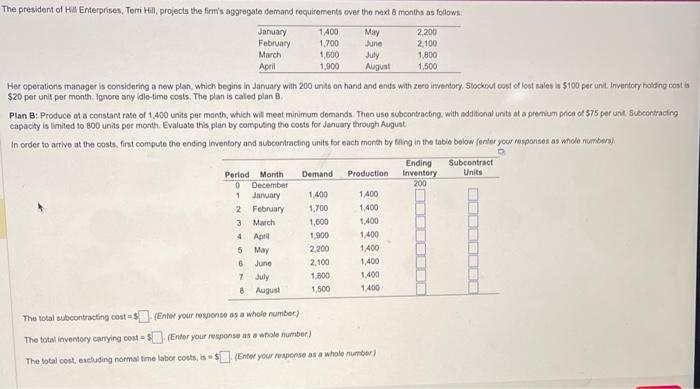

Question: Her operations manager is considering a new plan, which begins in January with 200 units on hand and ends with zero inventory. Stockout cost of

Her operations manager is considering a new plan, which begins in January with 200 units on hand and ends with zero inventory. Stockout cost of lost sales is $100 per unit inventory holdng cost $20 per unit per month. Ignore any idle-time costs. The plan is called plan B. Plan B: Produce at a constart rate of 1.400 units per month, which will meet minimum demands. Then use subcontracting. with additonal units at a premium price of $75 per unt subcortracting capacity is limited to 800 units per month. Evaluate this plan by computing the costs for January through Auguse The total subcontracting cost =3 ( Enter your response as a whole number) The total itventory carrying cost = ? (Enter your response as a whole number). The total cont, exduding normal time labor costs, is =1 (Entoc your response as a whale number) Her operations manager is considering a new plan, which begins in January with 200 units on hand and ends with zero inventory. Stockout cost of lost sales is $100 per unit inventory holdng cost $20 per unit per month. Ignore any idle-time costs. The plan is called plan B. Plan B: Produce at a constart rate of 1.400 units per month, which will meet minimum demands. Then use subcontracting. with additonal units at a premium price of $75 per unt subcortracting capacity is limited to 800 units per month. Evaluate this plan by computing the costs for January through Auguse The total subcontracting cost =3 ( Enter your response as a whole number) The total itventory carrying cost = ? (Enter your response as a whole number). The total cont, exduding normal time labor costs, is =1 (Entoc your response as a whale number)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts