Question: Here are data on three hedge funds. Each fund charges its investors an incentive fee of 20% of total returns. Suppose initially that a fund

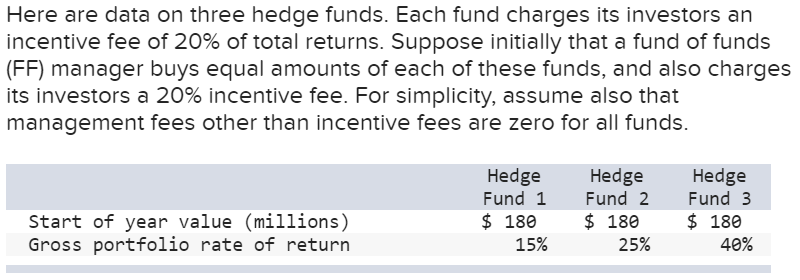

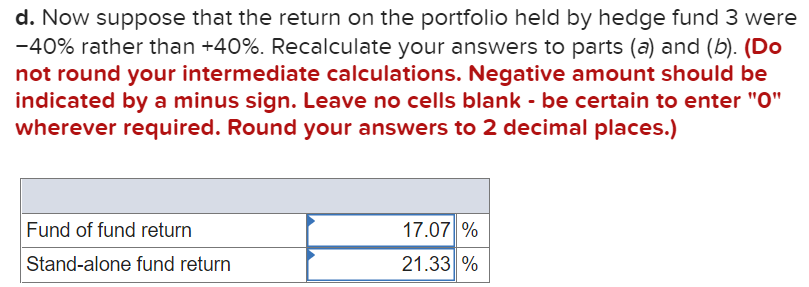

Here are data on three hedge funds. Each fund charges its investors an incentive fee of 20% of total returns. Suppose initially that a fund of funds (FF) manager buys equal amounts of each of these funds, and also charges its investors a 20% incentive fee. For simplicity, assume also that management fees other than incentive fees are zero for all funds. Hedge Hedge Hedge Fund 3 Fund 1 Fund 2 $ 180 $180 $ 180 Start of year value (millions) Gross portfolio rate of return 15% 25% 40% d. Now suppose that the return on the portfolio held by hedge fund 3 were -40% rather than +40%. Recalculate your answers to parts (a) and (b). (Do not round your intermediate calculations. Negative amount should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Round your answers to 2 decimal places.) Fund of fund return 17.07 % Stand-alone fund return 21.33 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts