Question: help with this this is what i need help with QUESTION 1 A borrower takes out a 30-year adjustable rate mortgage loan for $250,000 with

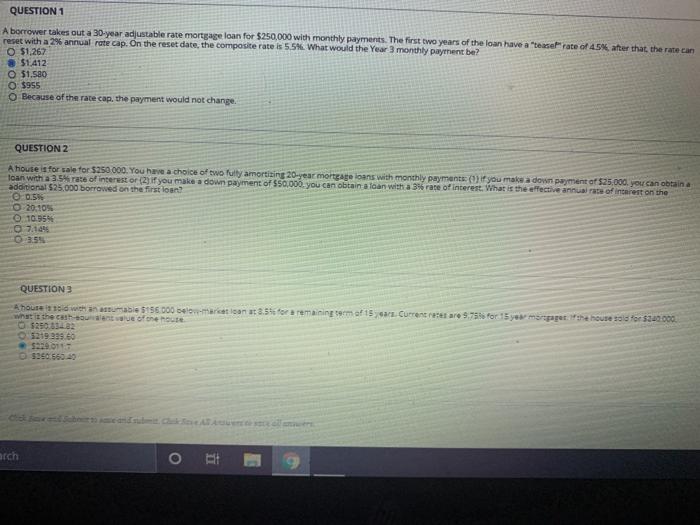

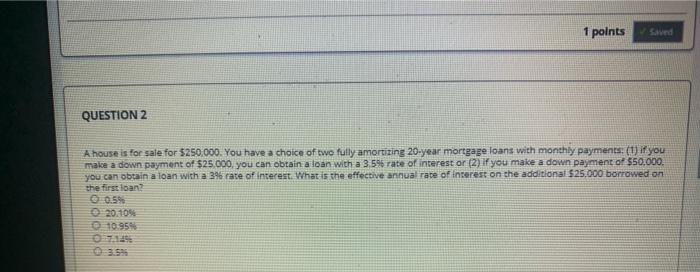

QUESTION 1 A borrower takes out a 30-year adjustable rate mortgage loan for $250,000 with monthly payments. The first two years of the loan have a tease rate of 45% after that the rate can reset with a 2% annual rate cap. On the reset date, the composite rate is 5.5%. What would the Year 3 monthly payment be? O $1,267 $1.412 $1.580 0$955 Because of the rate cap, the payment would not change QUESTION 2 A house is for sale for $250 000. You have a choice of two fulty amortizing 20-year mortgage loans with monthly payments if you make a down payment of $25.000, you can obtain a loan with a 3.5 rate of interest or if you make a down payment of $50.000, you can obtain a loan with a 3% rate of interest. What is the effective annual rate of interest on the additional $25.000 borrowed on the first loan 0.5% 0 20.10% 16.95 07.1995 3.54 QUESTIONS A house is able 5156.000 belo- maretiana 3.5 for a remaining term of 15 Current restare 9.75 Por 15 yearspaper house for $300.000 what the cash out of the house 5219 999.60 20.011 $290.560.40 arch o 1 points saved QUESTION 2 A house is for sale for $250.000. You have a choice of twe fully amortizing 20-year mortgage loans with monthly payments: () if you malce a down payment of $25.000, you can obtain a loan with a 3.5% rate of interest or (2) If you make a down payment of $50.000, you can obtain a loan with a 3% rate of interest. What is the effective annual rate of interest on the additional $25,000 borrowed on the first loan? 0.5% 20.10% 10.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts