Question: help with this question will be really handy!!! thank youuu Mini Case # 2 (Break-even Analysis, DOL, DFL and DTL) 14 Marks Specialty Products Limited

help with this question will be really handy!!! thank youuu

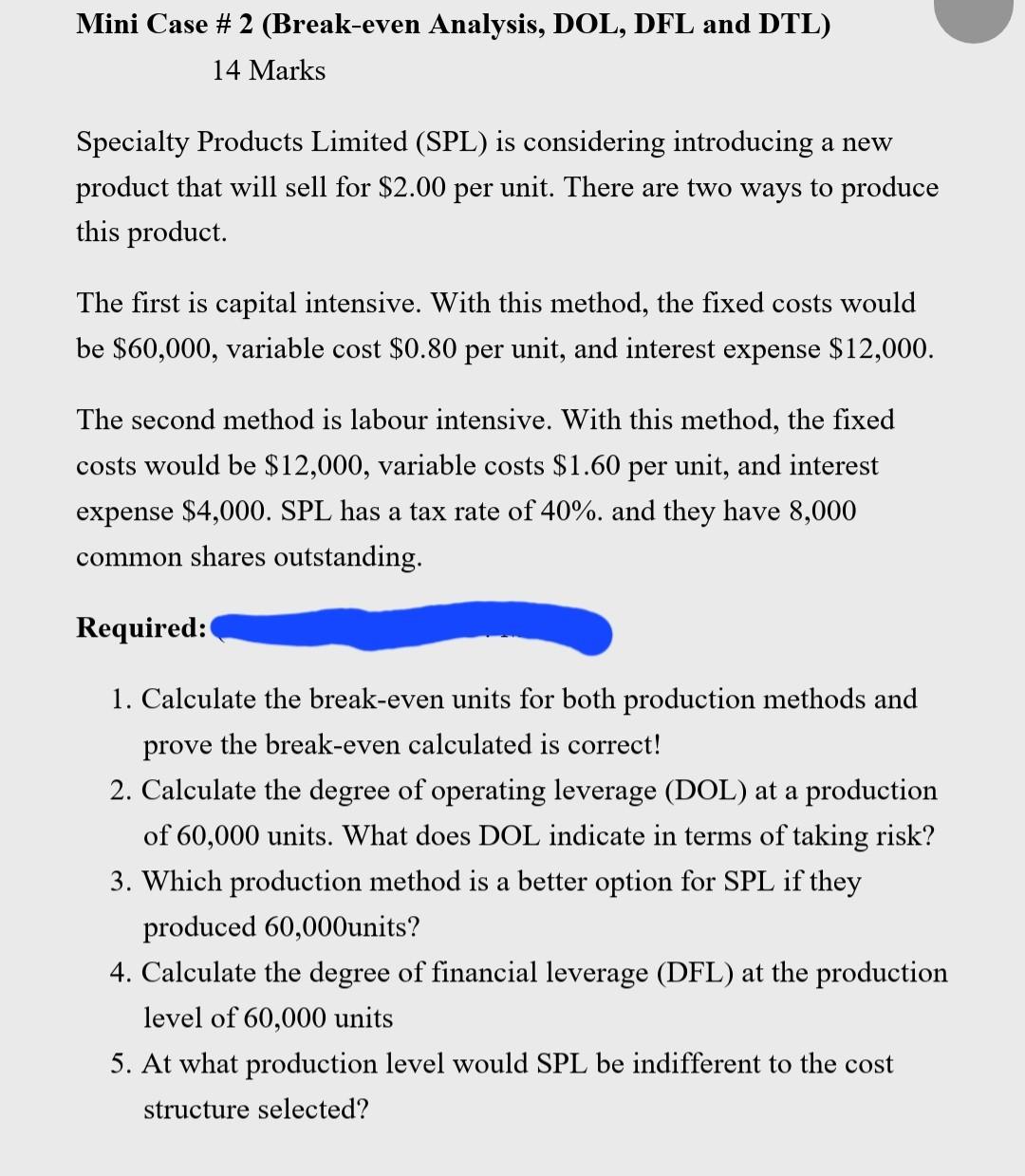

Mini Case \# 2 (Break-even Analysis, DOL, DFL and DTL) 14 Marks Specialty Products Limited (SPL) is considering introducing a new product that will sell for $2.00 per unit. There are two ways to produce this product. The first is capital intensive. With this method, the fixed costs would be $60,000, variable cost $0.80 per unit, and interest expense $12,000. The second method is labour intensive. With this method, the fixed costs would be $12,000, variable costs $1.60 per unit, and interest expense $4,000. SPL has a tax rate of 40%. and they have 8,000 common shares outstanding. Required: 1. Calculate the break-even units for both production methods and prove the break-even calculated is correct! 2. Calculate the degree of operating leverage (DOL) at a production of 60,000 units. What does DOL indicate in terms of taking risk? 3. Which production method is a better option for SPL if they produced 60,000units? 4. Calculate the degree of financial leverage (DFL) at the production level of 60,000 units 5. At what production level would SPL be indifferent to the cost structure selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts