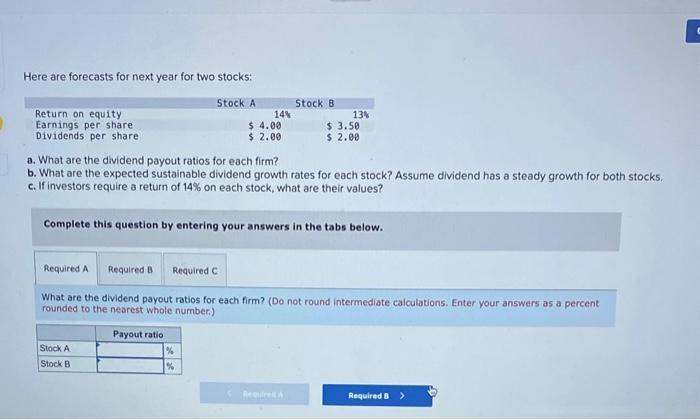

Question: Here are forecasts for next year for two stocks: Stock A Return on equity Earnings per share. Dividends per share. 14% Required A $

Here are forecasts for next year for two stocks: Stock A Return on equity Earnings per share. Dividends per share. 14% Required A $ 4.00 $ 2.00 Stock A Stock B a. What are the dividend payout ratios for each firm? b. What are the expected sustainable dividend growth rates for each stock? Assume dividend has a steady growth for both stocks. c. If investors require a return of 14% on each stock, what are their values? % % Stock B Complete this question by entering your answers in the tabs below. 13% Required B Required C What are the dividend payout ratios for each firm? (Do not round intermediate calculations. Enter your answers as a percent rounded to the nearest whole number.) Payout ratio $3.50 $ 2.00 Required A Required B

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

a Dividend Payout Ratios For Stock A Payout ratio for A24100 50 For Stoc... View full answer

Get step-by-step solutions from verified subject matter experts