Question: HELPPP ASAP Please help using this table information closing entries post closing trial balances please provide answers individual and detailed PROB 4 The calendar year-end

HELPPP ASAP

Please help using this table information

closing entries

post closing trial balances

please provide answers individual and detailed

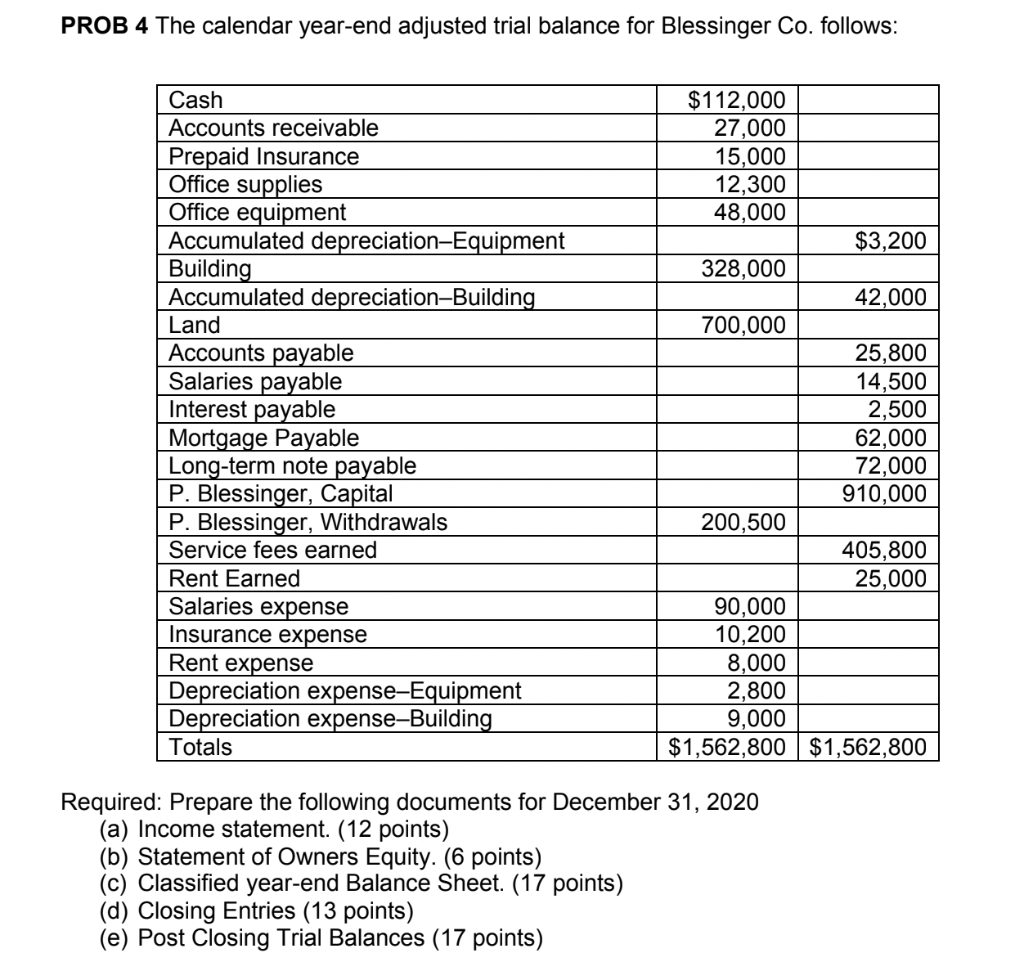

PROB 4 The calendar year-end adjusted trial balance for Blessinger Co. follows: Cash Accounts receivable Prepaid Insurance Office supplies Office equipment Accumulated depreciation-Equipment Building Accumulated depreciation-Building Land Accounts payable Salaries payable Interest payable Mortgage Payable Long-term note payable P. Blessinger, Capital P. Blessinger, Withdrawals Service fees earned Rent Earned Salaries expense Insurance expense Rent expense Depreciation expense-Equipment Depreciation expense-Building Totals $112,000 27,000 15,000 12,300 48,000 $3,200 328,000 42,000 700,000 25,800 14,500 2,500 62,000 72,000 910,000 200,500 405,800 25,000 90,000 10,200 8,000 2,800 9,000 $1,562,800 $1,562,800 Required: Prepare the following documents for December 31, 2020 (a) Income statement. (12 points) (b) Statement of Owners Equity. (6 points) (c) Classified year-end Balance Sheet. (17 points) (d) Closing Entries (13 points) (e) Post Closing Trial Balances (17 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts