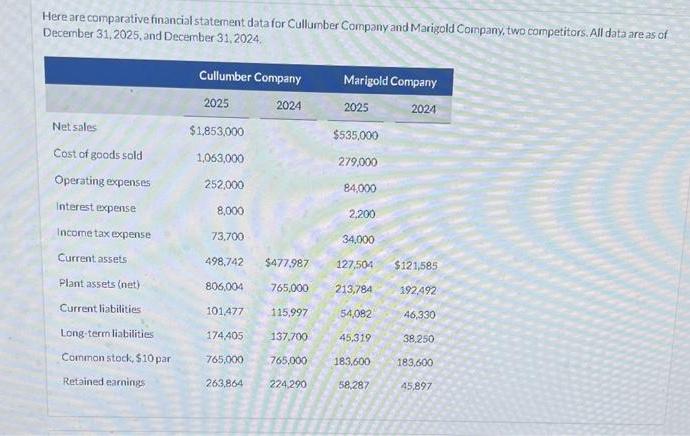

Question: Here are comparative financial statement data for Cullumber Company and Marigold Company, two competitors. All data are as of December 31, 2025, and December

Here are comparative financial statement data for Cullumber Company and Marigold Company, two competitors. All data are as of December 31, 2025, and December 31, 2024. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities: Long-term liabilities Common stock, $10 par Retained earnings Cullumber Company 2025 $1,853,000 1,063,000 252,000 8,000 73,700 498,742 $477.987 806,004 765,000 213,784 101,477 115,997 54,082 174,405 137,700 45,319 765,000 765.000 263,864 224,290 2024 Marigold Company 2024 2025 $535,000 279,000 84,000 2,200 34,000 127,504 $121,585 183,600 58,287 192,492 46,330 38,250 183,600 45,897 Prepare 2025 income statements and a vertical analysis for Cullumber Company and Marigold Company. (Round percentage answers to 1 decimal place, eg 2.5%) Compute the 2025 return on assets and the return on common stockholders' equity for both companies. (Round answers to 1 decimal place, eg 2.5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts