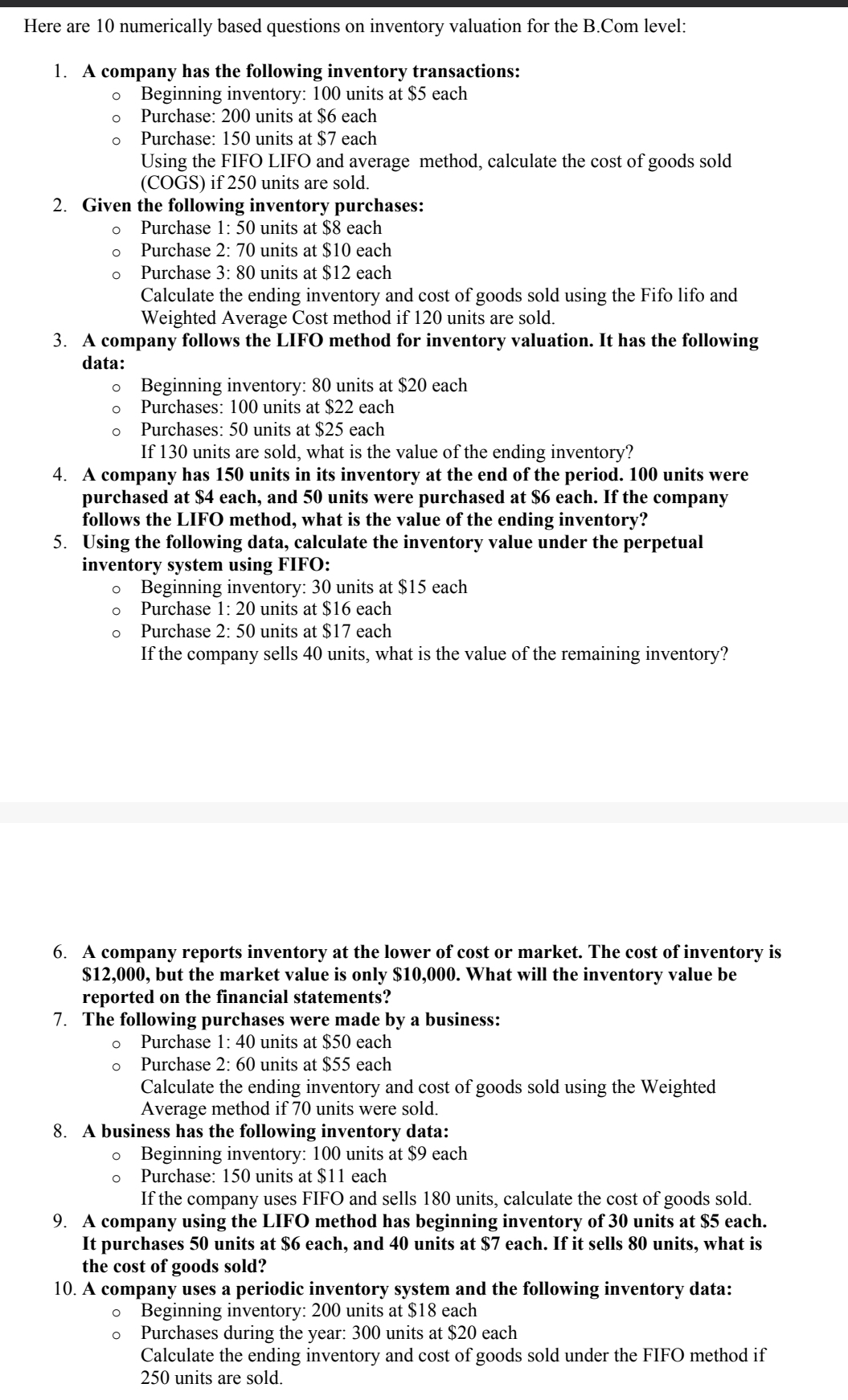

Question: Here are 1 0 numerically based questions on inventory valuation for the B . Com level: A company has the following inventory transactions: Beginning inventory:

Here are numerically based questions on inventory valuation for the

BCom level:

A company has the following inventory transactions:

Beginning inventory: units at $ each

Purchase: units at $ each

Purchase: units at $ each

Using the FIFO LIFO and average method, calculate the cost of goods sold

COGS if units are sold.

Given the following inventory purchases:

Purchase : units at $ each

Purchase : units at $ each

Purchase : units at $ each

Calculate the ending inventory and cost of goods sold using the Fifo lifo and

Weighted Average Cost method if units are sold.

A company follows the LIFO method for inventory valuation. It has the following

data:

Beginning inventory: units at $ each

Purchases: units at $ each

Purchases: units at $ each

If units are sold, what is the value of the ending inventory?

A company has units in its inventory at the end of the period. units were

purchased at $ each, and units were purchased at $ each. If the company

follows the LIFO method, what is the value of the ending inventory?

Using the following data, calculate the inventory value under the perpetual

inventory system using FIFO:

Beginning inventory: units at $ each

Purchase : units at $ each

Purchase : units at $ each

If the company sells units, what is the value of the remaining inventory?

A company reports inventory at the lower of cost or market. The cost of inventory is

$ but the market value is only $ What will the inventory value be

reported on the financial statements?

The following purchases were made by a business:

Purchase : units at $ each

Purchase : units at $ each

Calculate the ending inventory and cost of goods sold using the Weighted

Average method if units were sold.

A business has the following inventory data:

Beginning inventory: units at $ each

Purchase: units at $ each

If the company uses FIFO and sells units, calculate the cost of goods sold.

A company using the LIFO method has beginning inventory of units at $ each.

It purchases units at $ each, and units at $ each. If it sells units, what is

the cost of goods sold?

A company uses a periodic inventory system and the following inventory data:

Beginning inventory: units at $ each

Purchases during the year: units at $ each

Calculate the ending inventory and cost of goods sold under the FIFO method if

units are sold.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock