Question: Herbert and Myra are working with their financial planner to develop a savings program aligned with their personal retirement objectives. At retirement, they hope

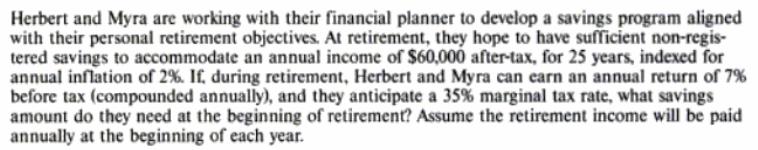

Herbert and Myra are working with their financial planner to develop a savings program aligned with their personal retirement objectives. At retirement, they hope to have sufficient non-regis- tered savings to accommodate an annual income of $60,000 after-tax, for 25 years, indexed for annual inflation of 2%. If, during retirement, Herbert and Myra can earn an annual return of 7% before tax (compounded annually), and they anticipate a 35% marginal tax rate, what savings amount do they need at the beginning of retirement? Assume the retirement income will be paid annually at the beginning of each year.

Step by Step Solution

3.52 Rating (176 Votes )

There are 3 Steps involved in it

Solution Applying Arthematic Rule... View full answer

Get step-by-step solutions from verified subject matter experts