Question: HEMI uses a perpetual inventory system with the weighted average method of costing inventory. For transmission inventory the Accountant wants you to: Compute the cost

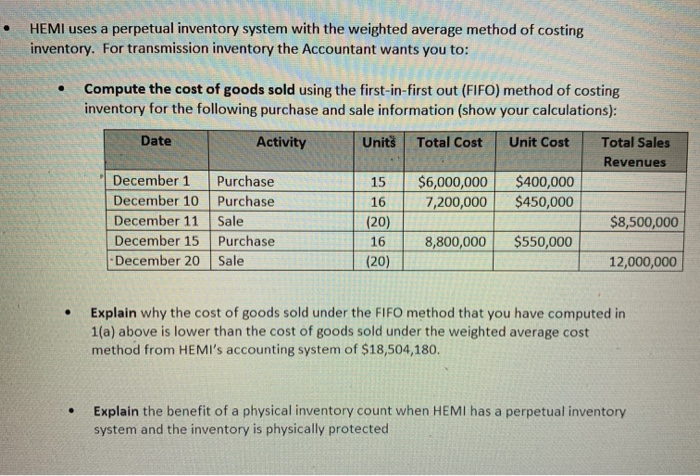

HEMI uses a perpetual inventory system with the weighted average method of costing inventory. For transmission inventory the Accountant wants you to: Compute the cost of goods sold using the first-in-first out (FIFO) method of costing inventory for the following purchase and sale information (show your calculations): Date Activity Units Total Cost Unit Cost Total Sales Revenues $6,000,000 ,200,000 $400,000 $450,000 16 7 December 1 Purchase December 10 Purchase December 11 Sale December 15 Purchase December 20 Sale (20) $8,500,000 8,800,000 $550,000 16 (20) 12,000,000 Explain why the cost of goods sold under the FIFO method that you have computed in 1(a) above is lower than the cost of goods sold under the weighted average cost method from HEMI's accounting system of $18,504,180. Explain the benefit of a physical inventory count when HEMI has a perpetual inventory system and the inventory is physically protected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts