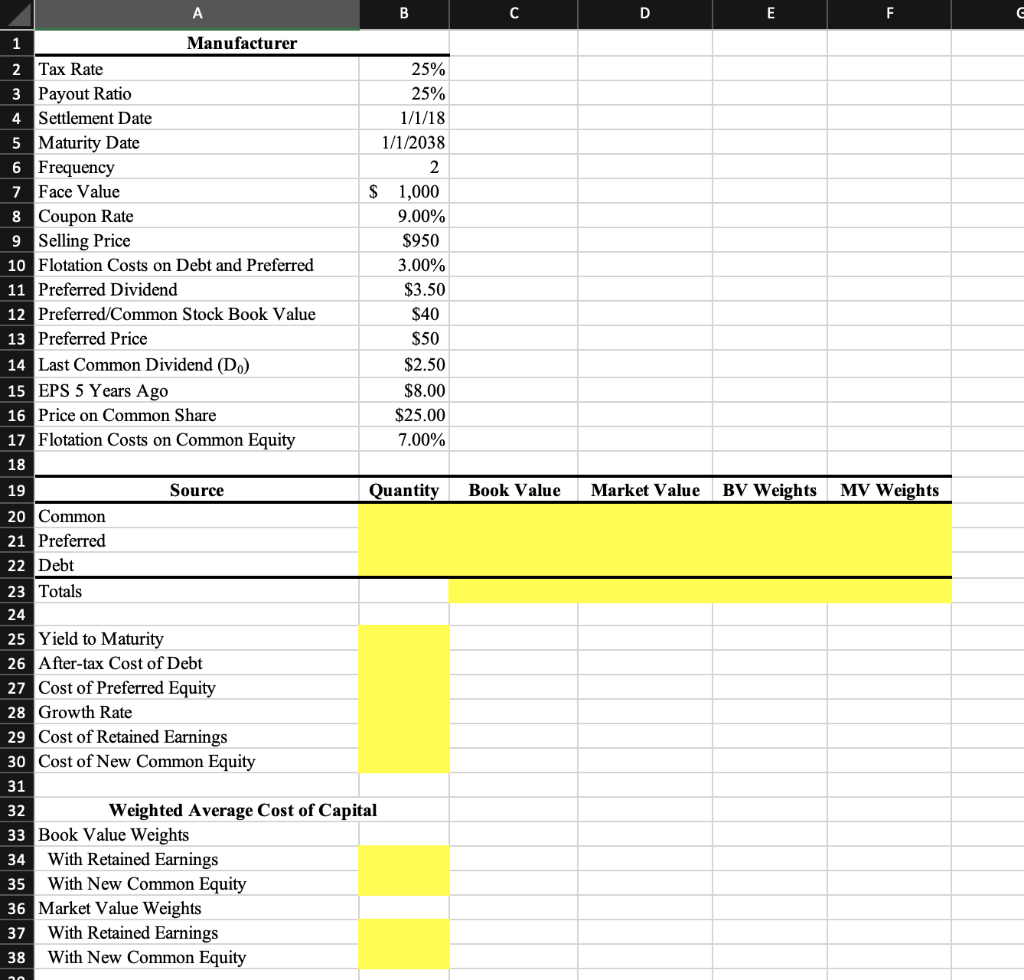

Question: help with yellow boxes please with formulas A B C D E F E Book Value Market Value BV Weights MV Weights 1 Manufacturer 2

help with yellow boxes please with formulas

help with yellow boxes please with formulas

A B C D E F E Book Value Market Value BV Weights MV Weights 1 Manufacturer 2 Tax Rate 25% 3 Payout Ratio 25% 4 Settlement Date 1/1/18 5 Maturity Date 1/1/2038 6 Frequency 2 7 Face Value $ 1,000 8 Coupon Rate 9.00% 9 Selling Price $950 10 Flotation Costs on Debt and Preferred 3.00% 11 Preferred Dividend $3.50 12 Preferred/Common Stock Book Value $40 13 Preferred Price $50 14 Last Common Dividend (D) $2.50 15 EPS 5 Years Ago $8.00 16 Price on Common Share $25.00 17 Flotation Costs on Common Equity 7.00% 18 19 Source Quantity 20 Common 21 Preferred 22 Debt 23 Totals 24 25 Yield to Maturity 26 After-tax Cost of Debt 27 Cost of Preferred Equity 28 Growth Rate 29 Cost of Retained Earnings 30 Cost of New Common Equity 31 32 Weighted Average Cost of Capital 33 Book Value Weights 34 With Retained Earnings 35 With New Common Equity 36 Market Value Weights 37 With Retained Earnings 38 With New Common Equity no A B C D E F E Book Value Market Value BV Weights MV Weights 1 Manufacturer 2 Tax Rate 25% 3 Payout Ratio 25% 4 Settlement Date 1/1/18 5 Maturity Date 1/1/2038 6 Frequency 2 7 Face Value $ 1,000 8 Coupon Rate 9.00% 9 Selling Price $950 10 Flotation Costs on Debt and Preferred 3.00% 11 Preferred Dividend $3.50 12 Preferred/Common Stock Book Value $40 13 Preferred Price $50 14 Last Common Dividend (D) $2.50 15 EPS 5 Years Ago $8.00 16 Price on Common Share $25.00 17 Flotation Costs on Common Equity 7.00% 18 19 Source Quantity 20 Common 21 Preferred 22 Debt 23 Totals 24 25 Yield to Maturity 26 After-tax Cost of Debt 27 Cost of Preferred Equity 28 Growth Rate 29 Cost of Retained Earnings 30 Cost of New Common Equity 31 32 Weighted Average Cost of Capital 33 Book Value Weights 34 With Retained Earnings 35 With New Common Equity 36 Market Value Weights 37 With Retained Earnings 38 With New Common Equity no

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts