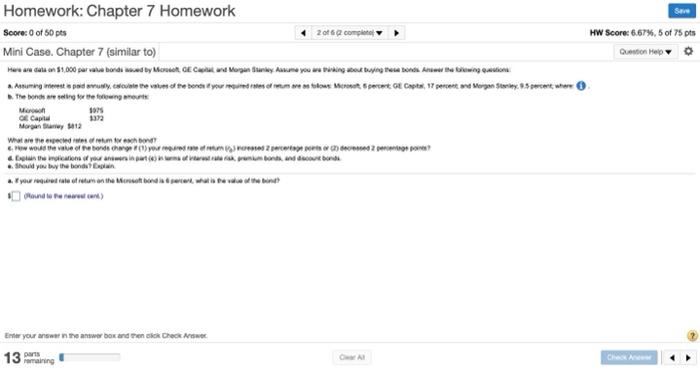

Question: Here are data on $ 1 , 0 0 0 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley. Assume you are thinking

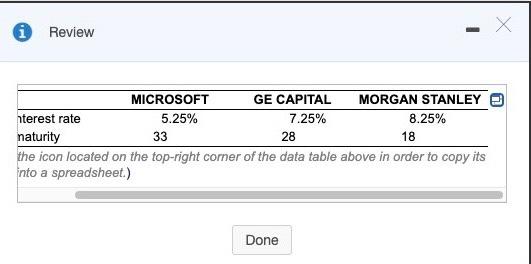

HW Score: 6.67%, 5 of 75 pts Question Help Homework: Chapter 7 Homework Score: 0 of 50 pts 2016.com Mini Case. Chapter 7 (similar to) Het on 1.000 percebo by Mr GE Morgan Stanley Are you get the wrong Assuming more pod usly, calculate the value of the bonet your married to return percent Ge Capts, 17 percentage Storey percent where the bones or the long runt Mer 1075 1322 Margary 12 What are the seed serum who? www.rundande ..For us on the Moondise et en Enter your answer the answer box and enclo Check 13 aning Darts Che X Review MICROSOFT GE CAPITAL MORGAN STANLEY nterest rate 5.25% 7.25% 8.25% naturity 33 28 18 the icon located on the top-right corner of the data table above in order to copy its nto a spreadsheet.) Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts