Question: Henley Homes is evaluating a project that would cost $15 million today. Henley estimates that once implemented, the project will generate positive net cash flows

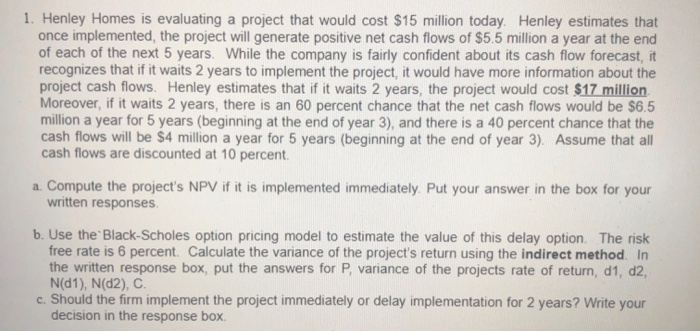

Henley Homes is evaluating a project that would cost $15 million today. Henley estimates that once implemented, the project will generate positive net cash flows of $5.5 million a year at the end of each of the next 5 years. While the company is fairly confident about its cash flow forecast, it recognizes that if it waits 2 years to implement the project, it would have more information about the project cash flows. Henley estimates that if it waits 2 years, the project would cost $17 million Moreover, if it waits 2 years, there is an 60 percent chance that the net cash flows would be $6.5 million a year for 5 years (beginning at the end of year 3), and there is a 40 percent chance that the cash flows will be $4 million a year for 5 years (beginning at the end of year 3). Assume that all cash flows are discounted at 10 percent. a. Compute the project's NPV if it is implemented immediately. Put your answer in the box for your written responses b. Use the Black-Scholes option pricing model to estimate the value of this delay option. The risk free rate is 6 percent. Calculate the variance of the project's return using the indirect method. In the written response box, put the answers for P, variance of the projects rate of return, d1, d2, N(dl), N(d2), C. c. Should the firm implement the project immediately or delay implementation for 2 years? Write your decision in the response box Henley Homes is evaluating a project that would cost $15 million today. Henley estimates that once implemented, the project will generate positive net cash flows of $5.5 million a year at the end of each of the next 5 years. While the company is fairly confident about its cash flow forecast, it recognizes that if it waits 2 years to implement the project, it would have more information about the project cash flows. Henley estimates that if it waits 2 years, the project would cost $17 million Moreover, if it waits 2 years, there is an 60 percent chance that the net cash flows would be $6.5 million a year for 5 years (beginning at the end of year 3), and there is a 40 percent chance that the cash flows will be $4 million a year for 5 years (beginning at the end of year 3). Assume that all cash flows are discounted at 10 percent. a. Compute the project's NPV if it is implemented immediately. Put your answer in the box for your written responses b. Use the Black-Scholes option pricing model to estimate the value of this delay option. The risk free rate is 6 percent. Calculate the variance of the project's return using the indirect method. In the written response box, put the answers for P, variance of the projects rate of return, d1, d2, N(dl), N(d2), C. c. Should the firm implement the project immediately or delay implementation for 2 years? Write your decision in the response box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts