Question: Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $94,000. The equipment falls into the five-year category for MACRS depreciation and

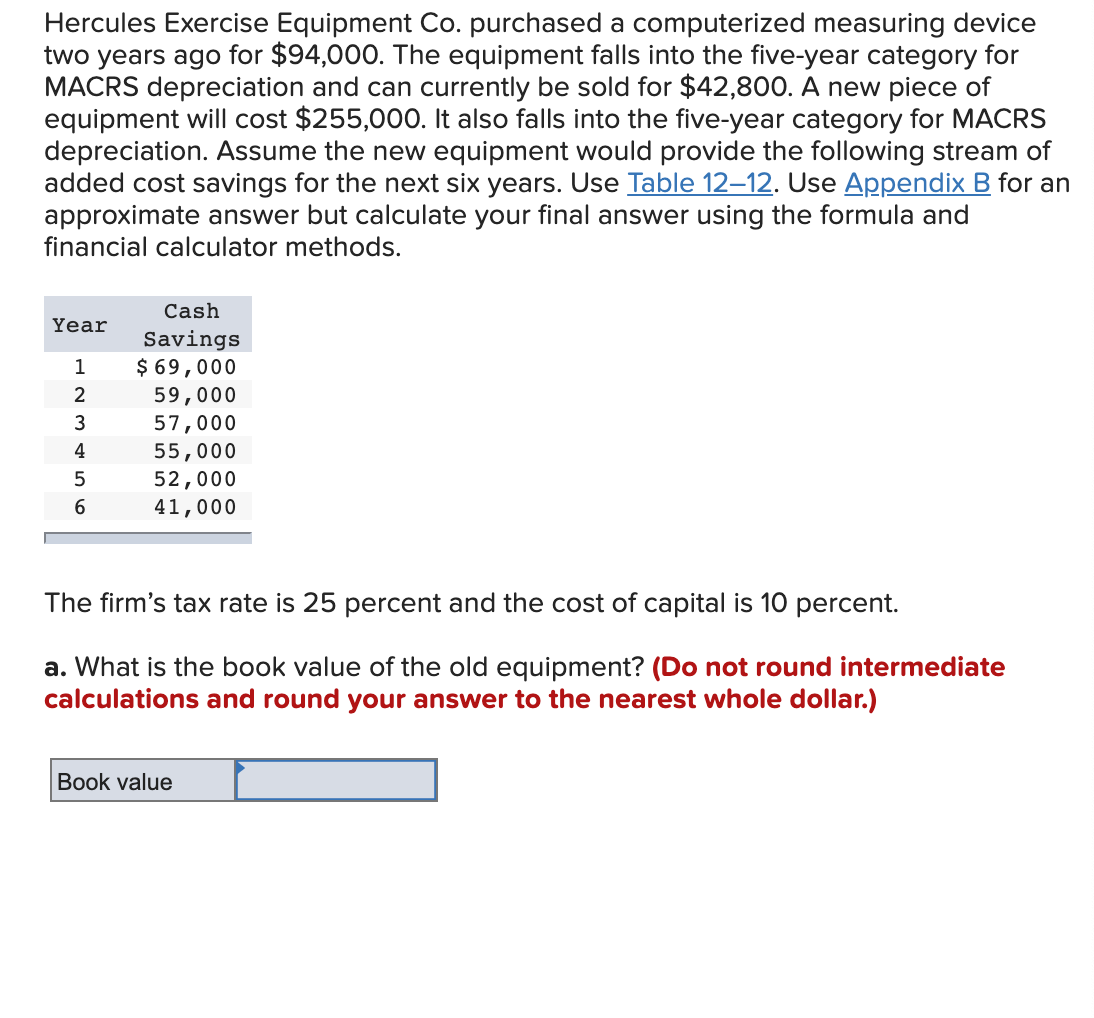

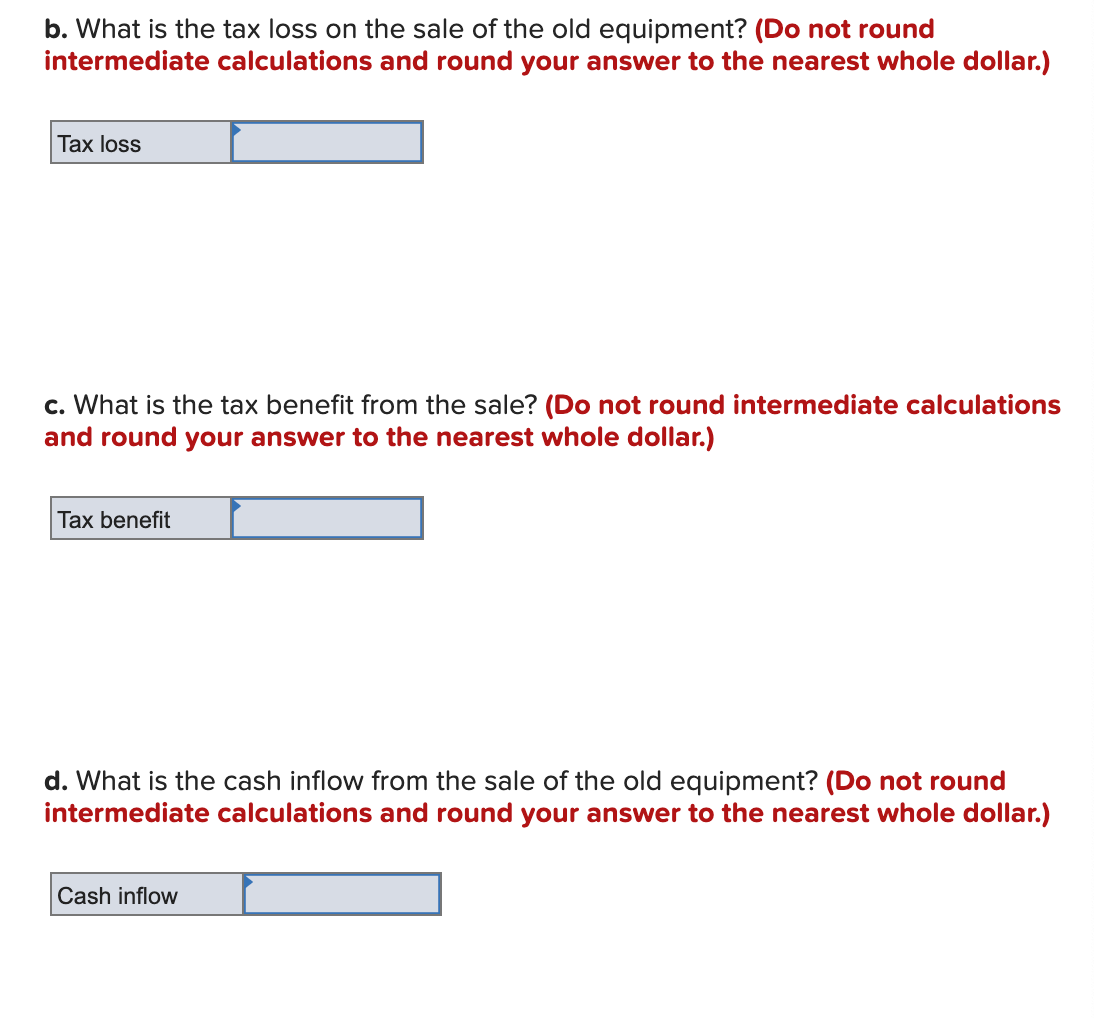

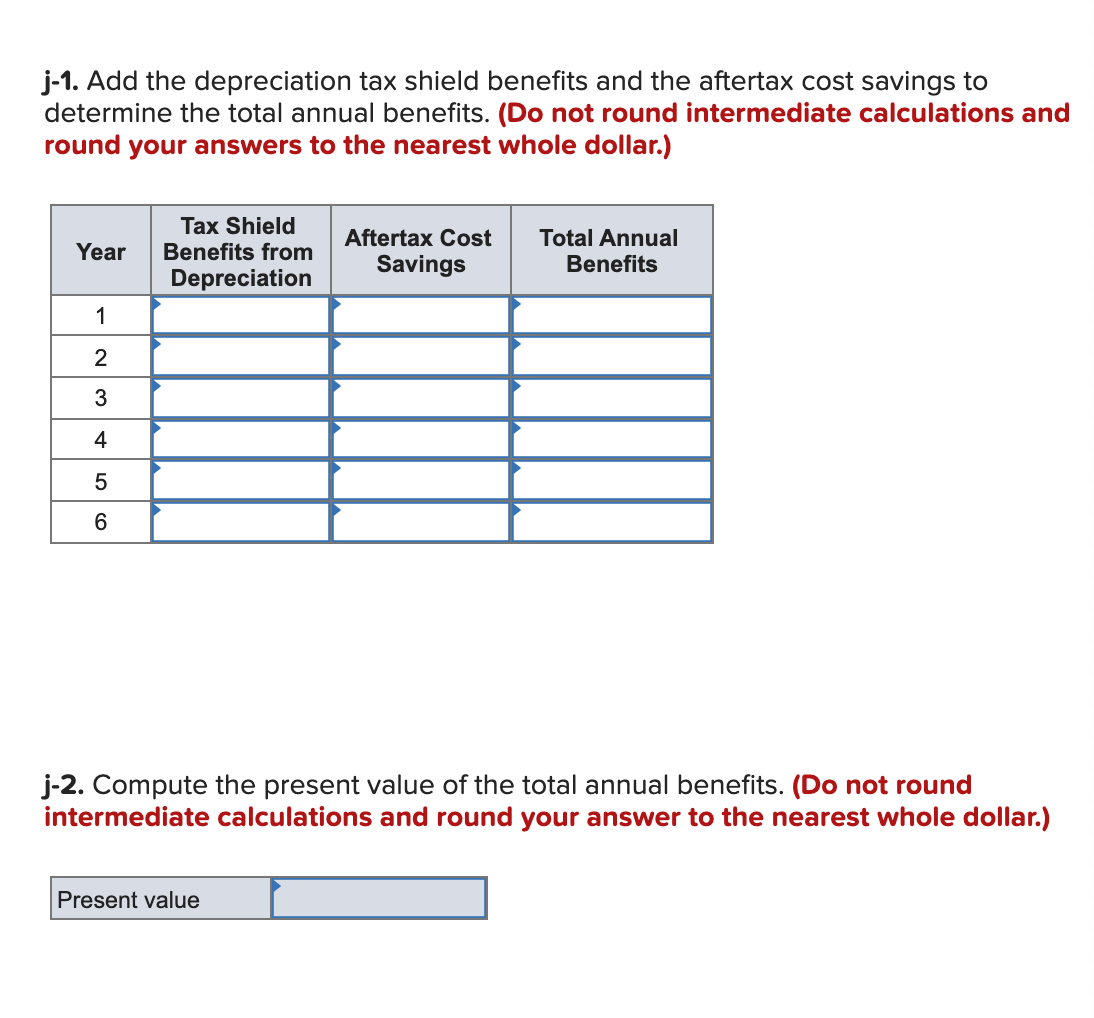

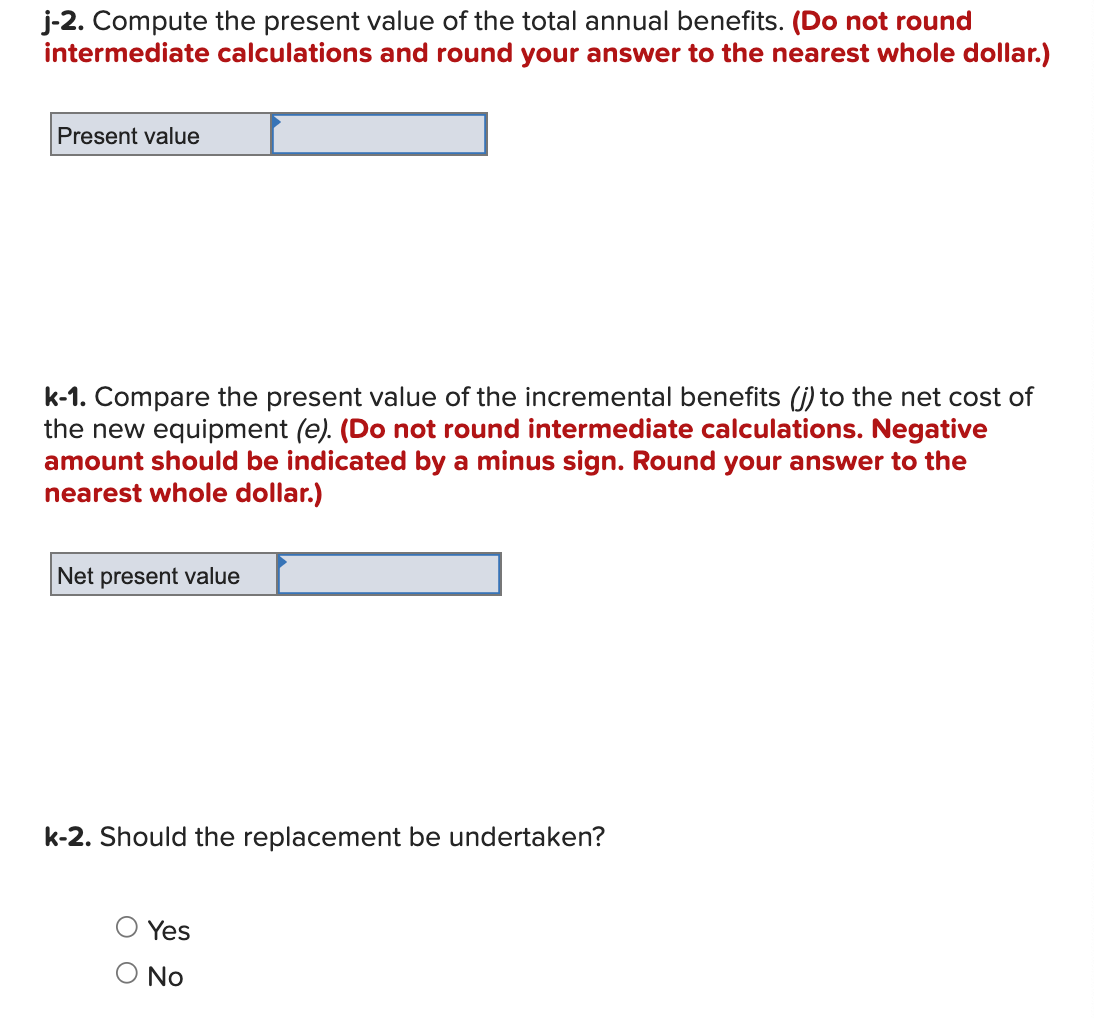

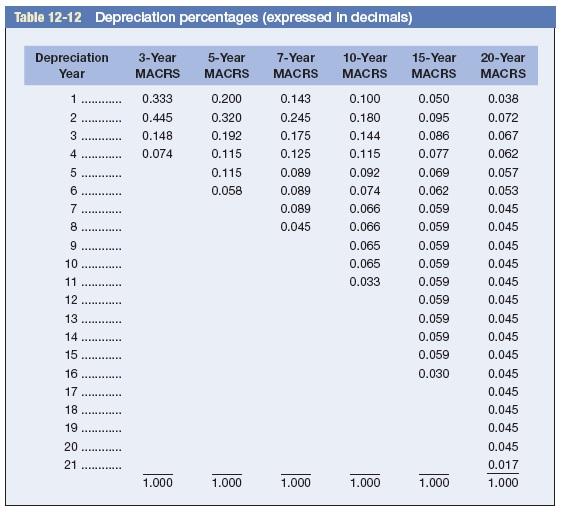

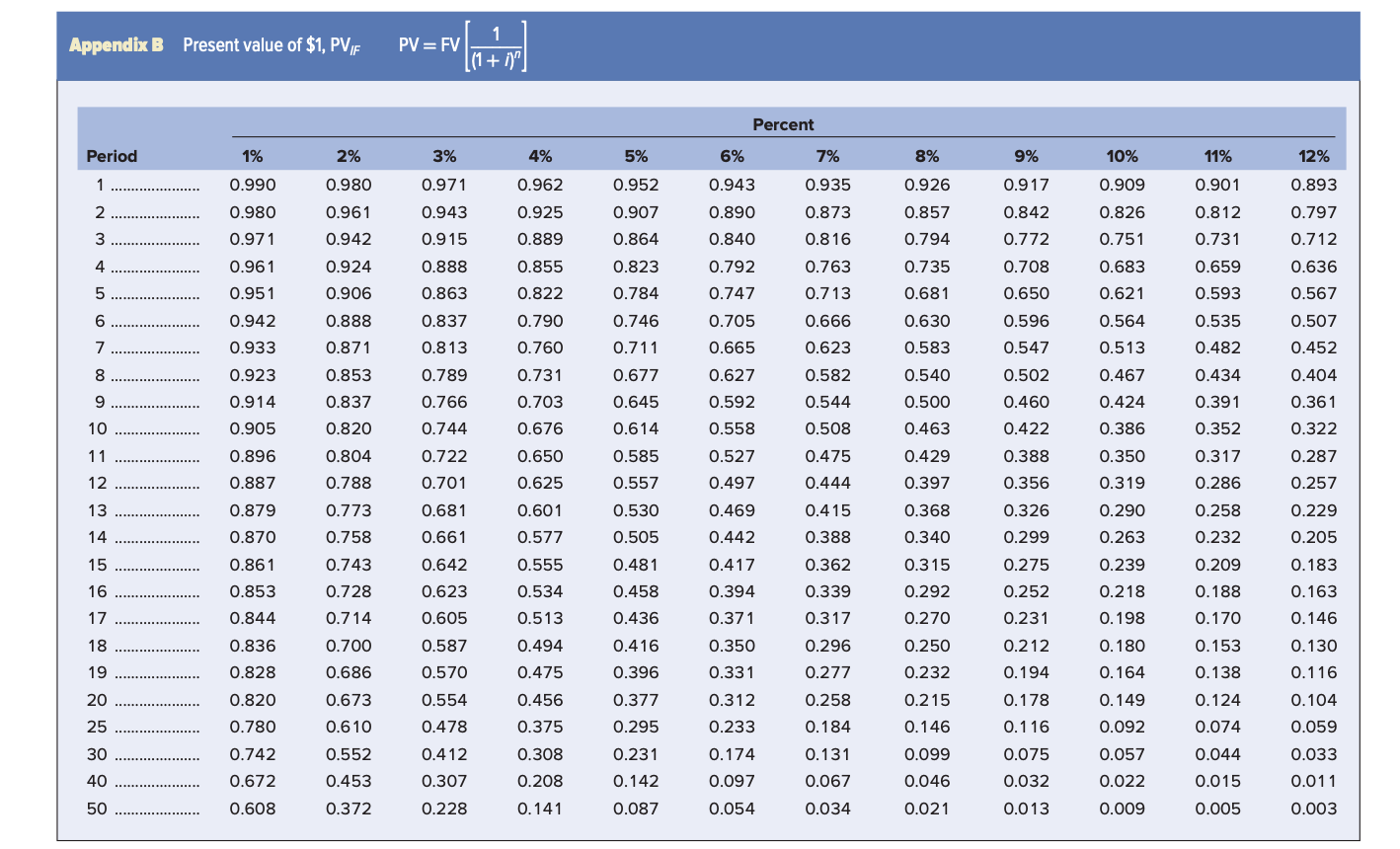

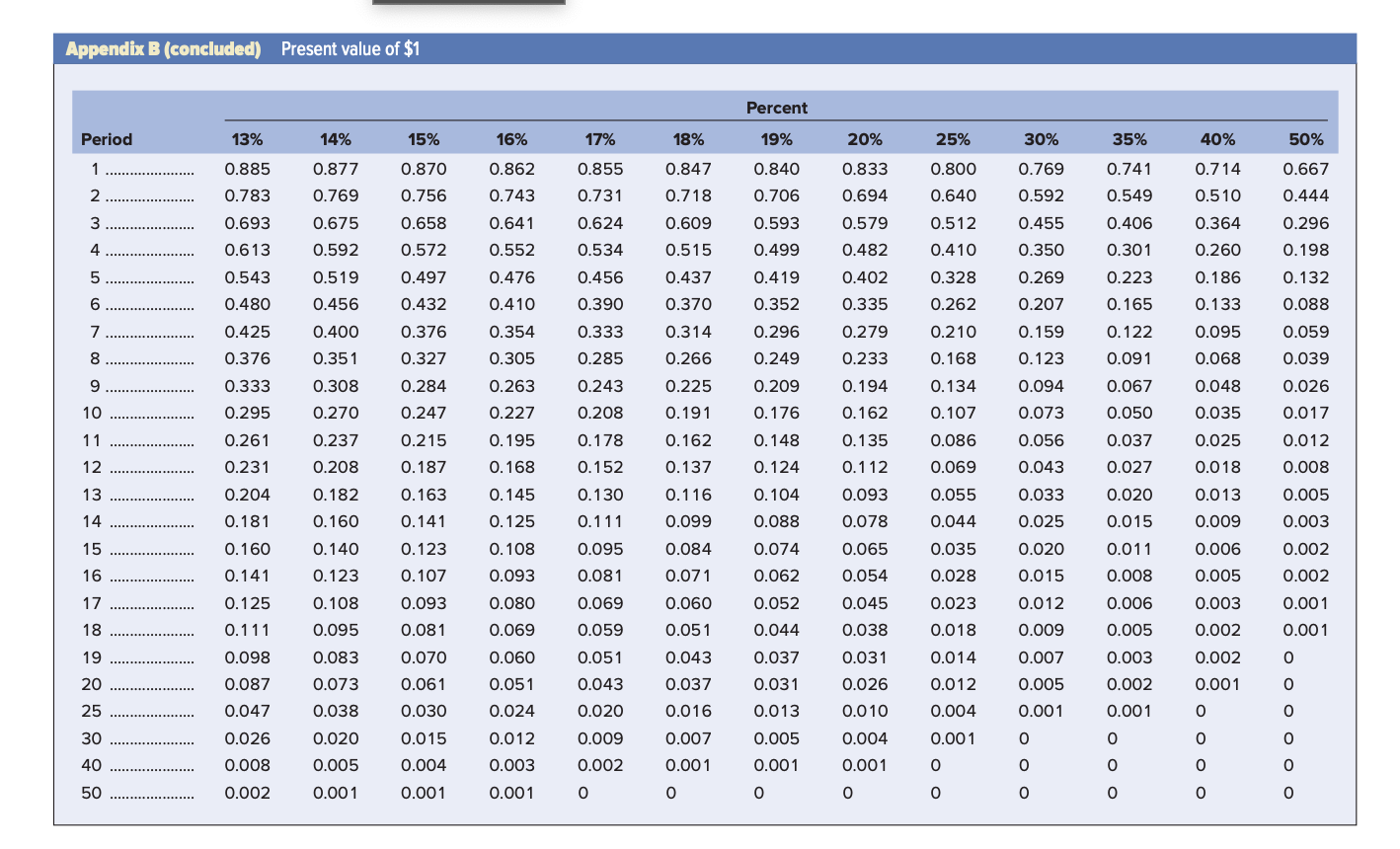

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $94,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $42,800. A new piece of equipment will cost $255,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 1212. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 6 Cash Savings $ 69,000 59,000 57,000 55,000 52,000 41,000 The firm's tax rate is 25 percent and the cost of capital is 10 percent. a. What is the book value of the old equipment? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Book value b. What is the tax loss on the sale of the old equipment? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Tax loss c. What is the tax benefit from the sale? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Tax benefit d. What is the cash inflow from the sale of the old equipment? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Cash inflow j-1. Add the depreciation tax shield benefits and the aftertax cost savings to determine the total annual benefits. (Do not round intermediate calculations and round your answers to the nearest whole dollar.) Year Tax Shield Benefits from Depreciation Aftertax Cost Savings Total Annual Benefits 1 2 3 4 5 6 j-2. Compute the present value of the total annual benefits. (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Present value j-2. Compute the present value of the total annual benefits. (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Present value k-1. Compare the present value of the incremental benefits (j) to the net cost of the new equipment (e). (Do not round intermediate calculations. Negative amount should be indicated a minus gn. Round your wer to the nearest whole dollar.) Net present value k-2. Should the replacement be undertaken? Yes Table 12-12 Depreciation percentages (expressed in decimals) Depreciation Year 3-Year MACRS 1 0.333 5-Year MACRS 0.200 0.320 0.192 0.115 0.115 0.058 0.445 0.148 0.074 3 7-Year MACRS 0.143 0.245 0.175 0.125 0.089 0.089 0.089 0.045 4 5 10-Year MACRS 0.100 0.180 0.144 0.115 0.092 0.074 0.066 0.066 0.065 0.065 0.033 7 8 15-Year MACRS 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.030 9 10 11 12 20-Year MACRS 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 13 14 15 w 16 17 18 19 20 21 1.000 1.000 1.000 1.000 1.000 Appendix B Present value of $1, PVF 1 PV=FV [(1 + 1)") Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1 0.990 0.980 0.971 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.962 0.925 2 0.980 0.961 0.943 0.907 0.890 0.873 0.797 0.857 0.794 0.842 0.772 0.812 0.731 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 4 0.924 0.855 0.961 0.951 0.792 0.747 0.888 0.863 0.837 0.763 0.713 0.735 0.681 0.659 0.593 5 0.712 0.636 0.567 0.906 0.708 0.650 0.596 0.822 0.790 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 6 0.942 0.888 0.535 0.705 0.665 7 0.507 0.452 0.933 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.871 0.813 0.789 0.630 0.583 0.540 0.482 0.666 0.623 0.582 0.544 0.547 0.502 8 0.923 0.627 0.434 0.760 0.731 0.703 0.676 0.404 0.853 0.837 9 0.766 0.500 0.460 0.592 0.558 10 0.820 0.744 0.463 0.422 0.386 0.391 0.352 .317 11 304 650 0.914 0.905 0.896 0.887 0.879 0.870 0.508 0.475 0.444 0.722 0.701 12 0.788 0.286 0.361 0.322 0.287 0.257 0.229 0.585 0.557 0.530 0.505 0.388 0.356 0.326 0.299 0.350 0.319 0.290 0.263 0.625 0.601 0.577 13 0.681 0.429 0.397 0.368 0.340 0.315 0.773 0.758 14 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.661 0.205 0.183 15 0.642 0.861 0.853 0.844 0.743 0.728 0.481 0.458 0.239 0.218 16 0.623 0.292 0.163 17 0.714 0.605 0.436 0.270 0.146 0.555 0.534 0.513 0.494 0.475 0.456 18 0.198 0.180 0.416 0.700 0.686 0.250 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.184 0.131 0.067 0.275 0.252 0.231 0.212 0.194 0.178 0.116 19 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.587 0.570 0.554 0.478 0.331 0.232 0.836 0.828 0.820 0.780 0.742 0.672 0.608 20 0.130 0.116 0.104 0.396 0.377 0.295 0.215 0.673 0.6 10 0.164 0.149 0.092 0.312 0.233 25 0.375 0.146 0.059 0.174 30 40 0.552 0.453 0.412 0.307 0.308 0.208 0.231 0.142 0.087 0.099 0.046 0.075 0.032 0.013 0.057 0.022 0.033 0.011 0.097 50 0.372 0.228 0.141 0.054 0.034 0.021 0.009 0.005 0.003 Appendix B (concluded) Present value of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.840 0.877 0.769 0.870 0.756 0.658 0.862 0.743 0.855 0.731 0.847 0.718 0.833 0.694 2 0.800 0.640 0.512 0.667 0.444 0.706 0.769 0.592 0.455 0.350 0.714 0.510 0.364 0.741 0.549 0.406 0.301 3 0.675 0.885 0.783 0.693 0.613 0.543 0.480 0.624 0.296 0.579 0.482 4 0.592 0.534 0.593 0.499 0.419 0.410 0.572 0.497 0.260 0.609 0.515 0.437 0.370 5 0.519 0.456 0.402 0.641 0.552 0.476 0.410 0.354 0.305 0.223 0.328 0.262 6 0.456 0.390 0.165 0.269 0.207 0.159 0.123 0.186 0.133 0.095 0.432 0.376 0.327 7 0.425 0.376 0.198 0.132 0.088 0.059 0.039 0.400 0.351 0.352 0.296 0.249 0.209 0.335 0.279 0.233 0.333 0.285 0.314 0.266 0.225 0.210 0.168 0.122 0.091 8 0.068 9 0.308 0.134 0.243 0.208 0.094 0.073 0.067 0.050 0.048 0.035 0.026 0.017 10 0.270 0.191 0.176 0.107 11 0.056 0.037 0.025 0.012 0.086 0.069 12 0.018 0.008 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.043 0.033 13 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.162 0.137 0.116 0.099 0.084 0.027 0.020 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.178 0.152 0.130 0.111 0.095 0.081 0.005 0.148 0.124 0.104 0.088 0.074 0.062 0.013 0.009 14 0.015 0.055 0.044 0.035 0.028 15 0.025 0.020 0.015 0.011 0.008 0.006 0.005 16 0.003 0.002 0.002 0.001 0.001 17 0.069 0.003 0.125 0.111 0.080 0.069 0.052 0.044 0.023 0.018 0.012 0.009 0.006 0.005 18 0.095 0.059 0.038 0.002 0.071 0.060 0.051 0.043 0.037 0.016 19 0.083 0.093 0.081 0.070 0.061 0.030 0.098 0.087 0.060 0.051 0.037 0.031 0.051 0.043 0.020 0.014 0.012 20 0.031 0.026 0.010 0.007 0.005 0.001 0.002 0.001 0.073 0.038 0.020 0.003 0.002 0.001 25 0.047 0.024 0.013 0.004 30 0.015 0.012 0.009 0.001 0.026 0.008 0.007 0.001 0.005 0.001 ooooo 0.004 0.001 40 0.005 0.004 0.003 0.002 0 50 0.002 0.001 0.001 0.001 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts