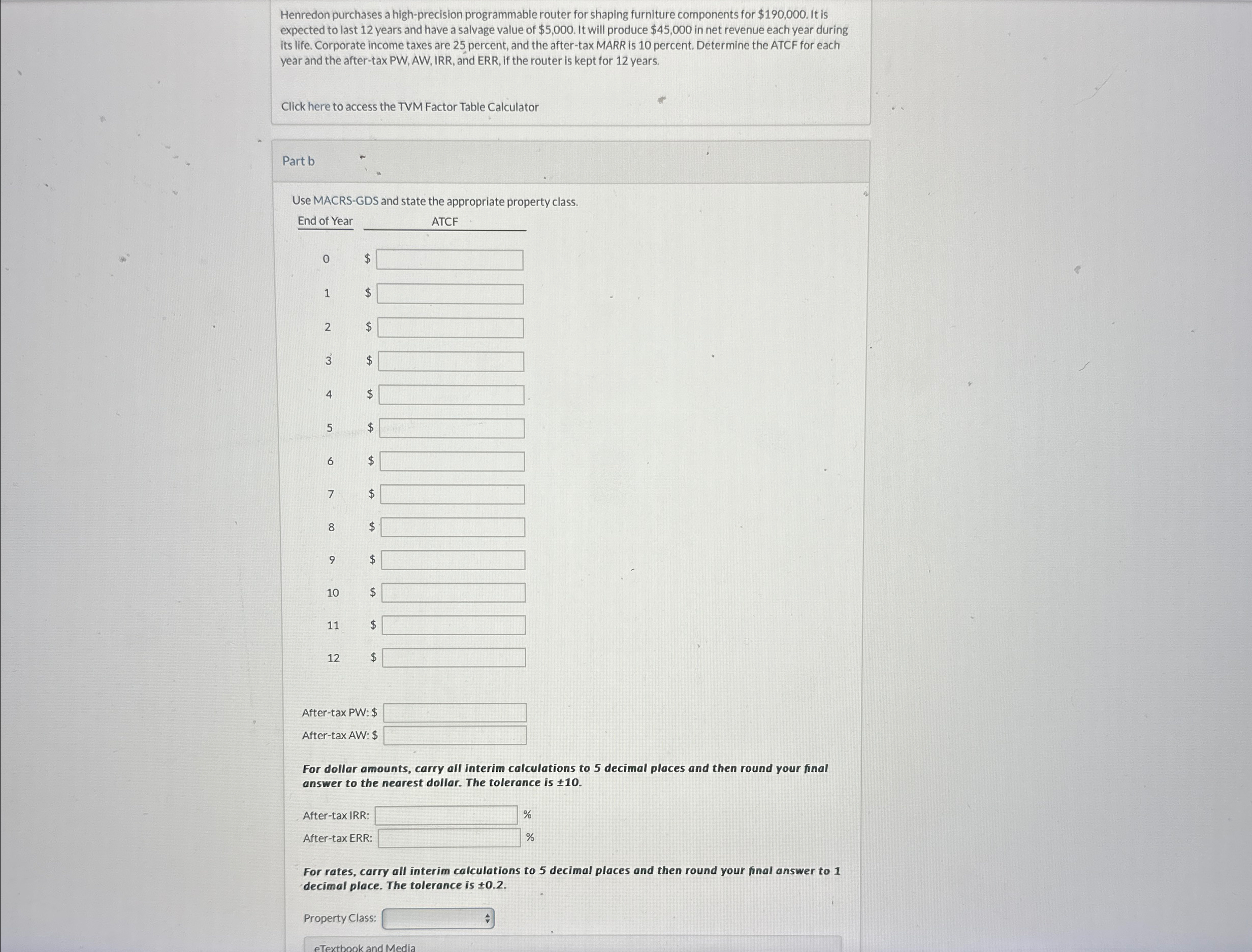

Question: Henredon purchases a high - precision programmable router for shaping furniture components for $ 1 9 0 , 0 0 0 . It is expected

Henredon purchases a highprecision programmable router for shaping furniture components for $ It is expected to last years and have a salvage value of $ It will produce $ in net revenue each year during its life. Corporate income taxes are percent, and the aftertax MARR is percent. Determine the ATCF for each year and the aftertax PW AW IRR, and ERR, if the router is kept for years.

Click here to access the TVM Factor Table Calculator

Partb

Use MACRSGDS and state the appropriate property class.

End of Year

ATCF

$

$

$

$

$

$

$

$

$

$

$

$

$

Aftertax PW: $

Aftertax AW: $

For dollar amounts, carry all interim calculations to decimal places and then round your final answer to the nearest dollar. The tolerance is

Aftertax IRR:

Aftertax ERR:

For rates, carry all interim calculations to decimal places and then round your final answer to decimal place. The tolerance is

Property Class:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock