Question: Henry, a U . S . citizen, is engaged in numerous, diverse operations and pays U . S . income tax at a flat rate

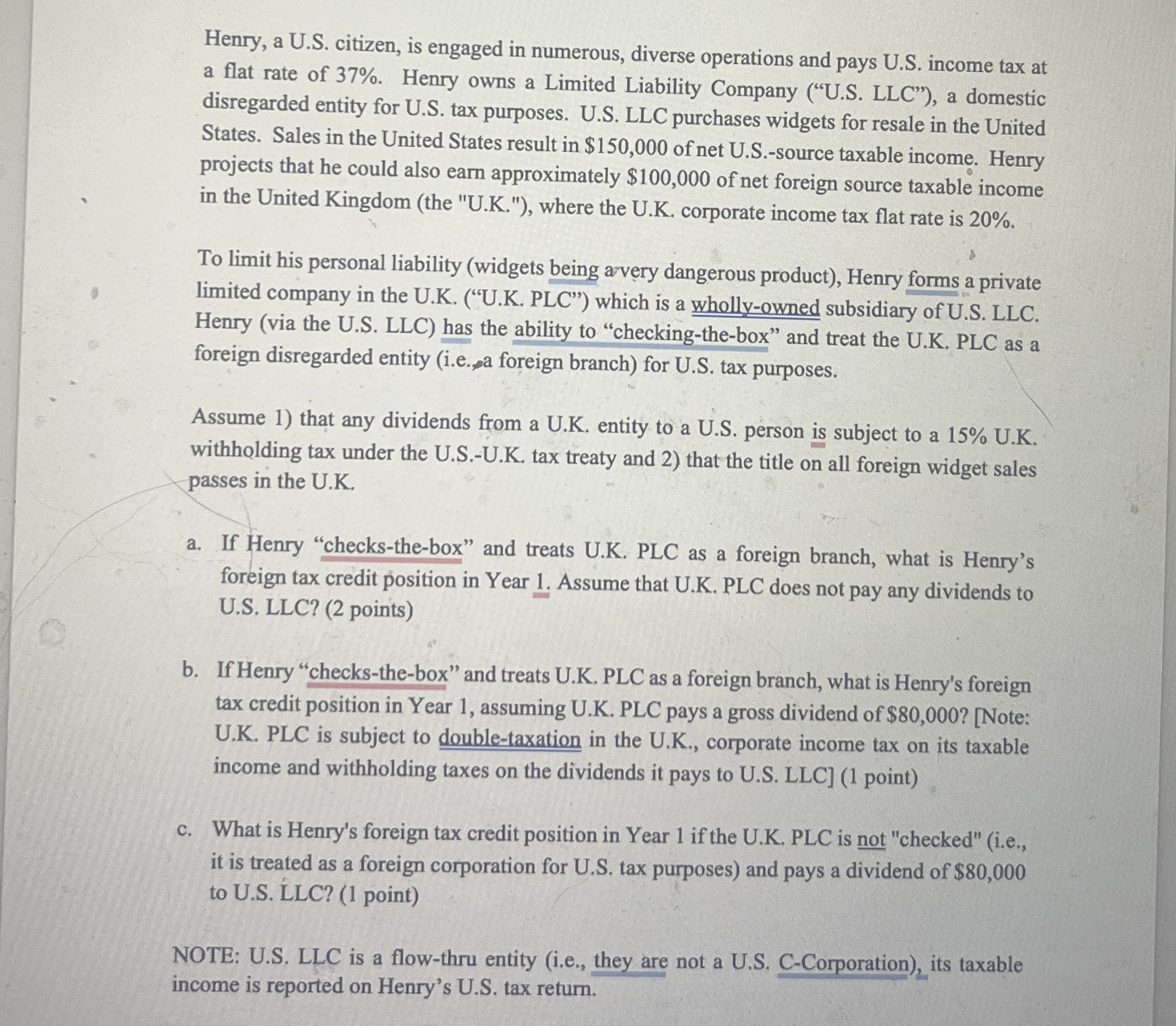

Henry, a US citizen, is engaged in numerous, diverse operations and pays US income tax at a flat rate of Henry owns a Limited Liability Company US LLC a domestic disregarded entity for US tax purposes. US LLC purchases widgets for resale in the United States. Sales in the United States result in $ of net USsource taxable income. Henry projects that he could also earn approximately $ of net foreign source taxable income in the United Kingdom the UK where the UK corporate income tax flat rate is

To limit his personal liability widgets being arvery dangerous product Henry forms a private limited company in the UKUK PLC which is a whollyowned subsidiary of US LLC Henry via the US LLC has the ability to "checkingthebox" and treat the UK PLC as a foreign disregarded entity ie a foreign branch for US tax purposes.

Assume that any dividends from a UK entity to a US person is subject to a UK withholding tax under the USUK tax treaty and that the title on all foreign widget sales passes in the UK

a If Henry "checksthebox" and treats UK PLC as a foreign branch, what is Henry's foreign tax credit position in Year Assume that UK PLC does not pay any dividends to US LLC points

b If Henry "checksthebox" and treats UK PLC as a foreign branch, what is Henry's foreign tax credit position in Year assuming UK PLC pays a gross dividend of $Note: UK PLC is subject to doubletaxation in the UK corporate income tax on its taxable income and withholding taxes on the dividends it pays to US LLC point

c What is Henry's foreign tax credit position in Year if the UK PLC is not "checked" ie it is treated as a foreign corporation for US tax purposes and pays a dividend of $ to US LLC point

NOTE: US LLC is a flowthru entity ie they are not a US CCorporation its taxable income is reported on Henry's US tax return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock