Question: Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $72,000. The equipment falls into the five-year category for MACRS depreciation and

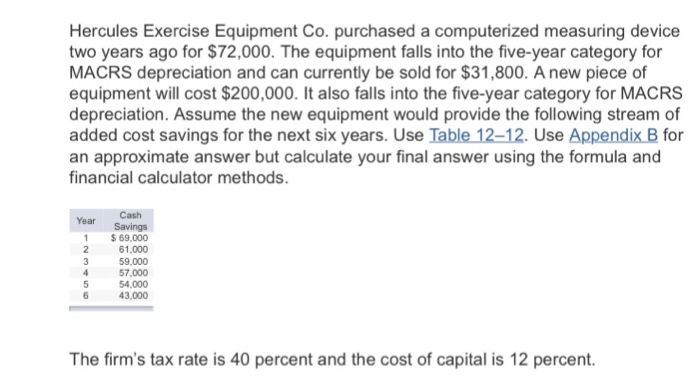

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $72,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $31,800. A new piece of equipment will cost $200,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year Savings $69,000 2 61.000 3 59.000 4 57,000 5 54.000 6 43,000 The firm's tax rate is 40 percent and the cost of capital is 12 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts