Question: Help witht this multi-step problem. APPLY THE CONCEPTS: Calculate the selling price of a bond Bond indenture Issue Date: 1/1/2011 Face value: $100,000 Coupon Rate

Help witht this multi-step problem.

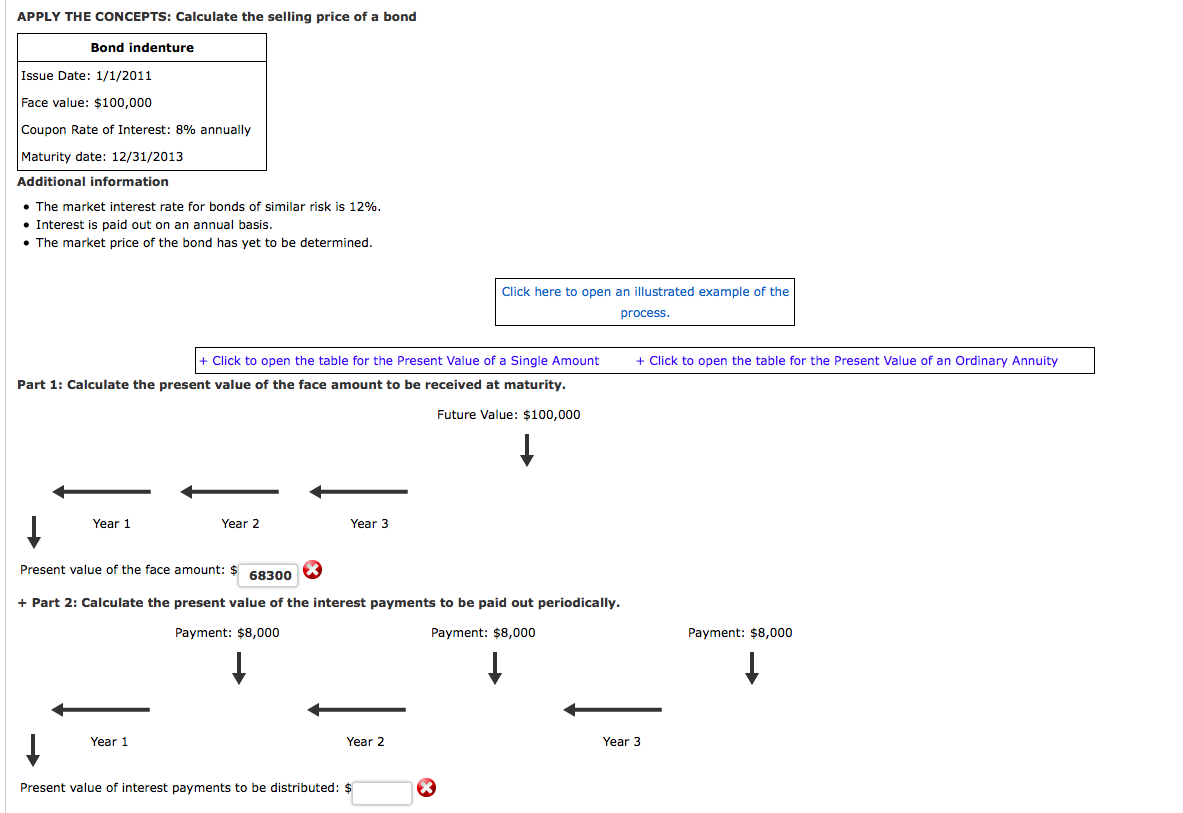

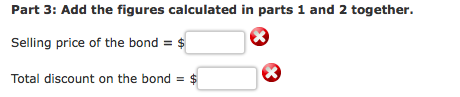

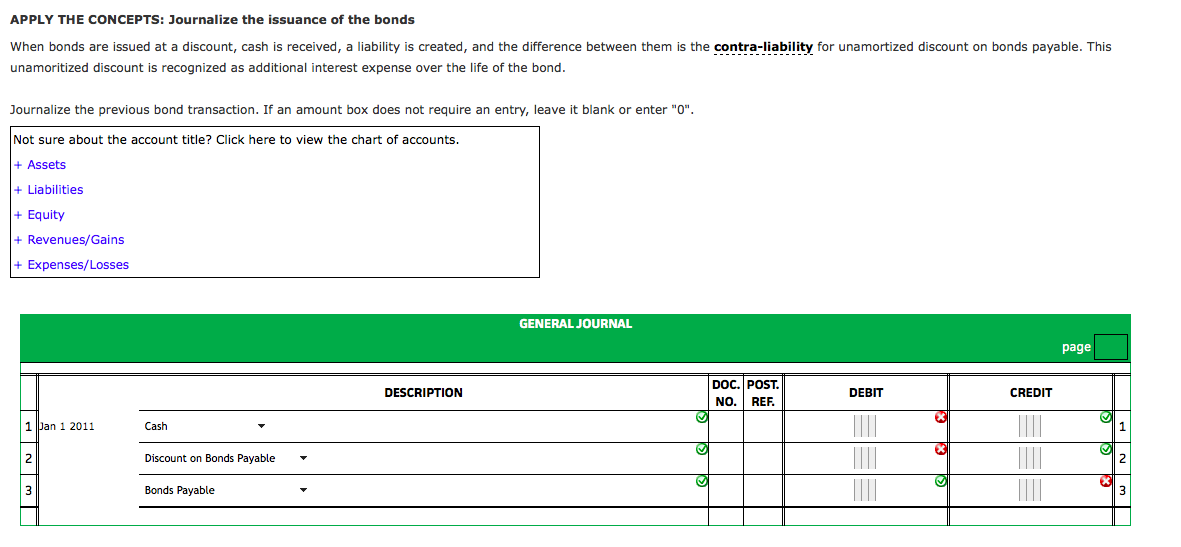

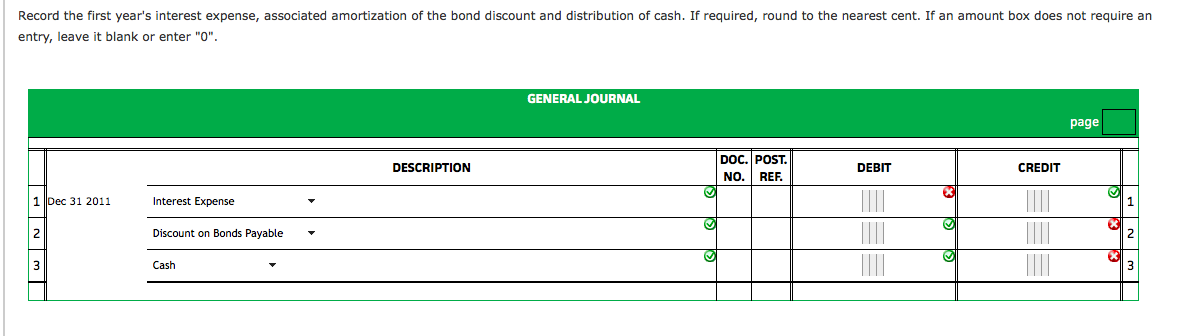

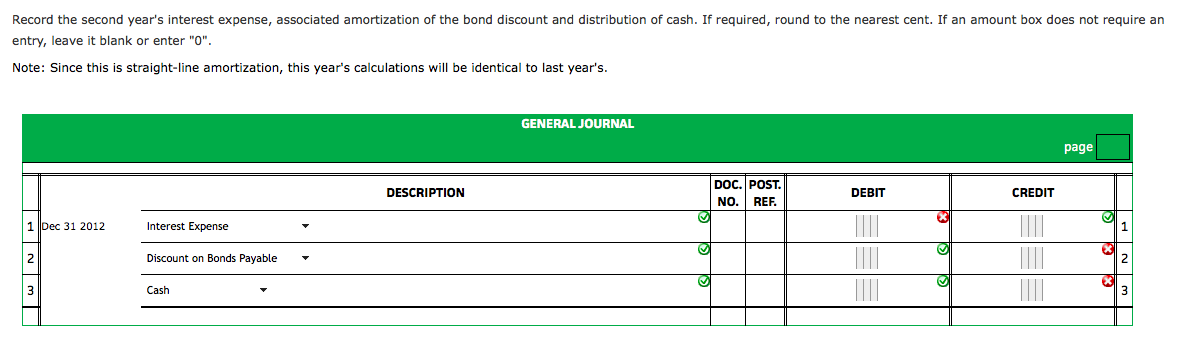

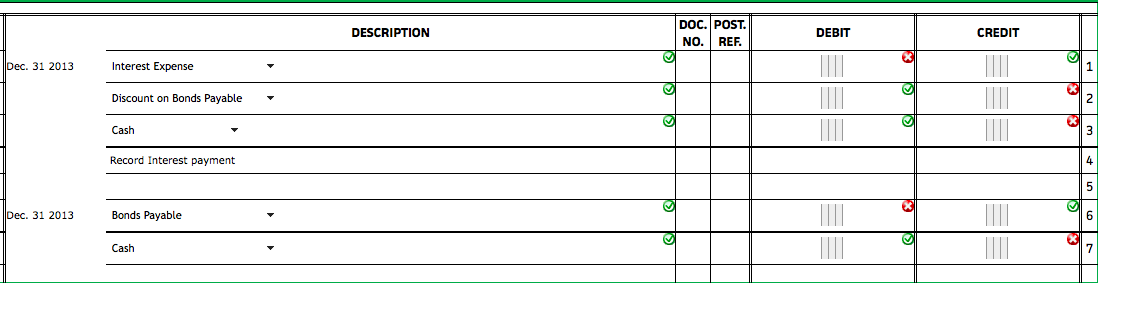

APPLY THE CONCEPTS: Calculate the selling price of a bond Bond indenture Issue Date: 1/1/2011 Face value: $100,000 Coupon Rate of Interest: 8% annually Maturity date: 12/31/2013 Additional information The market interest rate for bonds of similar risk is 12%. Interest is paid out on an annual basis. The market price of the bond has yet to be determined. Click here to open an illustrated example of the process. Click to open the table for the Present Value of a Single Amount Click to open the table for the Present Value of an Ordinary Annuity Part 1: Calculate the present value of the face amount to be received at maturity. Future Value: $100,000 Year 1 Year 2 Year 3 Present value of the face amount: 68300 Part 2: Calculate the present value of the interest payments to be paid out periodically. Payment: $8,000 Payment: $8,000 Payment: $8,000 Year 1 Year 2 Year 3 Present value of interest payments to be distributed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts