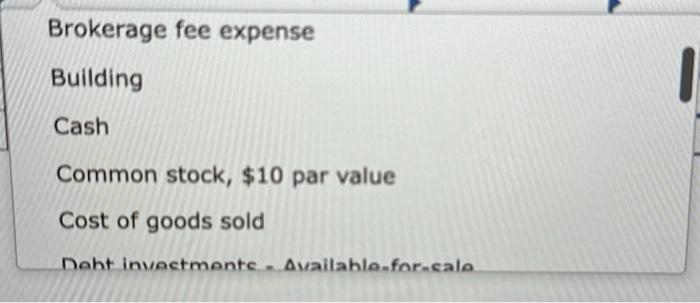

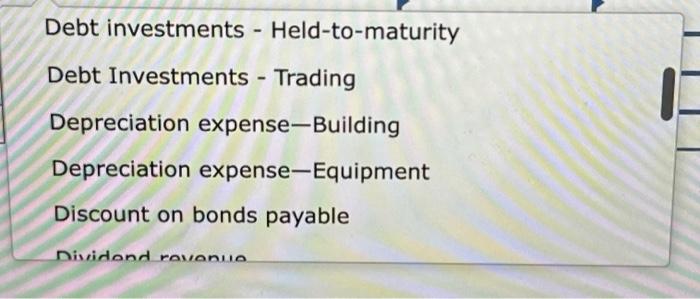

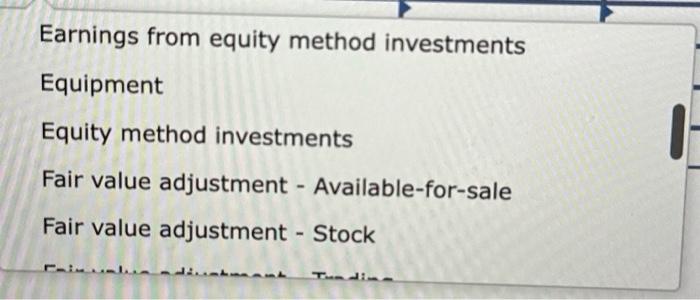

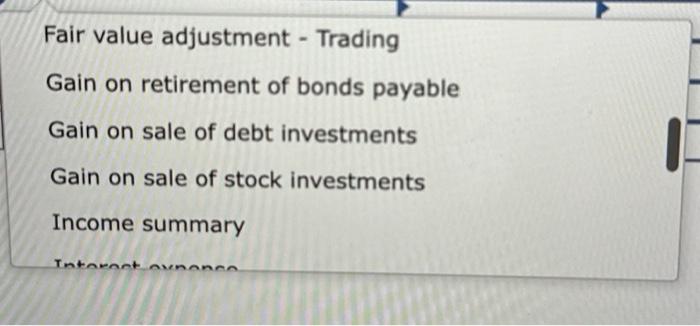

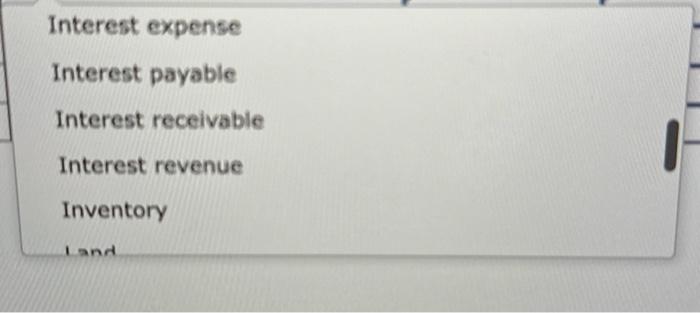

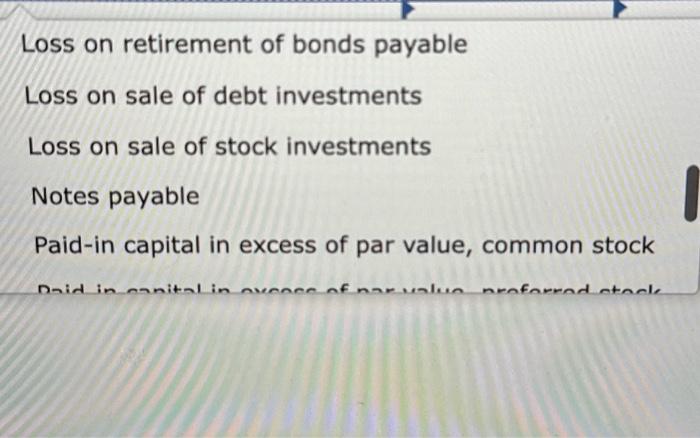

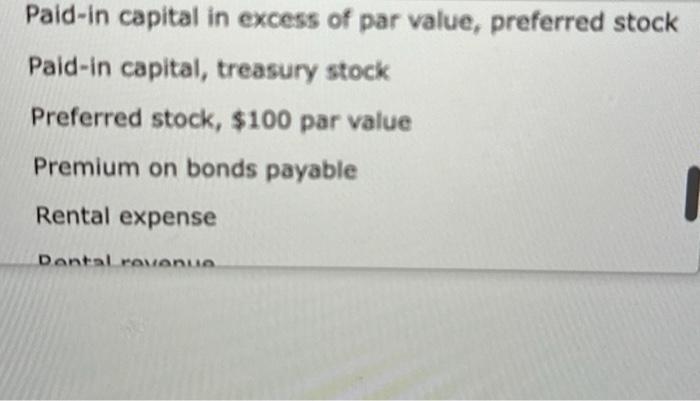

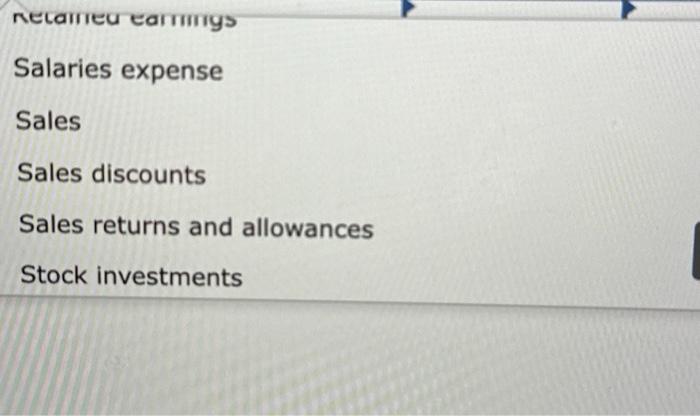

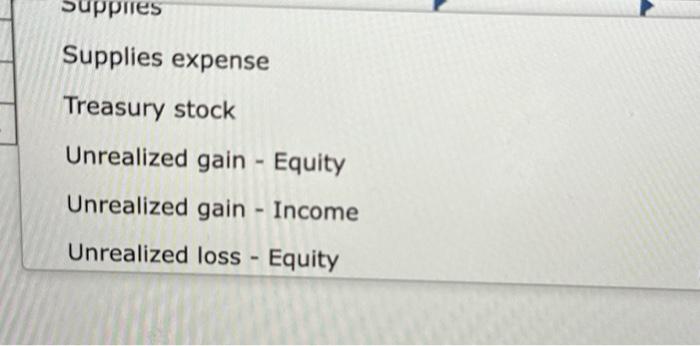

Ticker Services began operations in Year 1 and holds long-term investments in available-for-sale debt securities. The year-end costs and fair values for its portfolio of these investments follow. Prepare journal entries to record each year-end fair value adjustment for these securities. Journal entry worksheet Prepare journal entries to record each year-end fair value adjustment for these securities. Journal entry worksheet 4 Record the year-end adjustment to fair value. repare journal entries to record each year-end fair value adjustment for these securities. Journal entry worksheet 1 Record the year-end adjustment to fair value. Note: Enker debits before credits. Accounts payable Accounts receivable Accumulated depreciation-Building Accumulated depreciation-Equipment Amortization expense Ronde navahle Brokerage fee expense Building Cash Common stock, $10 par value Cost of goods sold noht invoctmonte - Availahle-for-cale Debt investments - Held-to-maturity Debt Investments - Trading Depreciation expense-Building Depreciation expense-Equipment Discount on bonds payable Earnings from equity method investments Equipment Equity method investments Fair value adjustment - Available-for-sale Fair value adjustment - Stock Fair value adjustment - Trading Gain on retirement of bonds payable Gain on sale of debt investments Gain on sale of stock investments Income summary Interest expense Interest payable Interest receivable Interest revenue Inventory Loss on retirement of bonds payable Loss on sale of debt investments Loss on sale of stock investments Notes payable Paid-in capital in excess of par value, common stock Salaries expense Sales Sales discounts Sales returns and allowances Stock investments Supplies expense Treasury stock Unrealized gain - Equity Unrealized gain - Income Unrealized loss - Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts